Organize & compile: Web3 Xiaolu

The origins of the public blockchain network can be traced back to the release of the Bitcoin White Paper in 2008 and the birth of the Genesis Block in 2009. However, the conceptual basis of blockchain has actually begun to be gradually constructed as early as the decades since the 1970s. Nevertheless, so far, blockchain has remained relatively limited in its application range in the financial and public sectors.

The open source and decentralized nature of blockchain are rooted in a core concept, namelyMathematics and code can protect privacy and freedom. Judging from the origin of its crypto-punk, blockchain is not only a technological innovation, it also has a strong political color, essentially an anti-establishment philosophical idea, representing an opposition to existing institutions (both banks or governments). Crypunk is a group of people who advocate utilizing encryption and privacy enhancement technologies to drive social and political change.

Public key cryptography first emerged in the mid-1970s, while hash functions and Merkle trees were born in the late 1970s. At the same time, the development history of modern Internet is also worth paying attention to. In the 1980s, Arpanet began to adopt the TCP/IP protocol, and by the early 1990s, the World Wide Web was officially born. However,In the process of the booming Internet in the 1990s, the important element of "digital currency" was missing.

The Bitcoin White Paper released in 2008 proposed to establish a "Point-to-point electronic cash system”, this concept has gradually been practiced in the following years, and Bitcoin usage has increased significantly. As of April 2025, Bitcoin remained one of the dominant cryptocurrencies in the crypto ecosystem, with a market share of up to 64%.

Entering the 2020s, the narrative surrounding blockchain has undergone an almost 180-degree turn.The movement that was once anti-established has now gradually become mainstream. Between 2023 and 2024, “Real World Asset Tokenization (RWA)” has become one of the dominant narratives of the crypto ecosystem. As of the end of March 2025, one of the largest holders of Bitcoin was the US Bitcoin ETF Fund. In addition, other US institutions, including the U.S. government, are also among the top ten Bitcoin holders. In 2025, a few days before the inauguration of the 47th US President, the $TRUMP meme coin was launched on the Solana blockchain.

As a digital currency based on blockchain network, stablecoins have huge development potential.In recent years, the use of stablecoins has shown a rapid growth trend. It is expected that the use of stablecoins may increase further significantly between 2025 and 2030 as regulatory transparency continues to increase (especially in the United States).

In addition, public chains can also bring higher transparency and enhanced trust. Whether in wealthy or poor countries, public institutions are working to improve their trust index, and these characteristics of public chains are exactly what they need urgently. The adoption of blockchain continues to advance with the evolution of regulation and the demands for transparency and accountability.

As the above review of blockchain history in 2025, how should we look forward to the future of stablecoins and blockchain? Citi GPS's latest research report, Digital Dollars - Banks and Public Sector Drive Blockchain Adoption, may give the answer, focusing on two key areas: new financial instruments (such as stablecoins), and modernizing legacy systems.

Therefore, we compiled this in a more detailed way, and its discussion of the stablecoin GPT moment is worth learning from.

Coincidentally, two years ago on May Day, we were also compiling Citi GPS's "Money, Tokens, and Games(Blockchain Next Billion Users and Trillions in Value)》, the subtitle of the article is Blockchain Next Billion Users and Trillions in Value.

In the 2023 report, Citi predicts that by 2030, Billion Users will come from: currency, social, gaming. Looking back in 2025, in addition to the flash in SocialFi and GameFi at that time, this gap will be filled by users holding cryptocurrencies or stablecoins. This is also the origin of Citi's 2025 stablecoin research report.

The full text is 18,000 words, the following enjoy:

Key Takeaways

1 Driven by regulatory changes, 2025 has the potential to become the "ChatGPT" moment for blockchain to be used in the financial and public sectors.

2 By 2030, the total supply of stablecoins in circulation may grow to $1.6 trillion under the baseline scenario we expect and $3.7 trillion under the optimistic scenario we expect. Even so, if the challenges in application and integration persist, that number could be close to $500 billion.

3 We expect the supply of stablecoins to remain denominated in US dollars (about 90%), rather than the central bank digital currency (CBDC) that will promote their own currencies.

4 The U.S. stablecoin regulatory framework may drive net new demand for U.S. Treasury bonds, allowing stablecoin issuers to become one of the largest holders of U.S. Treasury bonds by 2030.

5 Stablecoins pose a certain threat to the traditional banking ecosystem through deposit replacement. But they may provide new service opportunities for banks/financial institutions.

6 The public sector’s application of blockchain is also gaining increasing attention, thanks to continued attention to transparency and accountability for public spending, reflected in the U.S. government’s DOGE (Department of Government Efficiency) initiative and blockchain pilot projects by central banks and multilateral development banks.

7 The main use cases of public sector blockchain include: expenditure tracking, subsidy issuance, public record management, humanitarian aid activities, asset tokenization, and digital identity.

8 While on-chain transaction volumes in the public sector may initially be small and still have high risks and challenges, an increase in public sector interest may be an important signal for the wider use of blockchain.

1. Why is the large-scale adoption of blockchain now?

Why is it said that 2025 may become the "ChatGPT moment" for blockchain application in the financial and public domains?

-

The supportive stance of U.S. regulators on blockchain is expected to be a year to change the industry landscape. This could lead to wider adoption of blockchain-based currencies and stimulate other use cases in the U.S. private and public sectors.

-

Another potential catalyst is the ongoing focus on transparency and accountability of public spending.

These changes have been built on developments over the past 12-15 months, including the EU’s crypto asset regulatory market (MiCA), the growth in user demand reflected in cryptocurrency ETF issuance, the institutionalization of cryptocurrency trading and custody, and the U.S. government’s establishment of strategic Bitcoin reserves.

While banks, asset management companies, public sector and government agencies have increased their participation in blockchain, they still lag behind some more optimistic expectations. The reality is that digital finance already exists in the fields of consumer and institutional finance, including proprietary databases and centralized systems such as Internet banks. We are now seeing the accelerated convergence of Internet native technologies, currencies, and blockchain and digital native use cases.

The government's adoption of blockchain is divided into two categories: empowering new financial tools and modernizing systems. The system is upgraded by integrating shared ledgers to enhance data synchronization, transparency and efficiency.

Stablecoins are currently the main holders of U.S. Treasury bonds and are beginning to affect global financial flows. The growing popularity of stablecoins reflects the ongoing demand for dollar-denominated assets.

Artem Korenyuk, Digital Assets – Client, Citi

1.1 Stablecoins are on the rise

Stablecoins are cryptocurrencies pegged to stable assets such as the US dollar, and the main catalyst that drives them to gain wider acceptance may be the clarity of U.S. regulation. This can enable stablecoins, as well as blockchains (from a broader perspective) to better integrate into the existing financial system.

Given the dominance of the US dollar in international finance, changes in stablecoins in the United States will affect the broader global system.

The U.S. government seems keen to promote the development of the onshore digital asset industry, one of its priorities for improving innovation and efficiency. In January 2025, the U.S. President’s executive order titled “Strengthening U.S. leadership in the field of digital financial technology” established a digital asset task force responsible for developing a federal regulatory framework for the industry.

Against the backdrop of regulatory-friendly, digital assets are increasingly integrated with existing financial institutions, laying the foundation for the growth of stablecoin usage, and macroeconomic factors such as demand for the US dollar in emerging and cutting-edge markets have also further supported this trend.

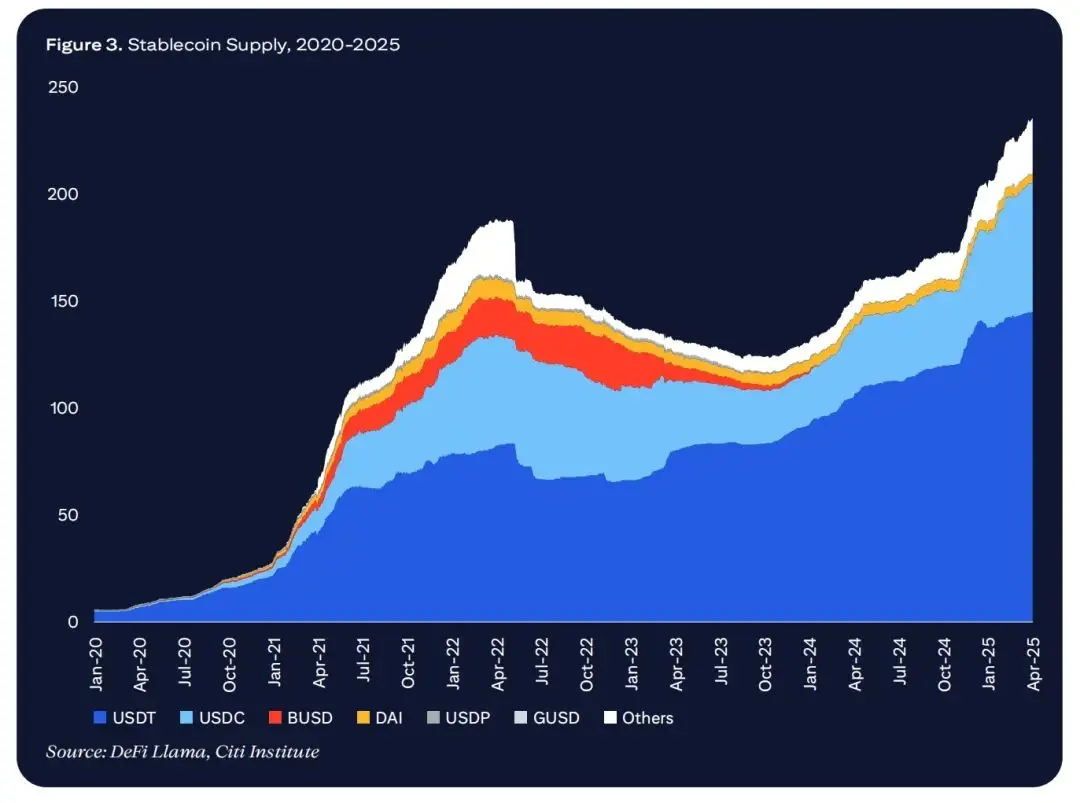

According to DefiLlama data, as of the end of March 2025, the total value of stablecoins was over $230 billion, 30 times that of five years ago. This reflects to a certain extent the growth in the total value of cryptocurrencies (1400% in the five years ended March 2025) and the growth in institutional demand. Our analysis shows thatUnder the benchmark scenario, the total supply of stablecoins could reach $1.6 trillion, with bear and bull market scenarios reaching about $0.5 trillion to $3.7 trillion respectively.

Treasury Demand: Establishing a US stablecoin regulatory framework will support the demand for US dollar risk-free assets at home and abroad. Stablecoin issuers must purchase U.S. Treasury bonds or similar low-risk assets as an indicator of their possession of secure underlying collateral.In the benchmark scenario, we expect U.S. Treasury bond purchases to exceed $1 trillion. By 2030, stablecoin issuers may hold more U.S. Treasury bonds than the total amount currently in any jurisdiction.

1.2 Future Challenges

The development of stablecoins also faces resistance and challenges. While the dominance of the dollar may evolve over time, and the euro or other currencies will be driven by national regulations, many non-U.S. policymakers may view stablecoins as tools of dollar hegemony.

The goal of blockchain is to align currency flows with the speed of the Internet and global commerce. Stablecoins can be a key tool to achieve this. The first step is the clarity of legislation and regulation. In addition, legal safeguards are needed.

Ryan Rugg, Digital Assets – Services, Citi

The geopolitical situation remains turbulent. If the world continues to move towards a multipolar system, policymakers in China and Europe will likely be keen to push for central bank digital currencies (CBDCs) or stablecoins issued in their own currencies. Policymakers in emerging and cutting-edge markets will also remain vigilant about the local risks brought about by dollarization.

Stablecoins and central bank digital currencies (CBDCs) are both attempts to create digital currencies, but they differ in terms of technical architecture and governance. The issuer of CBDC is a central bank, while private entities can issue stablecoins. CBDC is usually inspired by the principles of blockchain, but is not based on public chains. Given the demand for the US dollar in wholesale and financial transactions, especially in jurisdictions with high currency volatility, stablecoins may play the role of EuroDollar 2.0.

Therefore, we expect the stablecoin market to remain dominated by the US dollar in the next few years.In the benchmark scenario, we expect that approximately 90% of the stablecoin supply in 2030 will be denominated in US dollars, although lower than the current nearly 100%.

There is a risk of a run for stablecoins and may trigger a spreading effect. In 2023, stablecoins were decoupled about 1,900 times, of which about 600 were large stablecoins. Large-scale decoupling events may suppress liquidity in crypto markets, trigger automatic liquidation, weaken trading platforms' redemption capabilities, and may have a wider spreading effect on the financial system. For example, in March 2023, news of Silicon Valley banks’ bankruptcy triggered a massive redemption from USDC.

A recent report from Galaxy Digital noted that Tether provided about $8 billion in funding, accounting for about 25% of the total crypto lending business, noting that if Tether uses depositors’ funds to issue these loans, it “violates some banking systems and faces serious systemic risks.”

Note: Tokenized deposits are tokenized representations of commercial deposits, and each token is backed by retail or institutional deposits. Deposit tokens are native tokens on the blockchain, which directly represents retail or institutional deposits in the form of tokens. To date, most bank projects can be classified as “tokenized deposits.” Deposit tokens are mostly in pilot or early stages, such as the Guardian project, the Supervised Responsible Network (RLN), or the Helvetia project.

1.3 Does the public sector need blockchain?

Trust and transparency are essential to maintaining public support for governments and institutions.

Trust is the new currency of the government and they need to build confidence and trust with their citizens. Governments can continue to use centralized databases and traditional software solutions, but may miss the fundamental changes brought about by blockchain.

Saqr Ereiqa, Secretary General, Dubai Digital Asset Association

Blockchain introduces a trust-based approach to data management for public sectors. Trust in traditional systems stems from authoritative institutions—such as governments verify their own records—and blockchain allows encryption of proof of authenticity. Trust is rooted in the technology itself.

The immutability of blockchain ensures that information cannot be changed once recorded, thus providing tamper-proof records for sensitive public data such as land registration, voting systems, and financial transactions. While other technologies can also be tamper-free, they usually require a trusted party to execute.

Cross-border activities, especially payment of international funds through institutions such as the World Bank or humanitarian aid projects, are important use cases for blockchain. International capital flows may be opaque and it is difficult to effectively verify whether the resource reaches the intended recipient. Blockchain can provide transparency for complex transactions, even in remote or unstable areas where financial institutions are not functioning well.

Building a blockchain with a simple database that is enough to meet demand is like driving a Ferrari to a corner store – expensive, inefficient and unnecessary. If all inputs and outputs are controlled by one entity, there is no real advantage to blockchain. Its true value will only be revealed when the exchange of value that needs to be trusted.

Artem Korenyuk, Digital Assets – Client, Citi

1.4 Expert opinion

A. Digital Trust Revolution

Siim Sikkut was formerly the Chief Information Officer of the Government of Estonia (2017-2022) and is currently a member of the Digital Advisory Committee of the President of Estonia. He is also a Managing Partner at Digital Nation.

Q: What prompted Estonia to adopt blockchain?

Estonia's digital transformation stems from real needs. As a small country with a population of only a few million, efficiency and productivity are crucial. In the late 1990s, with the rise of the Internet, Estonia began experimenting with digital solutions in the government and banking sectors.

These early initiatives demonstrated significant advantages, allowing the country to operate beyond its land area and resource constraints. This success prompted Estonia to make a strategic commitment to digital innovation. Estonia has adopted an iterative approach to test emerging technologies, identifying which technologies work and promoting successful solutions. This approach has spawned groundbreaking initiatives such as online voting and e-residence, both of which were experimental projects and later gradually became an integral part of Estonia's digital infrastructure. Blockchain follows a similar trajectory. Estonia adopts blockchain not to respond to the crisis, but to ensure efficient digital governance.

Q: How does Estonia use blockchain in government operations? Why?

Estonia mainly uses blockchain to ensure data integrity in government systems. The key challenge is maintaining trust—making sure citizens can trust the security and accuracy of their data. While encryption and cybersecurity help solve confidentiality and availability issues, governments need a solution to verify the integrity of their records.

The key question is: How to trust the system administrator and the log files it provides?

In the early 21st century, Estonia adopted a custom blockchain, KSI (keyless signature infrastructure), as an additional layer of trust. Today, it has been applied to various government databases including the National Health Registration System.

It is worth noting that the blockchain does not store actual records, but records the time and person metadata of access or modification of records. For example, it does not store an individual's blood type, but records when and who accessed or modified the entry. This approach has two key advantages. First, it ensures user privacy and regulatory compliance. Secondly, it is impractical to store large data sets on a chain from a cost and performance perspective.

Q: What potential use cases do you think there are in the future blockchain?

One promising area is digital documentation, where blockchains can enhance the security, transparency and efficiency of welfare, grants and public sector resource allocation. By providing an immutable ledger, blockchain can reduce fraud, strengthen accountability, and ensure seamless verification across institutions.

Another potential use is to manage and protect storage value, especially in government projects that allocate financial aid or subsidies. Tokenization also has potential, especially for government departments involved in fiscal redistribution.

B. Overall digital policy

Julie Monaco is global head of public sector banking at Citibank.

Q: What does a successful national digital policy look like?

Successful national digital policies are not only about technology, but also about vision and goals. It begins with bold leadership and commitment to building an inclusive, people-centered digital economy. Authorizing the Digital Tsar to coordinate priorities in artificial intelligence, data privacy and cybersecurity is key.

It is estimated that strategic investment in digital identity identification systems can unlock access for 1.7 billion people, save 110 billion hours of labor time, and increase 6% of emerging market GDP. According to Juniper Research, 3.6 billion people have registered worldwide and are in a strong momentum. Countries such as Estonia, India and Singapore have demonstrated the infinite possibilities that policy-led innovation can bring.

Q: What role should blockchain play in achieving accountability, transparency and efficiency as part of a successful digital policy?

Blockchain can definitely play a role in successful digital policies, especially in strengthening accountability, transparency and efficiency. It can create untampered records and automate audit trails through smart contracts, which can potentially reduce fraud, improve regulation and build trust in public systems. In terms of efficiency, it can simplify services such as taxation or welfare allocation by reducing bureaucracy.

But it is not a panacea, but if used properly, blockchain can be a powerful tool to help governments operate with greater integrity, responsiveness and efficiency.

2. GPT moments of stablecoins

2.1 How does stablecoins work?

Stablecoins are cryptocurrencies designed to stabilize their value by pegging their market value to underlying assets. The underlying assets can be fiat currencies (such as US dollars), commodities (such as gold), or a basket of financial instruments.

Key components of the stablecoin ecosystem include:

-

Stablecoin Issuer: The entity that issues stablecoins and is responsible for managing its underlying assets, usually holding a value equivalent to the supply of stablecoins in the underlying assets.

-

Blockchain ledger: After the stablecoin is issued to the public, transactions will be recorded on the blockchain ledger. The ledger provides transparency and security by tracking ownership and flow of stablecoins between users.

-

Reserves and collateral: Reserves ensure that each token can be redeemed at its pegged value. For stablecoins secured by fiat currencies, these reserves usually include cash, short-term government bonds and other current assets.

-

Digital Wallet Provider: Provides digital wallets, which can be mobile applications, hardware devices, or software interfaces, allowing holders of stablecoins to store, send and receive their currency.

How do stablecoins maintain their anchor exchange rate?

Stablecoins rely on different mechanisms to ensure their value is consistent with underlying assets. Fiatcoin-backed stablecoins maintain their anchor exchange rate by ensuring that each issued token can be exchanged for an equal amount of fiat currency.

The main stablecoins in the market

As of April 2025, the total circulation of stablecoins has exceeded US$230 billion, an increase of 54% since April 2024. The top two stablecoins dominate the ecosystem, accounting for more than 90% of the market share by value and transaction volume, with Tether (USDT) leading the way, followed by USD Coin (USDC).

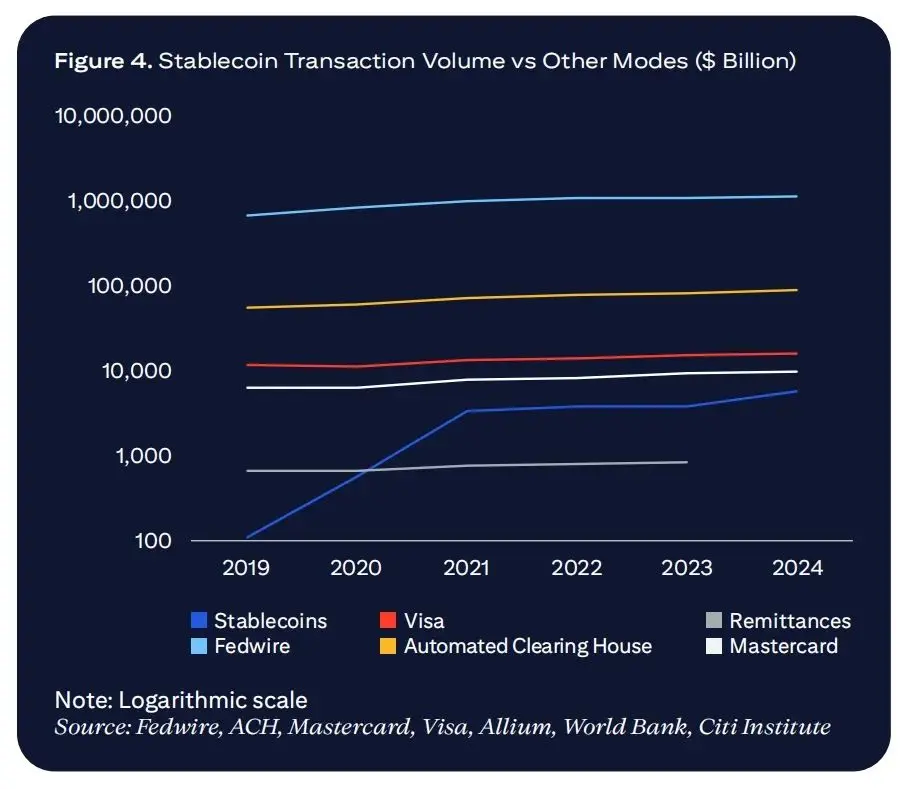

In recent years, the trading volume of stablecoins has grown rapidly. Adjusted by Visa Onchain Analytics, stablecoin trading volume reached $650 billion to $700 billion per month in the first quarter of 2025, about double the level from the second half of 2021 to the first half of 2024. Transactions that support the crypto ecosystem have always been a major use case for stablecoins.

USDT, the largest stablecoin with market capitalization, was launched on the Bitcoin blockchain in 2014 and expanded to the Ethereum blockchain in 2017, enabling its application in decentralized finance (DeFi). In 2019, USDT further expanded to the widely used Tron network in Asia due to faster and lower costs. USDT is mainly operated overseas, but times are changing.

We will certainly see more players (especially banks and traditional players) entering the market. USD-backed stablecoins will continue to dominate. final,The number of participants will depend on how many different products are needed to cover the main use cases – and the number of participants in this market may be more than the credit card network market.

Matt Blumenfeld, Global And US Digital Assets Lead, PWC

2.2 Drivers of Stablecoin Adoption

According to Erin McCune, Founder & Principal Consultant, Forte FinTech, the channel factors for stablecoins are as follows:

-

The practical advantages of stablecoins(Fast speed, low cost, available 24/7) is creating demand in developed and emerging economies. Especially in countries where instant payments are not yet widely available, small and medium-sized enterprises (SMBs) in these countries are not fully serviced by existing companies, while multinational corporations want to make global capital transfers easier. Cross-border transaction costs in these countries remain high, banking technology is immature, and/or financial inclusion lag.

-

Macro demand(Inflation hedging, financial inclusion) is driving stablecoins to be adopted in areas with severe inflation. Consumers in countries such as Argentina, Türkiye, Nigeria, Kenya and Venezuela use stablecoins to protect their funds. Today, more and more remittances are being transferred in the form of stablecoins, and consumers without bank accounts can now use digital dollars.

-

Recognition and integration of existing banks and payment providers is key to the legalization of stablecoins (especially for institutional and enterprise users) and can rapidly expand its scope of use and applicability.Mature and scaled payment network operators and core processors can increase transparency and promote integration with digital solutions businesses and merchants rely on. The clearing mechanism between various stablecoins between banks and non-bank institutions is also crucial to achieving scale. Technology improvements for consumers (easy to use wallets) and merchants (embedding stablecoins acceptance into acquisition platforms accessible via APIs) are removing barriers that once restricted stablecoins to the edge of cryptocurrencies.

-

The long-awaitedRegulatory clarity,It will allow banks and the wider financial services industry to introduce stablecoins in the retail and wholesale sectors. Transparency (audit requirements) and consistent liquidity management (reliable face value) will also simplify operational integration.

Matt Blumenfeld, Global And US Digital Assets Lead, PWC said the channel factors for stablecoins are as follows:

-

User Experience: The global payment landscape is increasingly shifting to real-time digital transactions. But the adoption of each new payment method faces the challenges of customer experience—whether it is intuitive, whether it can see the use cases, and whether the value is clear. Any organization that successfully enhances the customer experience—whether it is for retail users or institutional users—will stand out in their respective fields and become leaders.

The integration with our current payment methods will drive the next wave of application. In terms of retail, this will be reflected in the popularity of bank cards or mobile wallets. Institutional terms, this will be reflected in simpler, more flexible and more cost-effective settlements.

-

Regulatory clarity: After the introduction of new stablecoin regulatory regulations, we can see a serious suppression of innovation and application by regulatory uncertainty on a global scale. The introduction of MiCA regulations, clarity in Hong Kong's regulation and progress in U.S. stablecoin legislation has triggered a surge in activity aimed at simplifying the flow of institutions and consumers' funds.

-

Innovation and efficiency: Institutions must see stablecoins as a driving force for more agile product development, which is difficult to achieve in today’s era. This means providing a simpler, more creative or more attractive medium to enhance traditional bank deposits in the form of, for example, earnings generation, programmability, and composability.

2.3 Potential market for stablecoins

As Forte Fintech Erin McCune pointed out, any forecast of the potential size of the stablecoin market requires caution. There are many factors for market volatility, and our own analysis also shows that the market volatility range is very wide.

We constructed a forecast range based on the following factors that drive the growth of stablecoin demand:

-

Convert some US dollar holdings from paper money to stablecoins——U.S. banknotes held overseas are usually a hedge against local fluctuations, and stablecoins are a more convenient way to obtain such hedging. In the United States, stablecoins can be partially used for certain payment functions and held for this purpose.

-

Reconfigure some of the US dollar short-term liquidity held by U.S. and international households and businesses as stablecoins to support cash management and payment operations.Because stablecoins are easy to use (such as 24/7 cross-border payments, etc.), and if regulations allow, stablecoins may partially replace earning assets.

-

Furthermore, we assume that the short-term liquidity substitution trend of EUR/GBP is similar to that of the short-term liquidity of the US dollar, which is held by domestic households and businesses, albeit at a much smaller scale. In the benchmark case,We predict the 2030 optimism scenario that the stablecoin market will still be mainly driven by the US dollar (about 90%).

-

Growth of the public crypto market, where stablecoins are used as facilitators of settlement or monetary acceptance; in part because of the increased adoption rate of public crypto assets by institutions and the widespread use of blockchain technology. In our benchmark scenario, we assume that the growth trend of stablecoin issuances will continue from 2021 to 2024.

-

Our benchmark scenario for the size of the stablecoin market in 2030 is $1.6 trillion, the optimistic scenario is $3.7 trillion, and the pessimistic scenario is $0.5 trillion.

Note: The stock of total currency (circulating cash, M0, M1 and M2) in 2030 is calculated using the nominal GDP growth rate. The euro zone and the UK may issue and adopt local currency stablecoins. China may adopt sovereign central bank digital currency (CBDC), and the possibility of using foreign privately issued stablecoins is less likely. Bear market forecast for non-USD stablecoins in 2030: US$21 billion; benchmark forecast: US$103 billion; bull market forecast: US$298 billion.

2.4 Stablecoin market outlook and use cases

Erin McCune is the founder and chief consultant of Forte Fintech. She has over 25 years of consulting experience in the payments field. Her consulting efforts focus on commercial payments, cross-border transactions, and the intersection of corporate finance, banking and enterprise software. Prior to founding Forte Fintech, she worked as a partner at Bain Company and Glenbrook Partners.

Q: What are the optimistic and cautious outlooks on the recent size of the stablecoin market and the potential factors driving its development?

Predicting the growth of the global stablecoin market requires great confidence (or ego) because there are still many unknowns. Based on this, I put forward the following optimistic and pessimistic predictions:

The most optimistic forecast is that as stablecoins become the daily medium for instant, low-cost, low-friction transactions around the world, the market size will expand 5-10 times. A relatively optimistic prediction is thatBy 2030, the value of stablecoins will increase exponentially from the current $200 billion to $1.5 trillion - $2.0 trillion,and will penetrate into global trade payments, P2P remittances and mainstream banking businesses.

This optimism relies on several key assumptions:

-

Regulatory policies are loose in key areas – not only Europe and North America, but also markets with the largest demand for local fiat currency alternatives, such as sub-Saharan Africa and Latin America.

-

Establish real trust between existing banks and new entrants, as well as broad trust among consumers and businesses in the integrity of stablecoin reserves (e.g., 1 dollar stablecoin = equivalent value of 1 dollar-fiat currency)

-

Reasonable distribution of income throughout the value chain to facilitate cooperation; and

-

Technology that connects old and new infrastructure is widely adopted to promote structural efficiency and scale. For example, merchant acquiring agencies have begun to use stablecoins. For wholesale payment applications, corporate finance and accounts payable (AP) solutions, and commercial banks need to make adjustments. Commercial banks will need to deploy tokenization and smart contracts.

In a pessimistic scenario, the use of stablecoins remains limited to crypto ecosystems and specific cross-border use cases (mainly poorly liquid currency markets, which currently account for only a small part of global GDP). Geopolitical factors, resistance to digital dollarization and widespread adoption of CBDC will further hinder the growth of stablecoins.In this case, the market value of stablecoins may stabilize between $300 billion and $500 billion, and has limited role in mainstream economy.

The following factors will lead to more pessimistic scenarios:

-

If one or more major stablecoins experience reserve failure or decoupling events, this will seriously undermine the trust of retail investors and businesses.

-

The friction and cost associated with using stablecoins for daily shopping—whether it is the inability of remittance recipients to buy groceries, pay tuition and rent, or the inability of businesses to easily use funds to pay wages, inventory, etc.

-

Retail CBDCs have not yet gained attention, but stablecoins may not be very suitable in areas where digital cash alternatives in the public sector can scale.

-

In areas where stablecoins are increasingly receiving attention and local fiat currency correlations are further weakened, central bank governors may respond by strengthening supervision.

-

If the stablecoins supported by full reserves are large enough, this could "take up" a large number of security assets to support them, potentially limiting economic credit.

Q: What are the current and future use cases of stablecoins?

As with any other payment method, the relevance and potential growth of stablecoins must be considered based on specific use cases. Some use cases have received widespread attention, while others remain at the theoretical stage or are obviously impractical. Here are the use cases (from large to small) that contribute to stablecoin transaction volumes in the current (or near future):

-

Cryptocurrency trading: The use of stablecoins for individuals and institutions to trade digital assets is currently the largest use case, accounting for 90% to 95% of stablecoins transaction volume. This type of activity is largely driven by algorithmic trading and arbitrage. In the maturity stage, given the continued growth of the crypto market and its reliance on stablecoin liquidity,Transactions (retail + DeFi activity) may still account for about 50% of stablecoin usage.

-

B2B payment (business payment): According to Swift, the vast majority of traditional agency bank transaction amounts can reach their destination within minutes via Swift GPI. But this mainly occurs between centralized monetary banks, between highly liquid currencies, and during bank business hours. There are still many problems of inefficiency and unpredictability, especially when conducting operations in low- and middle-income countries. Businesses that use stablecoins to pay overseas suppliers and manage capital operations may occupy a considerable share of the stablecoin market.Given that global B2B capital flows are as high as tens of trillions of dollars, even if a small portion turns to stablecoins, in the long run, it may be equivalent to 20% to 25% of the total stablecoin market size.

-

Consumer remittance: Despite the steady shift from cash to digital currencies, pressure from regulators and focused efforts of new entrants, overseas workers’ remittances to family and friends in China are still expensive (5% of the average $200 transaction: 5 times higher than the G20 target). With lower fees and faster speeds,Stablecoins are expected to occupy a significant share of the remittance market of about $1 trillion.If the promised immediacy and significantly reduced costs are achieved, stablecoins may occupy 10% to 20% of the market share under high adoption rates.

-

Institutional trading and capital markets: The use cases of stablecoins for professional investors or tokenized securities settlement transactions are expanding. Large amounts of capital flows (foreign exchange, securities settlement) can start using stablecoins to accelerate settlement. Stablecoins can also simplify the financing process for retail purchases of stocks and bonds, which is currently usually achieved through batch automatic clearing house processing. Large asset management companies have begun to pilot stablecoin settlement for funds, laying the foundation for their widespread use in the capital market. Given the huge payment flows among financial institutions, even modest adoption may account for about 10% to 15% of the stablecoin market.

-

Interbank liquidity and capital: Banks and financial institutions that use stablecoins in internal or interbank settlements account for a small proportion, but may have a huge impact (maybe less than 10% of the total market size). Leading industry player JP Morgan has launched a blockchain project with more than $1 billion in daily transactions, which shows great potential despite the lack of transparency in regulation. This area is likely to grow significantly, although it may overlap with the institutional uses mentioned above.

2.5 Stablecoins: Bank card, central bank digital currency (CBDC) and strategic autonomy

We believe that stablecoin usage may grow and these new opportunities will create space for new entrants.The current duopoly pattern of issuers may continue in the offshore market, but the onshore market in each country may provide new players with a platform to join.

Just as the bank card market has evolved in the past 10 to 15 years, the stablecoin market will also change. Stablecoins have some similarities with the bank card industry or cross-border banking business. All of these industries have strong network/platform effects and strong reinforcement cycles. More merchants accept a trustworthy brand (Visa, Mastercard, etc.), which will attract more cardholders to use the card. Stablecoins also have a similar usage loop.

In larger jurisdictions, stablecoins are generally not regulated by financially, but this is changing in the EU (MICA, 2024) and the US (in progress). Tighter financial regulatory needs, along with high cost requirements for partners, could lead to centralization of stablecoin issuers, as we see in the credit card network.

Ultimately, having a handful of selected stablecoin issuers is good for the wider ecosystem.

While one or two major players may seem concentrated, too many stablecoins can lead to fragmented, irreplaceable currency patterns. Stablecoins can only flourish if they have scale and liquidity.

Raj Dhamodharan,Executive Vice President, Blockchain & Digital Assets, Mastercard

However, the continuous development of politics and technology has led to increased variance in the credit card market, especially outside the United States. Will the same happen with stablecoins?

Many countries have developed their own national card programs, such as Elo in Brazil (2011), RuPay in India (2012), and so on. Many national card programs were introduced for national sovereignty and were driven by changes in local regulatory and political encouragement by domestic financial institutions. They also enable integration with new national real-time payment systems, such as Brazil’s Pix and India’s UPI. Although the international card program has continued to grow in recent years, it has lost market share in many non-U.S. markets. In many markets, technological changes have led to the rise of digital wallets, account-to-account payments and super-apps. All of this has led to a decline in credit card market share.

Just as we see a surge in national programs in the credit card market, we are likely to see jurisdictions outside the United States continue to focus on developing their own central bank digital currency (CBDC) as a tool for national strategic autonomy, especially in the wholesale and corporate payments sectors.

OMFIF's survey of 34 central banks showed that 75% of central banks still plan to issue CBDCs. The percentage of respondents who issue CBDCs is expected to grow from 26% in 2023 to 34% in 2024 in the next three to five years. Meanwhile, some practical implementation issues are becoming increasingly prominent – 31% of central banks have delayed issuance schedules, citing legislation and the desire to explore broader solutions.

The CBDC project began in 2014 when the People's Bank of China (PBoC) began researching the digital renminbi. Coincidentally, Tether was also born this year. In recent years, driven by private market forces, stablecoins have developed rapidly.

By contrast, CBDC is still largely in the official pilot stage. A handful of small economies that launched national-level CBDC projects have not seen much natural user growth. However, the recent intensification of geopolitical tensions may increase interest in the CBDC project.

2.6 Stablecoins and Banks: Opportunities and Risks

Adoption of stablecoins and digital assets provides new business opportunities for some banks and financial institutions to drive revenue growth:

The role of banks in the stablecoin ecosystem

Banks have many opportunities to participate in the development of stablecoins and continue to act as hubs for currency flows. This can be directly as a stablecoin issuer, or as part of a payment collection/payment solution, around a structured product of stablecoin, general liquidity provision, or functioning in a more indirect way.

As users pursue more attractive products and better experiences, we have seen deposits flow out of the banking system. With stablecoin technology, banks have the opportunity to create better products and experiences while keeping their deposits in the banking system—users usually prefer deposits to be secured in the banking system.

Matt Blumenfeld,Global and US Digital Assets Lead, PwC

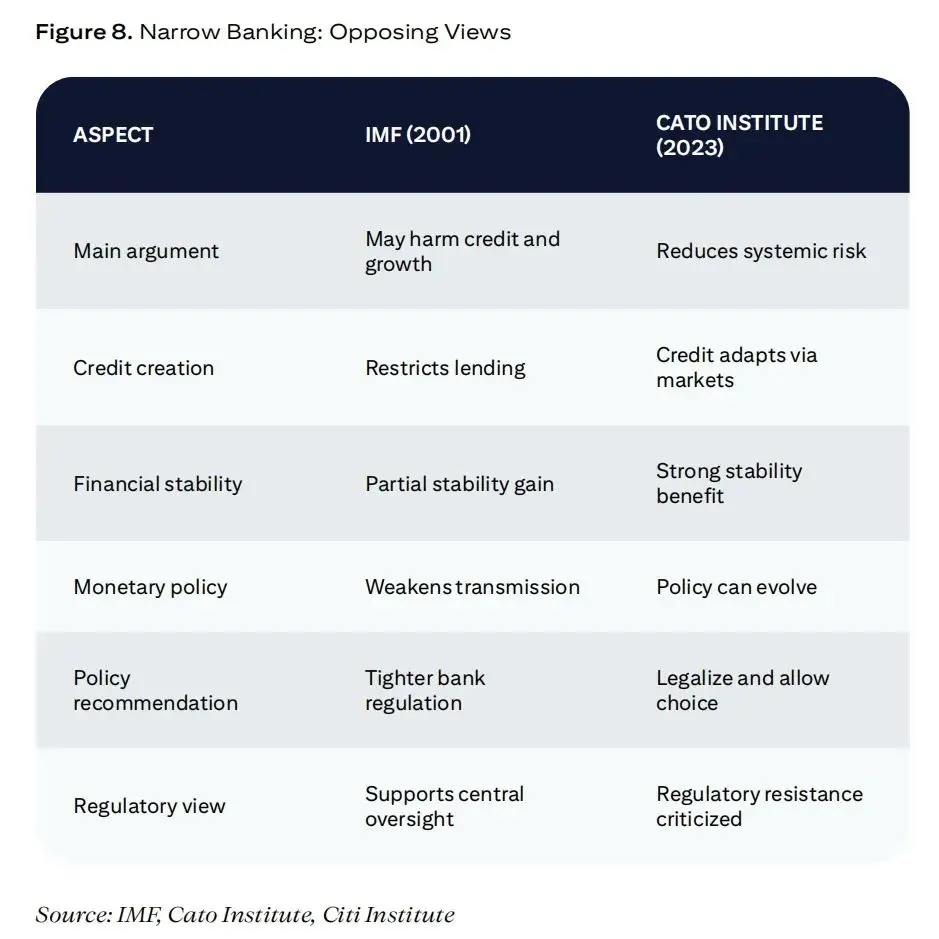

At the system level, stablecoins may have similar effects as “narrow bank”, and policy debates have been long-standing about the advantages and disadvantages of such institutions. The transfer of bank deposits to stablecoins may affect banks' ability to lend. This decline in lending capacity may dampen economic growth, at least during the transition period of system adjustments.

As the IMF Paper No. 9, 2001 concluded, traditional economic policies oppose narrow banking due to concerns about credit creation and growth. The Cato Institute’s 2023 report and other similar institutions have also raised objections, believing that “narrow banking” can reduce systemic risks while credit and other liquidities will adapt.

3. Public sector views on blockchain

Trust and transparency are the core advantages of blockchain in the public sector. Blockchain has great potential to replace existing centralized systems, thereby improving operational efficiency, enhancing data protection and reducing fraud.

While the on-chain transaction volume in the public sector may initially be smaller than in the private sector, the growing public sector interest is crucial for the widespread application of blockchain.

3.1 Public expenditure and finance

Blockchain technology is expected to transform public spending and fiscal spending on government services by increasing transparency, efficiency and accountability, while significantly reducing reliance on manual and paper processes. By integrating financial and non-financial reporting between government agencies and external partners,Blockchain can track spending in real time。

This should reduce the risk of corruption while increasing public trust in public institutions. The immutable nature of blockchain records ensures traceability and verifiability of transactions, thus simplifying the audit process and enhancing accountability. Blockchain also monitors fiscal appropriations in real time and provides data-driven insights to assess the impact of public spending.

Use of smart contractsThe efficiency of the bidding process can be improved by automating the bidding, evaluation and contract awarding processes. This reduces manual intervention and increases transparency in contract awarding, thus addressing common prejudices and favoritism in manual selection. Contract payments can also be made in phases by milestones, ensuring that funds are only issued when project milestones are reached.

By integrating blockchain into the accounting system, tax collection and management and compliance processes can be simplified, tax calculations can be automated and money sent to the government. As all transactions are permanently recorded on the blockchain, tax evasion becomes more difficult, thus enhancing tax collection and management.

Blockchain-based digital bonds can also be issued faster and more transparently by automatically paying interest. It also allows partial ownership, thereby increasing investor participation. Tracking debt instruments in real time during bond maturity can further increase accountability and investor confidence.

In addition to increasing efficiency and accountability, blockchain-based government services can reduce the large number of paper documents used for contracts, records and transactions each year. Dubai’s “paperless strategy” aims to reduce the billions of paper generated each year by digitizing all services, including visa application, bill payment and license renewal, that will now be traded securely through blockchain technology.

3.2 Issuance of public sector funds and appropriations

The traditional government and public sector funding and appropriation distribution process often involves a lot of manual work – processing forms, validating claims, and managing cash flow. Blockchain provides a more effective alternative that simplifies processes and enhances data security and integrity. Using blockchain can also increase transparency, ensure fair distribution of funds, and reduce opportunities for corruption and fraud. Blockchain can also reduce operating costs and improve the efficiency of record preservation and reconciliation.

Encrypted hashed data is integrated into the blockchain system to enhance the integrity of transaction information and avoid unauthorized access. Smart contracts can also automate and protect the allocation process by programming predefined conditions such as verification of eligibility criteria.

Blockchain technology is very suitable for cross-border use in many ways, and the World Bank’s “Fund Chain” initiative launched in September 2024 is a good example. The initiative has currently carried out nine projects in Moldova, the Philippines, Kenya, Bangladesh, Mauritius and Mozambique.

FundsChain - The World Bank's blockchain for fund allocation tracking

The World Bank is responsible for allocating billions of dollars in annual funds and ensuring that funds are used for their intended uses. With numerous projects in several countries, tracking and verifying fund use has traditionally been a time-consuming and manual process. While some tasks have been automated, most regulatory efforts still require a large amount of workforce. FundsChain program aims to increase transparency and efficiency in fund allocation processes.

The World Bank has partnered with Ernst & Young to develop a blockchain-based platform designed to track capital flows and spending in real time. FundsChain provides powerful fund allocation tracking capabilities that enable stakeholders to view funds in real time, increase transparency and increase confidence, ensuring funds are truly reaching the hands of expected beneficiaries, and ultimately enable the World Bank to support the borrowing countries’ anti-corruption reform agenda.

Tokens are generated when funds are recorded. These tokens are credited to each entity's digital wallet. Transaction automation is achieved through smart contracts, and efficiency is improved; by storing and notarizing resources uploaded on the blockchain, security and data integrity are further enhanced. Consensus algorithms are used to verify transactions and prevent overspending.

Currently, this oversight is achieved by contracting the borrower to submit expenditure reports and collect other supporting documents. This can be a highly manual, labor-intensive and time-consuming process that requires a lot of coordination work, time and cost. With FundsChain, all project stakeholders (including borrowers, suppliers, auditors and ultimate beneficiaries) can see where the funds go, how and when they are used, enabling end-to-end transparency, with all transactions recorded on the chain, allowing stakeholders to monitor the flow of funds in real time.

The World Bank uses private blockchains to build FundsChain because they want to take control of the platform and its future developments. Given the sensitivity of their public sector mission, they do not want to rely on third-party vendors. They also want to ensure that any platform they use can interoperate with other multilateral development banks' platforms for seamless integration.

3.3 Public record management

Blockchain technology provides a powerful and secure platform for public record management, ensuring the authenticity, integrity and accessibility of critical data. By leveraging an immutable ledger, blockchain can maintain the integrity, accuracy and tamper-proof of records, thereby enhancing public trust in government systems.

Unlike traditional databases that centrally store records, data on the blockchain is distributed in a network of multiple nodes, and data is still accessible even if a single node fails and reduces the risk of data breaches caused by network attacks. Any modification to the record is encrypted and timestamped, creating auditable clues that enhance accountability while protecting citizen data. Blockchain also improves the accessibility and availability of records, as records can be easily retrieved and accessed when needed.

Governments are exploring blockchain solutions for public record management. For example, OpenCerts in Singapore is a blockchain platform that enables educational institutions to issue and verify tamper-proof academic certificates. This helps reduce the risk of file forgery and simplifies credential verification.

Another area where blockchain can drive significant improvements are land ownership and real estate management. This field is often plagued by fragmented record keeping, outdated processes and corruption. In countries where public sector corruption is rampant, the risk of fraud is particularly high. For example, Georgia has integrated its land ownership registration system into the Bitcoin blockchain, improving the verification of real estate-related transactions while improving security and service efficiency.

In countries with weak institutional integrity, there is an opportunity to increase transparency through decentralized ledgers and restore public trust in public institutions. These books can be auditable, transparent to the public, and maintained by all parties, and there is a motive for non-cooperation.

Artem Korenyuk,Digital Assets – Client, Citi

3.4 Humanitarian Aid

Effective coordination is critical during a crisis, as multiple entities use different systems to provide assistance in food, health care and shelter. Blockchain can simplify project design, resource allocation and data sharing by providing a unified shared ledger, thus avoiding duplication of work and ensuring assistance can be delivered to those who need it most. Real-time, verifiable transaction records can also facilitate collaboration between aid agencies, governments and NGOs, thereby reducing overall response time.

In addition to coordination, blockchain also has the potential to reshape crisis crowdfunding and provide a transparent and decentralized fund mobilization mechanism. By leveraging digital currencies, blockchain can collect donations and transfer them directly to verified beneficiaries without intermediaries, thus reducing costs and reducing delays. The use of smart contracts can further realize the automation of fund payment based on predetermined conditions.

Ensuring the integrity of humanitarian supply chains is another key challenge that blockchain may help solve. By enabling end-to-end traceability, blockchain enables aid agencies to track the source, flow and use of humanitarian materials. This breaks down data silos, prevents corruption and ensures that aid is delivered to the affected communities effectively. It also enables real-time inventory tracking, helping organizations deal with material shortages faster and avoid logistics bottlenecks.

The United Nations Refugee Agency (UNHCR) uses the Stellar blockchain to distribute humanitarian aid, a compelling example of the impact of blockchain in the public sector. UNHCR implements blockchain technology to simplify the distribution process of financial aid and successfully applies it to Ukraine, Argentina and other parts of the world. A key advantage of blockchain is the significant cost savings through overall digital transformation efforts.

Blockchain also brings greater transparency. In many crisis situations, displaced persons may not have access to traditional banking services. By using a blockchain-based wallet, aid recipients can receive and use funds without relying on a third party.

Denelle Dixon, CEO and Executive Director, Stellar Development Foundation

3.5 Asset Tokenization

Tokenization is expected to represent real-world and financial assets digitally through tokens, thereby unlocking value and improving efficiency, transparency and accessibility. In the public sector, tokenization can be applied to financial and physical assets.

Governments can tokenize debt instruments, improve bond issuance efficiency and allow a wider range of investors to participate. Similarly, natural resource and infrastructure assets such as roads, bridges and utilities can also be presented in the form of digital tokens, enabling more efficient tracking, management and financing.

In addition to investment accessibility and partial ownership models, tokenization can also help financial institutions and public institutions simplify operations and reduce inefficiency and systemic risks. Automation through smart contracts can minimize intermediaries, increase liquidity, and enhance public trust in public asset management.

Some institutions have explored the application of blockchain in digital bonds. For example, the European Investment Bank (EIB) issued its first blockchain-based digital bond in 2021, with a total amount of €100 million. The issuance cooperates with French banks to use blockchain to register and settle digital bonds.

In 2022, the European Investment Bank launched the Venus project, using central bank currencies to issue its first euro-denominated digital bond on a private blockchain in the form of a wholesale CBDC. Similarly, the city of Lugano, Switzerland completed three bond issuances using distributed ledger technology (DLT)/blockchain technology in 2023-24.

Promissa – Tokenized Promises

Many international financial institutions, including the Multilateral Development Bank (MDB), have their funds derived in part from financial instruments called promissory notes, most of which still exist in paper form. While the current system framework provides operational controls for member states to pay subscription payments and membership fees to public institutions such as the World Bank, custody of outstanding promissory notes can be digitized to meet operational challenges and further improve efficiency.

The Promissa project was jointly initiated by the Innovation Center of the Bank for International Settlements, the Swiss National Bank and the World Bank to build a prototype platform for digital tokenized promissory notes. The Promissa project explores the use of distributed ledger technology (DLT) to simplify promissory notes management and provide a single source of true information for all counterparties throughout the life of the promissory notes. This will give member central banks a full understanding of their outstanding notes with multilateral development banks and vice versa.

There are huge promissory notes among multilateral development banks: For example, the two largest institutions of the World Bank, the International Bank of Reconstruction and Development (IBRD) and the International Development Association (IDA), have had a large number of promissory notes promised by member states since its inception. While the Project Promissa project aims to reimagine a “single source of fact” platform solution to simplify the management of promissory notes between member states and multilateral development banks, it can be expanded to payments related to such promissory notes in the future by integrating tokenization or existing payment systems.

3.6 Digital Identity

A single digital identity can serve as a valid proof of public and private transactions, enhancing storage security and convenience. Blockchain-based digital identity (ID) provides a decentralized, tamper-proof authentication mechanism that reduces the risk of fraud and identity theft.

Digital identity extends basic services to underserved communities and those without official documents, such as displaced people. As nearly 850 million people lack official identity proofs, digital ID cards can empower individuals through the use of alternative data such as biometrics and community verification.

The immutable nature of blockchain creates transparent records for each transaction, creating verifiable digital audit leads, enhancing security and accountability. Its decentralized architecture and powerful encryption protocols can protect personal data from breaches and fraud.

In addition, an autonomous sovereign identity ensures that individuals have ownership and control over their information and selectively share data as needed. Advanced technologies such as zero-knowledge proof can verify identity attributes without leaking sensitive information.

The city of Zug, Switzerland, is an early example, based on the Ethereum blockchain’s autonomous digital ID card, providing residents with a single, verifiable electronic identity for a variety of applications. The Blockchain Digital Identity Project in Zug City was launched in 2017 and has been limited in applications to date due to a range of factors such as complexity and limited availability.

In 2023, Brazil launched a new national identity card based on blockchain. The new digital ID card can be accessed via mobile devices using facial recognition and QR codes. The ID cards are stored on a private blockchain called b-Cadastros and are built by Brazilian state-owned IT services companies to improve the security and reliability of data sharing among public institutions.

3.7 Challenges facing the application of blockchain in the public sector

Blockchain brings huge potential to government services, bringing many advantages such as transparency, security and efficiency. However, the large-scale application of blockchain also faces the major challenges described below.

Developing standardized protocols and practices will help public blockchains gain wider recognition and trust in banks and governments. Promoting collaboration between the public and private sectors can drive innovation and ensure that blockchain solutions meet the needs of all stakeholders.

Ricardo Correia,Partner, Bain & Company

-

Lack of trust: Many blockchain solutions are still in experimental stages and are untested, which makes building trust in the ecosystem difficult. It is necessary to increase awareness of the entire ecosystem and develop relevant skills. This takes time and investment.

-

Interoperability and scalability: If blockchain solutions are to be adopted nationally or globally, they need to be interoperable and scalable to handle large volumes of transactions. Working to develop global standards for blockchain is currently underway to make it widely recognized in different markets.

-

Transformation Challenges: Thoroughly renovating existing infrastructure can be extremely challenging and requires a lot of time and resources. Inadequate evidence of actual returns, the deemed immature blockchain technology and the existence of complex legacy systems further hinder new investments.

-

Regulatory issues: The decentralized nature of blockchain poses challenges to large-scale applications, so a regulatory framework is needed to recognize the legal nature of blockchain, the effectiveness of stored documents, and the financial instruments issued. Unclear regulation has slowed down blockchain adoption.

-

Respond to the risk of abuse: While it is difficult to quantify the size of cryptocurrencies used illegally, it is estimated that illegal addresses received $51 billion in cryptocurrencies in 2024, an increase of 11% over the previous year. However, as a percentage of all on-chain transaction volume, this number is usually less than 1%.

Resistance to Change and Public Consciousness

Implementing blockchain often means radical reform of existing systems, which could change every aspect of public officials’ work, including their daily work. While some may see blockchain as a positive change to improve administrative processes, many tend to resist it because they see blockchain as a threat.

Public perception also plays a crucial role. Blockchain is sometimes associated with speculative cryptocurrency markets and meme coins, obscuring the advantages of its underlying technology in the real world. This may exacerbate suspicion and thus slow its mainstream application in the public sector.

Saqr Ereiqat, Secretary General, Dubai Digital Asset Association

IV. Appendix

4.1 Stablecoin Regulation: GENIUS Act and STABLE Act

This section highlights two major stablecoin legislation currently under consideration in the U.S. Congress. Both legislation aims to establish a regulatory framework that will incorporate stablecoins into the mainstream financial ecosystem.

The GENIUS Act proposes a two-pronged regulatory approach that regulates the market value level of stablecoin issuers.

Stablecoin issuers with a total market capitalization of less than $10 billion can choose to be regulated by state-level regulators (if the state-level regulatory regime is basically similar to the federal regulatory framework). Issuers with market capitalization exceeding the $10 billion threshold will be subject to federal regulation. Both banks and non-bank institutions can issue stablecoins with regulatory approval.

The bill outlines the issuer’s obligations, including 1:1 reserve support, disclosure and redemption procedures, monthly reserve composition reporting and proof, prudent standards, and a range of consumer protection measures.

The second legislation is the STABLE Act 2025 Stable Coin Transparency and Accountability Promotes Better Ledger Economy Act (STABLE Act). The bill has many similarities with the GENIUS Act in terms of the type of companies that allow stablecoins to be issued, and has similar requirements for issuers to maintain 1:1 reserves (but different in terms of reserve composition), and similar requirements for information disclosure, monthly proofs, etc. Unlike the GENIUS Act, the bill does not distinguish issuers by a $10 billion market threshold.

Given that these bills would give certain stablecoin issuers the ability to opt into state-level regulatory regimes, they could pose regulatory arbitrage risks, i.e. some states may introduce less stringent regimes to attract stablecoin issuers. Differences in state-level regulatory regimes may make it difficult for banks to conduct business with issuers subject to a number of different regulatory regimes.

While both bills open the door to banks’ stablecoin payment services, including the provision of custody services, private keys or reserve support for payment of stablecoins, ensuring legislation provides appropriate protections for illegal financing will be the key to enabling banks to make the most of such opportunities.

Both bills will come into force 18 months after the date of enactment (the specific date is pending) or 120 days from the date of issuance of the final implementation regulations by the federal banking regulator, whichever is earlier. Both bills must undergo a coordinated process, and the whole House and Senate vote on the same version of legislation before they can be passed into law. In this process, the bill may still be modified in substance.

4.2 Public chain vs. Private chain

When exploring blockchain-based infrastructure, the pros and cons between private and public chains must be weighed. Public chains are permissionless networks that allow anyone to participate, verify transactions and access data. This openness makes it a powerful tool for achieving accessibility and transparency, but also presents challenges in areas such as regulatory execution and scalability.

This is similar to the current situation of public cloud computing and hosting. Bank and financial institution regulators have worried about the security and control of data stored in the public cloud. This time, people have similar concerns about public chains. Banks need to take appropriate control measures and risk mitigation measures, formulate rulebooks, and provide relevant education on this.

Biser Dimitrov, Digital Assets – Technology, Citi

-

Decentralized and not subject to any authority: Public chains tend to operate independently of any single entity, reducing the risk of excessive government intervention, scrutiny or unilateral manipulation. Governance is usually decentralized, through consensus mechanisms such as Proof of Work (PoW) or Proof of Stake (PoS).

-

Transparency and auditability: Public chains ensure transactions are permanently recorded and publicly accessible. This transparency enhances accountability, reduces corruption, and helps to strengthen trust in the financial system.

-

Interoperability and open accessibility: Stablecoins issued on public chains can be used in a variety of applications and services without custom integration. They also promote global accessibility, which can be accessed and used by anyone with an internet connection.

-

Security and elasticity: The decentralized nature of public chains is protected by a huge node network and encryption mechanism, making it more resistant to single point of failure, network attacks and centralized attacks than private systems.

On the other hand, public chains may not be suitable for all use cases:

-

Scalability and transaction throughput: Public chains may have difficulties in transaction throughput, especially when processing large numbers of transactions, which can lead to slower transaction processing and higher fees. This makes them less suitable for handling large-capacity, real-time financial transactions.

-

Lack of privacy and anonymity: Since all transactions are publicly visible, public chains may not be ideal for handling sensitive financial or other government data. Anonymity may vary by the type of blockchain.

-

Regulatory Compliance Challenge: The anonymity of public chains makes it difficult to enforce anti-money laundering (AML) and Know Your Customer (KYC) regulations. The government may have difficulty tracking illegal financial activities or effectively enforce financial policies.

-

Limited level of customization: While stablecoins issued on public chains provide a mature framework, they have limited flexibility in customizing solutions for specific use cases.

Other issues that policy makers and risk managers may need to consider: (1) uptime and reliability, and (2) identifying the most trusted tokens in the tokens associated with the public chain. For some, this has something to do with people’s negative perceptions of cryptocurrencies (because it was originally associated with illegal activity).

Whether private or public sector, banks and large institutions have traditionally relied on proprietary on-premises technologies. Open source and cloud technologies take time to penetrate these institutions. The integration of public chains, permissionless blockchains, will be a challenge – but with the support of regulatory and policy changes, the change is underway.

No comments yet