As April draws to a close, the atmosphere in the Bitcoin market is quietly changing. Data shows that Bitcoin may hit a new all-time high sooner than most investors expect. A large number of short liquidations, institutional holdings, and the trend of Bitcoin decoupling from traditional assets provide strong support for BTC prices to hit the $100,000 mark.

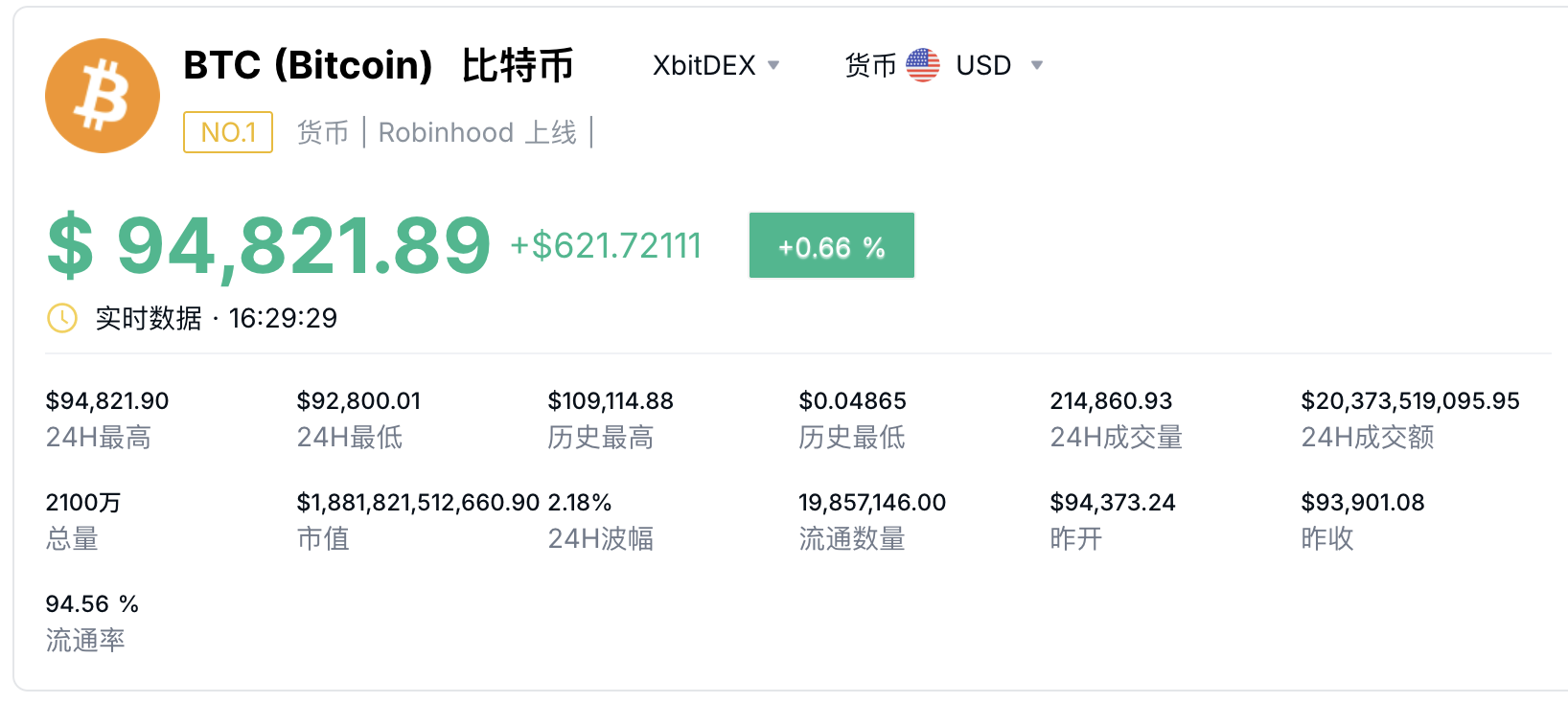

Massive liquidations help push Bitcoin back to $94,000

In the past week, the price of Bitcoin rose by 11%, breaking through $93,000 in one fell swoop and briefly hitting a high of $94,000. The rebound occurred after the Trump administration sent a signal of reducing import tariffs and the first quarter of the United States corporate earnings exceeded expectations, which stimulated investors' interest in risky assets.

At the same time, the spot Bitcoin ETF has received a net inflow of $3.1 billion for five consecutive days, setting a new record since the ETF was officially listed in January this year. This strong inflow of funds has further consolidated the market's bullish sentiment.

However, it is worth noting that despite the price increase, the derivatives market has shown subtle divergence signals. The funding rate of perpetual futures once turned negative, which is extremely rare during the bull market, indicating that shorts are trying to block the rise. But the result is that as the price of Bitcoin climbed, short positions were blown up on a large scale.

Since April 21, more than $450 million of Bitcoin short positions have been forcibly liquidated. This intensive liquidation in a short period of time not only cleared the upward obstacles for the bulls, but also further intensified the upward momentum, helping BTC successfully return to the $94,000 mark.

As of now, the price of Bitcoin is $94,821.

Institutional holdings have increased significantly, is $100,000 just around the corner?

Perhaps the most important factor supporting Bitcoin's continued rise is the firm accumulation of institutional investors.

While retail sentiment in the perpetual futures market appears cautious, the monthly futures contracts present a completely different picture. On April 26, the premium (basis) of Bitcoin two-month futures rose to a 7-week high and currently remains around 6.5%, close to the strong bullish range.

In other words, while short-term traders appear hesitant in the spot and perpetual markets, institutional investors continue to bet on the long-term rise of Bitcoin through the traditional futures market.

Even more impressive is that in just five days, the spot Bitcoin ETF has inflows of up to $3.1 billion. Considering the existing circulation and liquidity of Bitcoin, this scale of incremental buying is extremely influential. Moreover, as expectations of monetary policy easing by central banks around the world heat up, more and more asset allocation advisors are also re-examining the role of digital assets in asset allocation.

Against the backdrop of rising uncertainty in traditional markets, Bitcoin is increasingly seen as a "macro hedge asset" rather than just a speculative tool.

An unexpected tailwind for Bitcoin

The broader macroeconomic backdrop also provided an "unexpected tailwind" for Bitcoin.

First, the U.S. dollar index continued to weaken in the second half of April. This not only reflects the weak U.S. economic data, but also indicates that global investors are expecting a policy shift by the Federal Reserve. A weak dollar is usually good for scarce assets denominated in U.S. dollars, and Bitcoin, as a representative of scarce digital assets, naturally becomes one of the beneficiaries.

Secondly, the International Monetary Fund (IMF) recently lowered its global economic growth forecast and warned of a return of inflation risks. In this context, traditional financial assets (such as government bonds and stocks) are facing double pressure, while non-traditional safe-haven assets such as Bitcoin and gold have attracted more attention.

Not to mention, the news that the US Treasury Department may introduce Bitcoin exposure in part of its foreign exchange reserves has also pushed up the market's risk appetite to a certain extent.

As Nansen CEO Alex Svanevik concluded: "If even national sovereign capital begins to consider allocating Bitcoin, then the ceiling of the next round of increases will be much higher than the current market imagines."

The subtle relationship between retail investor mentality and market cycles

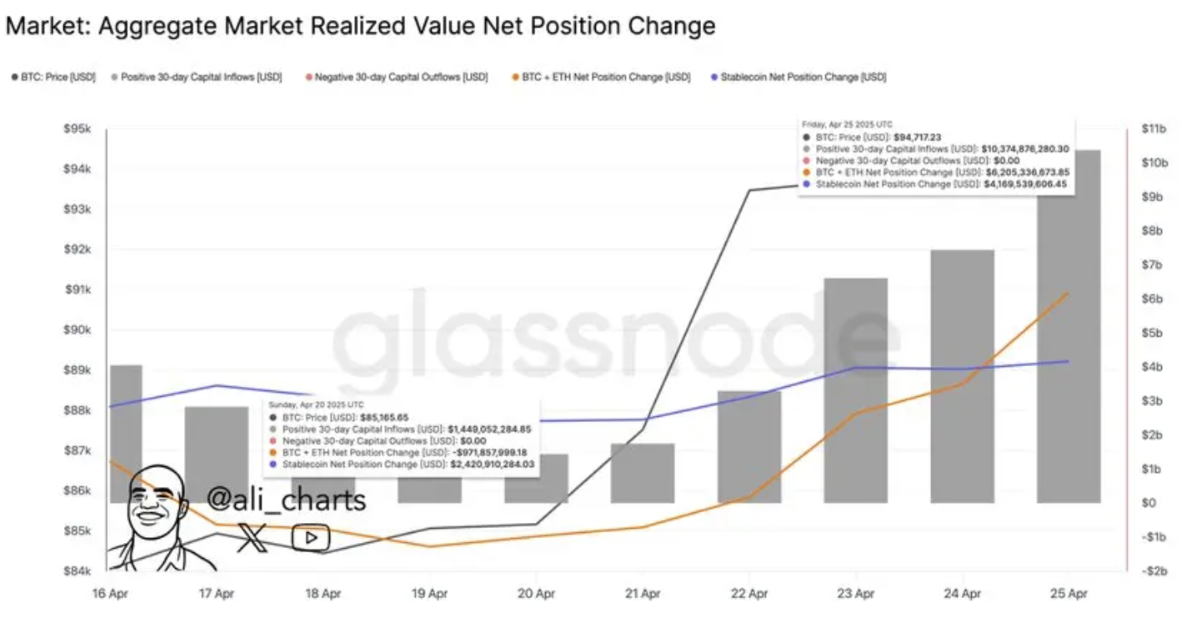

Although institutional funds are actively deploying, retail investors are extremely cautious. According to Glassnode on-chain data, the growth rate of the number of new retail wallets (holding addresses with less than 1 BTC) has slowed down significantly, and many small investors are still hesitant.

This situation of retail investors fearing and institutions increasing their positions has appeared many times in history in the early stages of major rising cycles. As shown by the two rounds of bull markets in 2017 and 2020, the real crazy rise often occurs after retail investors rush in again.

Therefore, if the current trend continues, Bitcoin is not only expected to break through $100,000 in May, but is more likely to usher in a resonant rise driven by retail investors and institutions in the second half of the year.

In the past week, the crypto market has a net inflow of nearly $9 billion! Funds are flowing back, and investor interest is recovering strongly.

Conclusion

Although the overall market sentiment remains cautious, judging from multi-dimensional indicators such as liquidation data, ETF inflows, and futures premiums, Bitcoin is accumulating momentum to hit $100,000.

Of course, risks have not been eliminated. For example, the Trump administration's change in attitude towards Sino-US negotiations, fluctuations in global economic data, and potential financial regulatory uncertainties may all become short-term disturbances.

However, from the perspective of structural changes, Bitcoin, as a global, decentralized, scarce asset, is gradually getting rid of the label of being highly dependent on macro liquidity in the past and turning to a broader and more diversified investment logic.

As Alex Svanevik, CEO of Nansen, an on-chain analysis platform, said: "Throughout the trade war, Bitcoin has shown unexpected resilience. Continuous good news - especially the discussion that the US Treasury is seeking to convert part of its reserves into Bitcoin, is pushing up market sentiment."

Although volatility and pullbacks are not ruled out in the short term, in the medium and long term, it may only be a matter of time before Bitcoin breaks through $100,000.

After all, what the market fears most is never the bad news that has already happened, but the good news that you can't see or think of.

No comments yet