Understanding the Computing Power Threshold from ASIC Evolution to Global Hashrate

As a crypto blogger, I'm often asked: "Why is Bitcoin mining so difficult now?" The answer lies in three dimensions: The hashrate arms race, dynamic difficulty adjustment, and the balance between cost and profit.

1. Hashrate Evolution: From CPU to ASIC Dominance

In 2010, you could mine Bitcoin with a home computer CPU and earn dozens of coins daily. Today, ASIC miners like Antminer S21+ 235T deliver 235T hashrate – equivalent to 230,000 PCs working simultaneously! This exponential growth stems from:

Algorithm specialization: SHA-256 optimized ASIC chips are 1,000x more efficient than CPUs/GPUs

Network hashrate explosion: Global Bitcoin hashrate now exceeds 140EH/s, meaning solo miners have near-zero success rate

2. Difficulty Adjustment: Bitcoin's Self-Regulating Mechanism

The network automatically adjusts mining difficulty every 2,016 blocks (~2 weeks) to maintain 10-minute block intervals. This creates two effects:

Hashrate growth → Difficulty surge: 2024 saw 45% difficulty increase, forcing constant hardware upgrades

Price volatility fuels competition: When BTC hit $100k, new ASIC influx doubled difficulty in 90 days

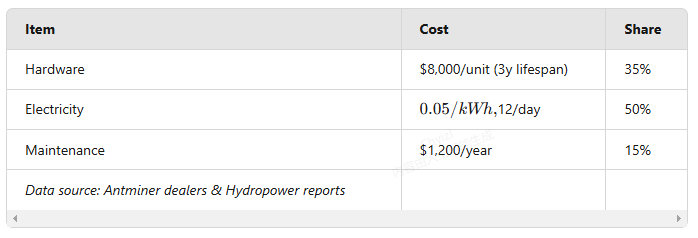

3. Cost Breakdown: Electricity is the Real Game-Changer

Let's analyze economics for S21+ miners:

Even with stable BTC prices, breakeven takes 18+ months. Worse, quantum computing breakthroughs like Google's Willow chip once caused 30% hashrate spike, instantly obsolescing older miners.

4. Future Outlook: Is Mining Still Accessible?

For newcomers, three strategies matter:

Join mining pools: Platforms like F2Pool distribute rewards proportionally

Leverage seasonal electricity: Sichuan's rainy season offers $0.03/kWh rates

Monitor tech disruptions: Quantum computing progress demands hardware upgrades

Bitcoin mining has evolved from a hobbyist activity to a capital-intensive industry. Yet this very difficulty guarantees Bitcoin's security and scarcity – perhaps Satoshi Nakamoto's most brilliant design.

No comments yet