After Bitcoin's fourth halving in 2024, block rewards dropped from 6.25 BTC to 3.125 BTC, slashing mining revenue by half. However, Bitcoin's price stabilized between 80,000−100,000 due to institutional inflows (e.g., BlackRock's ETF holding over 980,000 BTC) and geopolitical demand. This delicate balance forces miners to re-evaluate three core factors: electricity costs, hardware efficiency, and regulatory risks.

1. Tech Evolution: Next-Gen Mining Rigs

Antminer S21 Hydro (16 J/TH), a 2025 flagship model, reduces energy costs by 50% compared to 2020's S19 (30 J/TH). But high upfront costs (

12,000perunit)meanan8−12monthbreakevenperiod.Forretailminers,thechoiceisstark:scaleup(bulkpurchases)orchasecheappower(e.g.,CentralAsianfarmsat0.03/kWh)

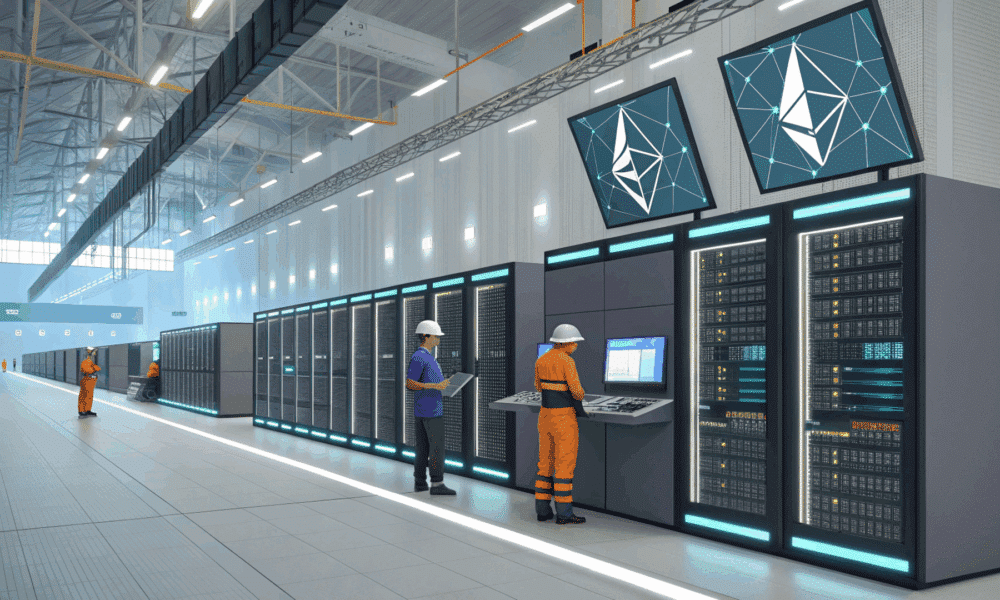

2. Hosting Services: Passive Income or Scam?

While mining hosting dominates in 2025, risks abound. Reputable farms (e.g., Kazakhstan zones) offer

0.035/kWhwith24/7maintenancebutcharge150/month per rig. Conversely, Southeast Asian "discount" farms ($0.025/kWh) often face blackouts or regulatory raids. Key checks: Power contract terms, government licenses, real-time monitoring transparency.

3. Altcoin Opportunities: AI-Driven Mining

Projects like KavaAI and Virtuals Protocol redefine mining by rewarding GPU-powered AI model training — a "Mining 2.0" paradigm shift. For example, Virtuals' metaverse identity verification mining yields $5-8/day per GPU, outperforming traditional ETH mining. But beware: 90% of AI tokens lack real utility, relying on hype.

4. Regulatory Battles: Carbon Taxes and Geopolitics

The U.S. Digital Asset Mining Regulation Act (2025) imposes carbon taxes (~

0.02/kWh),raisingNorthAmericanoperationalcostsby300.035/kWh — exclusive to state-backed firms. Retail miners should target free zones in Central Asia (Kazakhstan) or the Middle East (Abu Dhabi).

Survival Strategies for Retail Miners

Diversify Portfolios: 50% BTC, 30% AI coins (e.g., KAVA), 20% speculative tokens (e.g., Trump-themed TRUMP).

Hedge Volatility: Allocate 20% of monthly revenue to Bitcoin put options to mitigate price crashes.

Join Mining Pools: Collaborate with small miners to lease nuclear-powered facilities in Serbia, cutting compliance costs.

No comments yet