What Is Sui?

Sui is a Layer 1 blockchain with a focus on accessibility offering high-speed and low-cost transactions through parallel processing. It leverages the Move programming language, which can be used to define, create, and manage Sui objects (user assets).

Key Takeaways

-

Sui offers its users high-speed, low-cost, and near-instant finality using parallel processing enabled by its unique object model.

-

Its performance is ideal for demanding applications like DeFi and gaming, with a growing focus on BTCFi.

-

Sui is a Layer 1 developed by Mysten Labs, a team with experience working on Meta’s Diem and Move language projects.

-

Sui is focused on accessibility, with features like zkLogin (using social IDs for wallets) and sponsored transactions lowering the barrier for user adoption.

-

Sui’s native token is SUI, which is used for gas fees, staking, and governance.

This article was updated in April by Vera Lim.

Sui stands out among Layer 1 blockchains for its focus on accessibility, parallel transaction technology, and its growing Bitcoin DeFi (BTCFi) ecosystem. By solving blockchain scaling and user accessibility issues, Sui positions itself as a major contender for real-world crypto applications.

Since its launch in May 2023, Sui has grown to become one of the largest Layer 1s, with its token price reaching a high of $5.35 and a market cap of over $15.9 billion in Jan 2025. Its growth has outstripped its Move competitor Aptos; at time of writing on DefiLlama, Sui has almost $2 billion in TVL, while Aptos has around $1.6 billion.

Introduction to Sui

Sui is a Layer 1 blockchain optimized for near-instant and low-cost transactions. This makes Sui suitable for applications ranging from decentralized finance to gaming, both of which require near-instant transaction finality. Sui is also designed for mass adoption by allowing users to create wallets with web credentials, instead of requiring them to manage private keys and seed phrases.

Sui utilizes the Move programming language (originally developed for Meta’s Diem blockchain), which offers safer and more efficient programming. Sui’s enhancements to Move include moving from an account-based data model to an object-based one, which allows independent transactions to run in parallel, and subsequently enabling Sui to scale horizontally.

The native token of Sui is SUI, which is used for gas fees and staking with validators. Sui operates on the DPOS (Delegated Proof of Stake) consensus mechanism, where SUI token holders stake their tokens with validators. Validators earn rewards, which are then shared with stakers as staking rewards. Tokens delegated to validators reflect their voting power.

Sui has been audited by firms including Halborn and Zellic to identify any potential security issues and threats to user safety.

Who Created Sui?

Sui is developed by Mysten Labs, which was founded by former Meta engineers who worked on the Diem blockchain and Move programming language including co-founder Sam Blackshear, who created Move. Other notable members of the team include Evan Cheng, Adeniyi Abiodun, George Danezis, and Kostas Chalkias, all of whom previously worked at Facebook/Meta as well.

In September 2022, Mysten Labs raised $300 million from VCs including Andreessen Horowitz (a16z), Coinbase Ventures, and Circle.

How the Sui Blockchain Works: Object Model, Parallelization and Mysticeti Consensus

Now, let’s take a look at key components of Sui and how they contribute to the blockchain’s efficiency.

Sui’s Object Model

Blockchains like Ethereum organize their data around accounts (addresses), where the network operates as a giant spreadsheet where one column is the account address and another column is the token balance. However, Sui treats digital assets as real-world objects, where everything on Sui is an “object.” Crypto assets in your personal wallet are objects, each of which has their own unique ID so the network can tell them apart.

Object ownership on Sui include:

-

Individual users: Tokens and NFTs owned by individuals can only be transacted by their respective owners.

-

Shared: Shared objects don’t have a single owner, and can be used and modified by multiple people according to specific rules programmed into the object. In order to change these shared objects, consensus is required from network validators.

-

Immutable: Immutable objects are created and permanently locked. These objects cannot be changed by anyone, like smart contracts or foundational rules.

-

Owned by another object: Objects can also be owned by other objects, like accessories attached to a game character object.

Sui’s efficiency stems from how transactions on Sui state which specific objects are involved.

-

If your transaction only uses objects owned by you, Sui knows nobody else can interfere, so it can process it extremely quickly, often without needing the whole network to agree (no full consensus needed).

-

If multiple transactions use completely different objects, Sui can process them all at the same time (in parallel).

-

Only transactions involving shared objects always need the full network consensus process, because multiple people might try to change them simultaneously.

How Sui Enables Parallel Transaction Execution

Now, with an understanding of objects, let’s take a look at how they enable parallelization on Sui.

Sui identifies dependencies upfront through ownership, and can immediately recognize and execute the majority of simple, independent transactions in parallel, without needing to wait for network consensus.

Simple transactions involve owned and immutable objects because they don’t conflict with others’ simple transactions. This means they don’t need to go through the full consensus to be ordered relative to each other, allowing them to be validated quickly and executed in parallel by the network validators.

Mysticeti Consensus Protocol

Mysticeti is Sui’s consensus mechanism, created with the goal to significantly reduce the latency of transaction finalization on the Sui network It aims for sub-second finality, while maintaining high throughput and efficiency.

Previously, Sui operated on the Narwhal and Bullshark consensus mechanism. Narwhal was used to order transactions using a Directed Acyclic Graph (DAG) structure, where validators broadcast blocks referencing previous blocks, building a web of possible transaction blocks. Bullshark was used on top of this DAG structure, designating leaders from the set of validators based on a rotation scheme. The leader’s job was to drive the finalization of transactions for their round by proposing commitment and broadcasting the proposal to all other validators.

Mysticeti changes this by removing the need for a leader, as the system has a built-in rule to figure out when a block is committed. It checks the DAG to see if a block has a strong majority of validators that have previously linked back to that block. Instead of two separate mechanisms (one ordering, one finalizing), consensus on Sui now operates as a single streamlined process.

How Mysticeti improves consensus on Sui:

-

Speed: By removing the need to wait for leaders and voting rounds, transactions are confirmed faster; often in less than a second on Sui.

-

Efficiency: By eliminating extra communication rounds around consensus coordination, Mysticeti cuts down the time to confirm transactions.

-

No more leader bottleneck: Performance is more consistent and less dependent on the individual performance of a validator in the leader role.

Sui Use Cases: Gaming, DeFi, and BTCFi

Here are some primary use cases of Sui.

Gaming and GameFi

Sui’s architecture works well for games due to its high throughput, low latency, and its ability to handle many operations in parallel. Its object model also works for in-game assets, where an NFT(for example, a character) can have other objects attached to it (like weapons or other character-related assets).

Sui also supports in-game currencies and tokens, soulbound assets, dynamic assets (that change based on gameplay), and Kiosk, which manages asset trading on Sui marketplaces.

Improving Accessibility for Web2 Gamers

zkLogin: Sui’s zkLogin capability also allows users to sign in with social platforms like Google, Facebook, and Twitch. This automatically creates a Sui wallet, providing users with a web2 login experience on web3.

Sponsored Transactions: Sui also allows applications to sponsor gas fees for users’ transactions. This removes a major obstacle for new users, as they don’t need to purchase SUI in order to transact on-chain.

DeFi: Efficiency, Speed, and Low Cost

Sui’s speed and low transaction costs are crucial for DeFi applications like decentralized exchanges (DEXs), lending protocols, and derivatives platforms. Sui’s parallel execution also avoids bottlenecks during periods of high activity, ensuring that DeFi activity can be handled efficiently without slowing down the network for everyone.

The Move programming language also helps prevent common vulnerabilities like re-entrancy, double-spending, and asset duplication due to its resource-oriented nature and strong ownership rules.

DeepBook Native Liquidity Layer

DeepBook is a decentralized central limit order book (CLOB) built on Sui, which DeFi protocols can use as a liquidity source. According to Sui, DeFi activities leveraging DeepBook can achieve settlement in about 500 milliseconds with sub-second finality, while gas fees remain consistent and low. For users, they can also set limit orders, where the asset will be sold at a pre-set price once someone is willing to buy it at the price.

BTCFi: Bringing Bitcoin to Sui

Less than 2% of BTC is active on DeFi due to Bitcoin’s lack of smart contracts, slow transactions, and limited interoperability. Sui is changing that with its focus on Bitcoin DeFi, where users can bridge wBTC to Sui and deploy their BTC across Sui’s DeFi protocols to earn yield, trade, and borrow. According to Sui, 10% of Sui’s TVL consists of BTC assets like wBTC, LBTC, and stBTC.

Why Sui is perfect for BTCfi ⚡

— Sui (@SuiNetwork) April 22, 2025

• Parallel execution = faster, cheaper DeFi

• Built-in asset security from Move

• Low fees & instant finality

• Native BTC bridges + modular infrastructure

And it’s already working: 10% of Sui’s TVL is BTC assets like wBTC, LBTC, and stBTC.

Sui is also becoming a Bitcoin Secured Network (BSN) through the Babylon protocol, inheriting Bitcoin security and liquidity, backed by staked native-BTC. This means BTC holders can secure the Sui network without giving up custody of their bitcoin, expanding BTC’s utility beyond a store of value and medium of exchange.

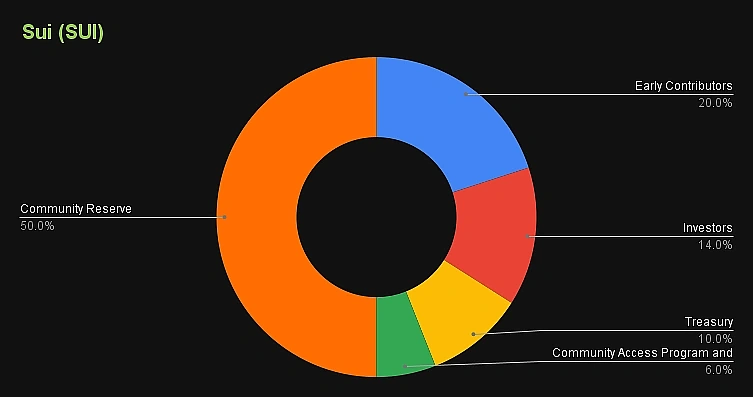

What Is the SUI Token and Its Tokenomics

SUI has a total supply of 10 billion tokens. As the native currency of the Sui network, SUI is used to pay for gas fees on the network. SUI can also be staked with validators to earn staking rewards and for governance, where token holders decide the direction of the blockchain.

A unique aspect of SUI’s tokenomics is its storage fund, where each on-chain transaction that adds data to the chain includes a fee for storage. The storage fund also has a stake in the network, and collects rewards based on that stake. The protocol then regularly distributes these storage fund rewards to Sui validators to pay for storage.

Originally, upon the launch of the Sui Mainnet, there was a one-year cliff period for vested SUI tokens. This means that certain blocks of SUI were only available to the market at specified time periods. However, this period ended in May 2024.

Where to Buy and Trade SUI

SUI is widely listed and traded across most major centralized exchanges including Binance, OKX, Bitget, and Bybit. However, as SUI is native to the Sui blockchain, it is only available on Sui decentralized exchanges like Cetus, Bluefin, Turbos Finance, and FlowX.

As native USDC is integrated into the Sui network, it is the stablecoin of choice on the network.

Risks and Challenges Facing Sui

While Sui has a growing ecosystem of dApps, it’s still competing against established incumbents such as Ethereum and Solana.

Centralization Concerns

As Sui operates on delegated Proof-of-Stake (DPOS) model, it is less decentralized than Proof-of-Stake blockchains as there are less validators. At time of writing, there are 113 validators on the Sui Network. However, with a lower validator count, it improves network speed as the network is able to reach consensus in a short period of time.

To prevent centralization, there is a 10% voting power cap for individual Sui validators, where even if a validator accumulates more than 10% of total stake, their voting power remains fixed at 10% and the remaining voting power is spread across the rest of validators. Users can also withdraw their stake or switch to a different validator at the end of each 24 hour epoch, allowing users to “vote with their stake.”

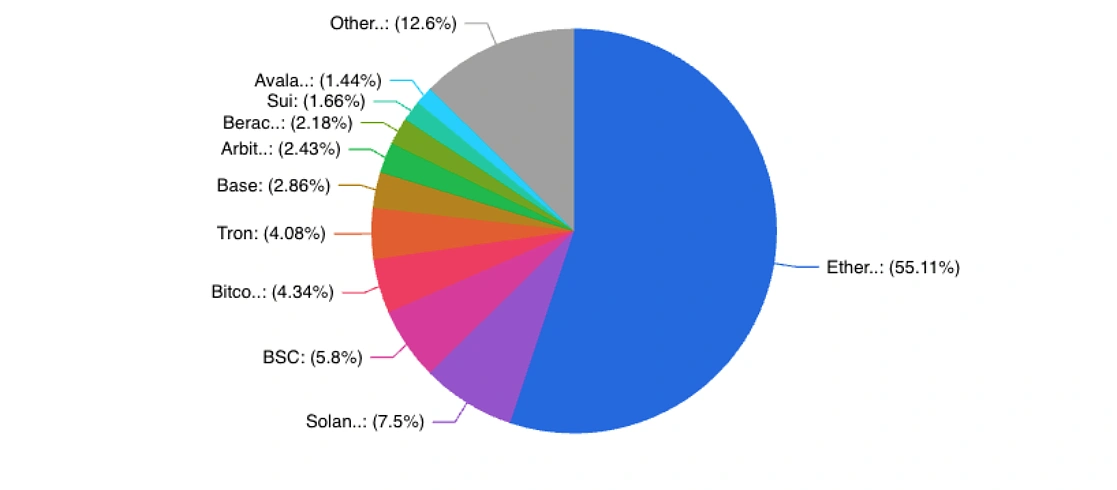

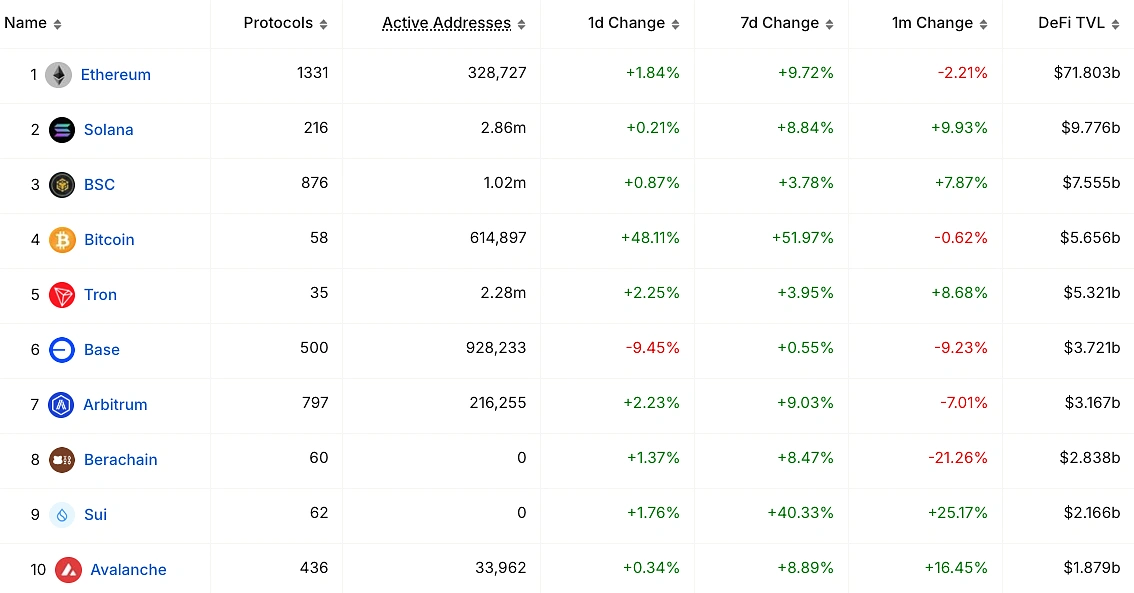

Competition

The Layer 1 space is extremely competitive, with multiple chains fighting for a share of the pie. Based on DefiLlama data, Sui only has 1.66% of total DeFi TVL.

However, looking at the performance of the top 10 chains on DefiLlama, Sui’s consistent growth outstrips almost every chain except Bitcoin.

Sui stays competitive with features including:

-

Deepbook to provide foundational liquidity tools for DeFi apps.

-

Dynamic NFTs to improve the on-chain gaming experience.

-

zkLogin which abstracts away the complexity of crypto wallet management.

Adoption

While the Move programming language offers benefits around security and more efficient programming, it is also less common than Solidity (used by Ethereum) and Rust (used by Solana).

While this is a hurdle to drawing developers to Sui and its ecosystem, Sui’s focus on high growth areas in crypto like BTCFi ensures that the chain stays relevant, while tapping into the large potential market of bitcoin holders.

Sui’s introduction of zkLogin also helps to draw new users to the chain, as users can easily create web3 wallets through social IDs. With more new users on-chain, there is an added draw for developers to create applications on Sui.

Considerations When Using Sui

Here are a couple of considerations to take note of when exploring the Sui ecosystem.

Sui-Compatible Wallets

As Sui is a Layer 1 blockchain, users who wish to interact with the Sui blockchain and ecosystem will need a wallet that is specifically compatible with Sui. Different Sui wallets may also offer different features, like Sui Wallet offering zkLogins that let users create wallets with their social IDs, or Nightly with its auto-confirm feature for transaction approvals.

Interacting With dApps

As a network growing in popularity, Sui is home to many dApps (decentralized applications) ranging from games to DeFi and BTCFi. However, this also means that there may be more malicious actors looking for victims.

Always be cautious when connecting your wallets to dApps and ensure that you are connecting to the real application, and disconnect your wallet when you are done with your transactions. Never share your seed phrase and private key; there is no reason for any protocol to require these details.

The Sui Ecosystem

We’ve picked out some key projects to watch on Sui. This list is non-exhaustive, and should only serve to provide a picture of the Sui ecosystem.

DeFi: Suilend – Full DeFi Suite on Sui

Suilend is the largest protocol on Sui, with a TVL of $696 million based on DefiLlama data. Suilend’s offerings include:

-

Suilend: Primarily a lending and borrowing that offers up to 54% deposit APR. Bridges and swaps are also available, although bridges are powered by Wormhole and swaps are powered by other Sui DEXs like Cetus.

-

SpringSui: A liquid staking protocol for Sui, where users can stake their SUI with SpringSui and receive sSUI which can be used in DeFi protocols to generate yield, immediately redeem their sSUI for SUI. sSUI can be unstaked instantly, allowing users to convert their sSUI back to SUI without delay.

-

STEAMM: STEAMM is a capital-efficient AMM that deposits idle liquidity to Suilend for additional yield.

DeFi: NAVI – Decentralized Liquidity Protocol

NAVI is the second largest protocol on Sui, with a TVL of $653 million according to DefiLlama. NAVI’s products include:

-

NAVI Lending: A lending and borrowing platform with features like flash loans and automatic leverage vaults that can be used for leveraged strategies.

-

Volo LST: A liquid staking platform where SUI can be staked for vSUI, which can be used in DeFi. According to the protocol, staking BTC through Volo is on the roadmap.

-

Astros: A DEX aggregator on Sui that offer the best trading routes across the Sui DEX ecosystem.

DeFi: Cetus – DEX and Concentrated Liquidity Protocol

Cetus is built on the Sui and Aptos blockchain, with a TVL of $241.9 million according to DefiLlama. Cetus utilizes concentrated liquidity, which is a type of liquidity pool on decentralized exchanges where liquidity providers allocate liquidity within a custom price range, ensuring better capital efficiency and preventing available liquidity from staying idle.

Users can also bridge assets on Cetus with Wormhole.

BTCFi: Lombard – Bringing Bitcoin to Sui

Lombard’s goal is to make bitcoin liquidity accessible. Lombard Staked BTC (LBTC) is a yield-bearing cross-chain token backed 1:1 with bitcoin, and the liquid staked bitcoin is now available on Sui.

LBTC is live on @SuiNetwork!💧

— Lombard | LBTC (@Lombard_Finance) March 6, 2025

With LBTC, institutional and retail users can mint LBTC natively from BTC on Sui, bridge LBTC from EVM chains, and access lending, borrowing and liquidity opportunities with the speed, security, and efficiency of Sui. pic.twitter.com/NTyv8imEVS

With this integration, users can now mint LBTC from BTC on Sui without needing to sell their bitcoin, bridge LBTC from supported chains, and use LBTC for DeFi opportunities including lending, borrowing, swapping, and liquidity provision – on top of additional yield incentives for LBTC deposits on Sui.

LBTC is integrated with Sui’s leading DeFi protocols including Cetus, NAVI, and SuiLend. It is supported on Sui Wallet, Phantom Wallet, and OKX Wallet.

Gaming: Samurai Shodown R – Utilizing Sui’s Dynamic NFT Technology

The Samurai Shodown franchise by SNK is coming to the Sui blockchain. Samurai Shodown R will be a mobile MMORPG (massively multiplayer online role-playing game) where in-game items exist as dynamic NFTs on Sui. These become more powerful as the character wins battles and gains achievements, and with Sui’s near-instant finality, updates to these dynamic NFTs take place instantly.

Sui Wallet: The Official Sui Wallet

Sui Wallet is developed by Mysten Labs, the team behind the Sui blockchain, and is considered the official wallet, hence ensuring that it supports the latest developments on Sui. Sui Wallet incorporates Sui’s zkLogin feature, which lets users create their wallet using a social ID like Google or Discord.

Final Thoughts

Sui has grown to become the 7th largest Layer 1 by market capitalization based on CoinGecko data, outstripping chains like Avalanche and TON. With technological innovations like its object model, parallel transaction execution, and the Mysticeti consensus protocol, Sui offers its users high throughput, near-instant transaction finality, and low costs. This makes it suitable for a wide range of applications, ranging from DeFi to gaming.

Furthermore, by actively supporting BTCFi, Sui is staying on top of the latest developments in the crypto space, ensuring it attracts adoption from bitcoin holders who are looking to put their BTC to work.

This article is only for information and education purposes, and should not be taken as financial advice. Users are advised to do their own research before investing in any protocol.

No comments yet