Spot Bitcoin ETFs posted the longest streak of daily inflows in months, with investors injecting more than $3.75 billion into the funds over the past seven days.

The bullish momentum pushed the total net assets managed by spot Bitcoin ETFs above $100 billion for the first time since March 6. The funds currently hold $109.3 billion worth of BTC after rebounding 26.4% from a local low of $85.7 billion on April 8, according to SoSoValue. The sector tagged an all-time high of $123.6 billion on Jan. 21.

The milestone marks the longest streak of inflows to the funds in two months, when $1.06 billion entered the sector from March 14 through March 27. The streak includes the second-largest weekly inflow on record, with $3.06 billion entering Bitcoin ETFs during the week ending April 25.

Investors injected $591.3 million into spot Bitcoin ETFs on April 28. BlackRock’s IBIT fund accounted for all inflows to the sector over the past 24 hours with $970.9 million, while capital flowed out of the Bitcoin ETFs offered by Fidelity, Grayscale, Bitwise, VanEck, Ark and 21Shares.

Interest in Hong Kong-based spot Bitcoin ETFs continues to wane, with the sector’s last recorded flow comprising a 7.91 BTC outflow on April 17.

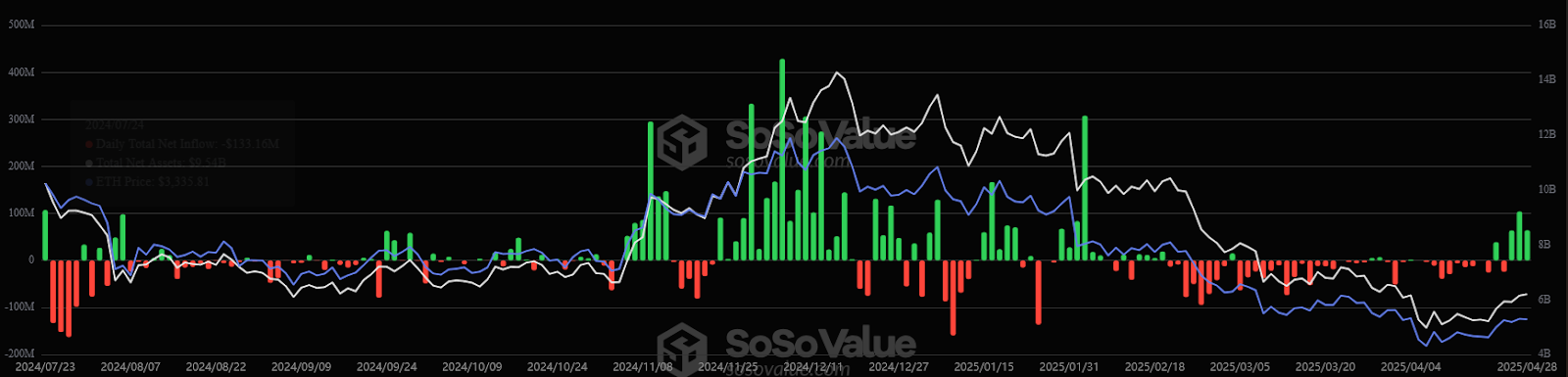

Spot Ether funds rebound from all-time low

Spot Ether exchange-traded funds (ETFs) also posted a third consecutive daily inflow on April 28, similarly marking the funds’ longest streak of inflows since mid-February. The funds took in $231.8 million over three days, including $64.1 million on April 28. Investors injected $67.5 million into BlackRock’s ETHA fund over the past 24 hours, while $3.35 million exited Bitwise’s ETHW fund.

Spot Ether ETFs now manage $6.2 billion worth of ETH, up from an all-time low of $4.98 billion on April 4. The sector peaked at $14.3 billion on Dec. 16.

BlackRock’s IBIT and ETHA funds accounted for all inflows to U.S. crypto ETFs on April 28.

Grayscale advocates for crypto ETP staking

Newly published documents reveal that Grayscale met with members of the U.S. Securities and Exchange Commission’s Crypto Task Force to champion regulatory amendments that would allow Ethereum exchange-traded product (ETP) providers to participate in staking on April 21.

The company estimated that U.S.-based Ether ETP providers could miss out on $5.5 billion worth of ETH staking rewards over the next 10 years should the current prohibition on ETP staking remain in place.

“ETH ETPs have foregone approximately $61 million as a result of not being able to participate in staking from launch through February 2025, not including daily compounding of rewards,” Grayscale said. “Instead, such rewards have gone to non-US ETH ETPs and other non-ETP stakers.”

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More

No comments yet