silver

Analyst: Silver (weekly) is currently fighting important resistance levels over 17 years. Looking back at history, silver successfully broke through this resistance zone in 2010 and then achieved a 115% increase in six months. I think,In the next round of gains, silver prices will significantly surpass the all-time high of $50 set in 2010.

Market sentiment

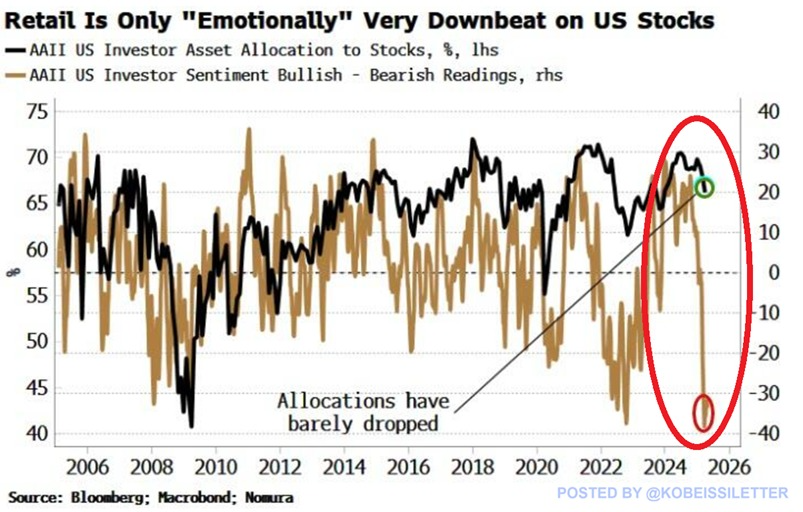

The latest AAII survey shows that 55.6% of respondents said they were pessimistic about the next six months, while only 21.9% expressed optimistic expectations. Although sentiment has turned extremely pessimistic, investors' allocation of stock assets has only dropped slightly by 3 percentage points, and is still as high as 67%, at a historical high. For comparison, during the 2020 epidemic, the proportion of stock allocations of retail investors once dropped to about 55%.

in other words,Although retail investors are very pessimistic, there are almost no obvious reduction in positions in actual operations, and they still hold heavy positions in US stocks as a whole.

Volatility

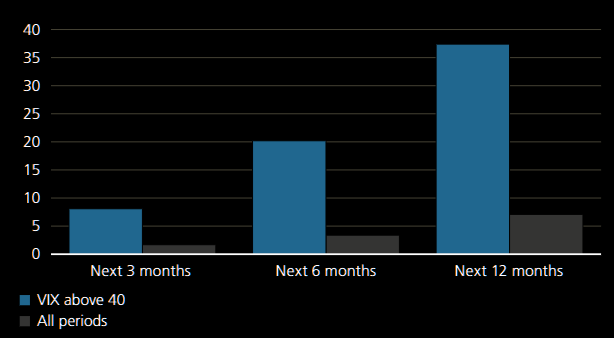

Panic often breeds opportunities. Recently, the VIX volatility index soared to 50 at one point, but has now fallen below 30. Judging from historical data, whenever VIX soars sharply, future market returns tend to perform strongly.

Crude oil fundamentals

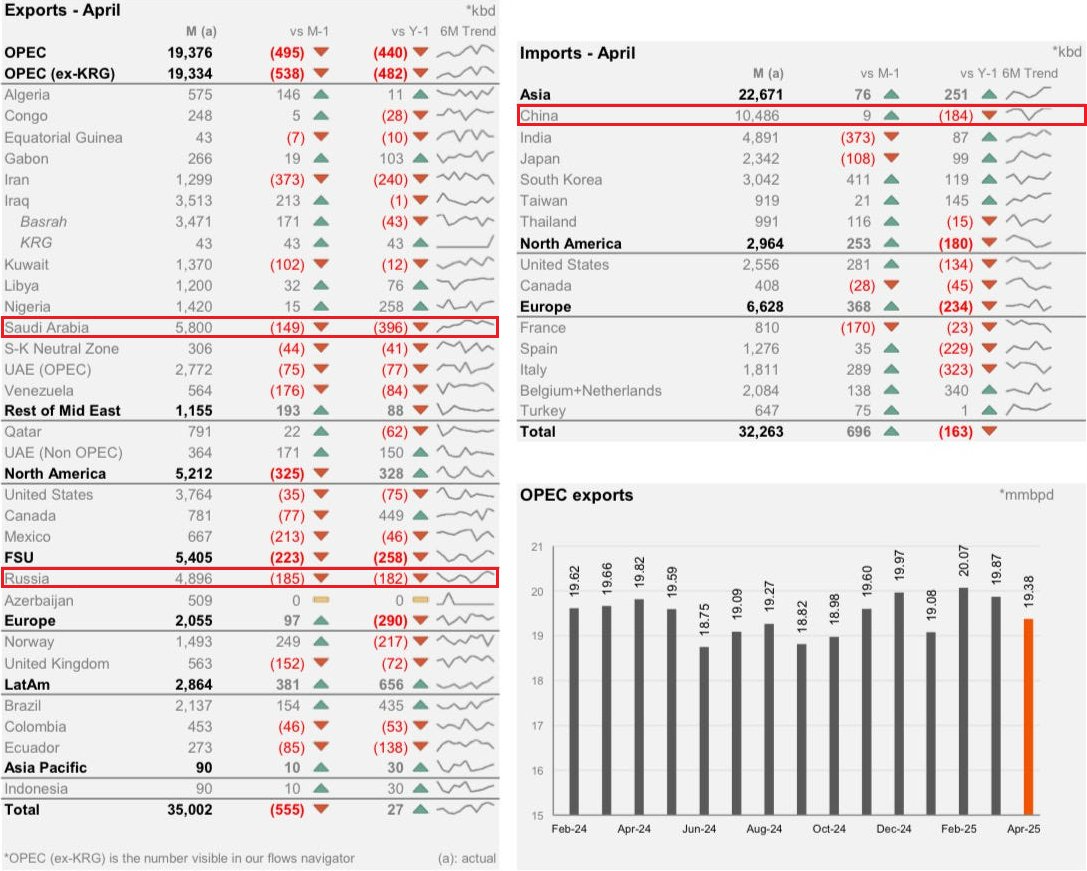

Many market views believe that OPEC+ has given up market management or is trying to increase volume to impact the market, but from the actual situation, they seem to have no intention. In the past two years, Saudi Arabia has only truly strictly implemented the production cut agreement. Most of the so-called "production cuts" of OPEC+ are just on paper. Similarly, the "production increase" announced in the future is likely to be just an increase on paper. In fact,Many member states have experienced overproduction, and Saudi Arabia is expected to gradually increase production in an extremely cautious manner.

Therefore, overall, the possibility of the planned increase in production scale to actual supply is extremely low. (Data: Kpler export/import statistics)

gold

Analyst: As shown in the figure below, there are likely to be two trend paths in gold, and both are extremely bullish in the long-term outlook...

——————

The "Macro Must-see Chart" series is exclusively updated on Inner Planet Daily, and researcher Lexie screens out the "God Pictures" shared by Wall Street masters every day. Scan the code to unlock all contents of this issue (at least 15 charts per issue), enjoy the benefits of referring to the planet within one year, and take a look at the series of contents such as macro strategy analysis, professional trader sharing, and key data prospects.

No comments yet