"比特币杠杆交易如同一把加密世界的双刃剑——用对公式能斩获百倍收益,算错小数点则可能瞬间爆仓。当小白投资者看着交易所里10倍、50倍甚至100倍的杠杆按钮跃跃欲试时,90%的人其实从未真正理解过那串跳动的盈亏数字背后的数学法则。本文将以矿机算力般的精确度,拆解比特币杠杆交易的底层计算逻辑,带你看懂K线波动1%时,你的账户究竟会膨胀还是蒸发。"

一、杠杆交易的核心逻辑

杠杆交易的本质是「以小博大」,通过借入资金放大本金效应。例如10倍杠杆下,1万元本金可操作10万元头寸,盈亏波动率同步放大10倍。

二、盈亏计算公式拆解

基础公式:

盈利 = 杠杆倍数 × 本金 × (卖出价 - 买入价) / 买入价

若比特币从3万美元涨至3.3万美元,使用5倍杠杆的1万元本金可盈利:5 × 10,000 × (33,000 - 30,000)/30,000 = 5,000元。亏损同理:

价格反向波动时,公式中的差值变为负数。例如价格下跌10%,5倍杠杆下本金将亏损50%。

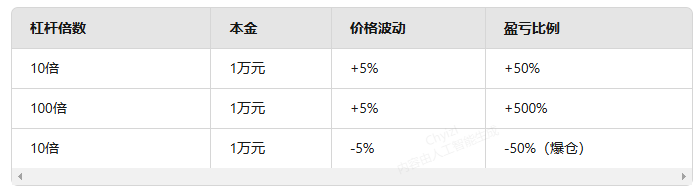

三、实战案例:不同杠杆的风险对比

注:主流平台通过动态熔断机制降低爆仓风险,部分平台已将强平线从45%降至28%。

四、必知风险管理技巧

轻仓原则:杠杆倍数建议≤本金可承受亏损的倒数(如能接受20%亏损,最高开5倍杠杆)。

止损工具:设置价格预警,例如买入价下方3%触发自动平仓。

时间成本:杠杆持仓按日计息,年化利率约5%-15%。

分散投资:避免单押一个方向,可同时配置现货与合约对冲风险。

No comments yet