作者:kizoki _Yz

Introduction: A Trading Storm Impacting $12.7 Billion

On April 20, 2025, the cryptocurrency trading sector was rocked by a sudden and extraordinary trading anomaly.

The VOXEL/USDT perpetual futures pair on the Bitget exchange saw its trading volume surge to $12.7 billion in just 30 minutes (16:00-16:30 UTC+8), far surpassing Bitcoin's $4.2 billion trading volume on the same platform during the same period. This incident not only thrust the obscure gaming token VOXEL into the market spotlight overnight but also exposed technical vulnerabilities and trust crises in centralized exchanges (CEXs) under high-frequency trading conditions.

This article provides an in-depth analysis of the VOXEL incident's timeline, perspectives from involved parties, technical roots, and industry implications, offering a comprehensive view for cryptocurrency enthusiasts and blockchain researchers.

Incident Timeline: From Anomalous Trading to Platform Response

The Outbreak of Anomalous Trading

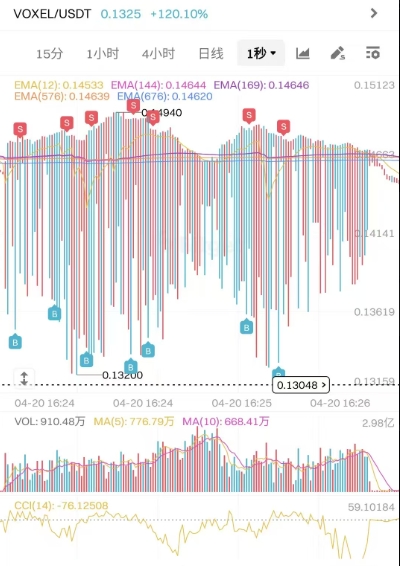

VOXEL, the native token of the Polygon-based RPG game Voxie Tactics, has historically had low trading volume and limited recognition. However, from April 18 to 20, VOXEL's price surged over 300% across three consecutive days, with trading volume amplifying dozens of times beyond its norm, signaling early market irregularities. On April 20, between 16:00 and 16:30, the VOXEL/USDT perpetual futures pair on Bitget exhibited extreme anomalies, with the trading system repeatedly matching orders within a narrow price range of $0.125 to $0.138. According to on-chain analyst Dylan, a technical glitch in Bitget's market-making bot likely triggered repeated trades in this price range, inflating trading volume to $12.7 billion, far exceeding Bitcoin's $4.2 billion volume during the same timeframe.

This anomaly created arbitrage opportunities for high-frequency traders. Some users leveraged trading with just a few hundred dollars in capital to achieve profits in the tens or hundreds of thousands of dollars. However, this "wealth frenzy" quickly caught the platform's attention.

Bitget's Swift Response

Following the incident, Bitget promptly implemented a series of measures:

• Withdrawal Suspension: Suspended withdrawals for VOXEL on the Polygon chain to prevent capital outflows.

• Account Freezes: Froze 438 accounts suspected of anomalous trading to curb further arbitrage.

• Trade Rollbacks: Rolled back all anomalous trades from 16:00 to 16:30 to restore market order.

• User Compensation: Pledged airdrop compensation in USDT or BGB (Bitget's platform token) to cover affected users' losses.

• Investigation Commitment: Announced a detailed investigation report would be released within 24 hours to clarify the incident's cause.

However, these measures did not fully quell community unrest. Some users questioned why Bitget's risk control mechanisms failed to issue early warnings and accused the platform of shifting blame onto ordinary traders. Bitget's platform token, BGB, saw a 5% price drop in the immediate aftermath, with its annualized staking yield falling from 12% to 5%, reflecting a shake in market confidence.

Market Makers' Defense: Legitimate Trading or Market Manipulation?

Bitget's Allegations

On April 27, Bitget issued a statement via its Chinese regional head Xie Jiayin's X account, addressing community discussions. Key points included:

1. Legal Action: Bitget would issue eight legal notices targeting eight allegedly linked accounts, labeled a "professional profiteering group," accused of being the primary instigators of the VOXEL incident, with illicit gains exceeding $20 million.

2. Fund Recovery: Recovered funds would be 100% airdropped back to platform users.

3. User Assurance: Accounts that traded during 16:00-16:30 on April 20 and withdrew funds would face no further action, with normal operations restored by April 23.

4. Transparency Pledge: Bitget promised to release a comprehensive incident report soon to reveal the truth and apologized for user inconvenience.

Xie Jiayin's statement emphasized Bitget's commitment to community interests, but the "professional profiteering group" accusation sparked further controversy.

Market Makers' Response

On the same day, the accused market-making team publicly refuted Bitget's claims, offering their perspective. They identified themselves as Bitget's official contract market makers since November 2024, having previously served as Binance's official market makers from early 2022 to early 2024. They stated that around 15:30 on April 20, the VOXEL/USDT pair exhibited a brief window of heightened trading activity, with significant increases in trading volume and order book activity. As market makers, they seized the market opportunity, increasing order placements and ultimately profiting approximately $43 million, though most profits could not be withdrawn, and some team members' Binance accounts were frozen.

The market makers insisted their trading was fully compliant with their duties and constituted legitimate market operations, not malicious manipulation. They questioned Bitget's attribution of blame, arguing that platform technical flaws caused the anomalous trading.

This response fueled further community debate: Should market makers be held accountable for platform system flaws? Were their profits justified? Technically, market makers provide liquidity to stabilize markets, but in this case, system vulnerabilities amplified individual profit opportunities, raising questions about whether this constituted "illicit gains" that warrant further investigation.

Technical Roots: Market-Making Bot Flaws and Risk Control Shortcomings

The incident's core issue lies in Bitget's AMM-Pro system, where the market-making bot suffered from price anchoring failures and liquidity depth simulation distortions, causing instantaneous order executions within a specific price range. Analysts noted that the platform's risk control system failed to respond promptly to anomalous trading, delaying risk mitigation measures and indirectly amplifying the vulnerability's impact.

Bitget's Hybrid Custody Model also became a point of contention. This model combines hot and cold wallet features to balance security and liquidity, but an anonymous analyst argued it may expose user assets to systemic risks. Additionally, Bitget's lenient position size controls provided opportunities for high-frequency traders, further exacerbating the potential for market manipulation.

Community Reaction: Trust Crisis and Double Standards Controversy

The VOXEL incident sparked intense and polarized community reactions:

• Retail Traders' Anger: Some retail traders shared profit screenshots on X, boasting of turning "hundreds of USDT into millions," but their sentiments turned to outrage after account freezes. One X user questioned, "If users engaged in normal trading without exploiting technical attacks to trigger bugs, what fault do they have? The platform should first examine its own issues." Another demanded that if Bitget cannot manage its operations effectively, it should allow users to freely close accounts.

• Supporters' Perspective: Some users praised Bitget's swift response as a sign of responsibility, viewing account freezes and trade rollbacks as necessary to protect most users' interests.

Industry observers drew comparisons to the March 2025 Hyperliquid JELLY incident, criticizing Bitget for potential double standards. In the JELLY case, Hyperliquid's short squeeze caused $13 million in losses, and its trading freezes and forced liquidations sparked controversy. Bitget CEO Gracy Chen publicly criticized Hyperliquid's handling, warning it could become "FTX 2.0." Yet, in the VOXEL incident, Bitget's account freezes and trade rollbacks mirrored Hyperliquid's approach, prompting community accusations of hypocrisy.

Colin Wu, editor-in-chief of Wu Blockchain, commented in ABMedia, “Unless Bitget provides detailed evidence, it should not hastily blame users but acknowledge its technical errors and issue a public apology.” This reflects the community’s demand for platform transparency.

Industry Lessons: The CEX vs. DeFi Battle

Centralized Exchanges’ Struggles

The VOXEL incident underscores centralized exchanges' vulnerabilities in technical security and trust management. CEXs are known for efficiency and low latency, but technical flaws and opaque centralized risk controls often become their Achilles' heel. Bitget's Hybrid Custody Model and high-leverage perpetual contracts offered opportunities for high-frequency traders but also amplified systemic risks. Similar incidents may drive the industry toward stricter technical standards, such as:

• Multi-Source Oracles: Implementing multi-source price feeds to reduce single-source biases.

• Safety Circuit Breakers: Setting thresholds for trading volume or price volatility to automatically halt trading during anomalies.

• On-Chain Validation: Drawing from DeFi's transparency to enhance user trust in transaction data.

The Rise of DeFi

In contrast, decentralized exchanges (DeFi) leverage fully on-chain trading and zero-knowledge proof (ZK-Proof) validation to ensure traceable order execution and asset states, mitigating similar vulnerabilities. For instance, XbitDEX, a fully on-chain trading platform catering to both novice and professional traders, offers the following advantages:

• Low Latency and High Throughput: Achieves near-CEX trading experiences through off-chain computation and on-chain validation, processing thousands of transactions per second.

• AI-Assisted Decision-Making: Supports built-in strategies like "momentum tracking" and "volatility breakout" to aid automated entry and risk management.

• Multi-Layer Liquidation System: Features a multi-source oracle price feed with safety circuit breakers (triggered by >2% price deviations) to protect user positions during extreme market conditions.

• Token Profile Analysis: Provides narrative analysis for meme coins, aggregated social data, and on-chain holding tracking to save users research time.

For investors passionate about trading meme coins, Bitcoin, and Ethereum, XbitDEX's smart copy-trading features and low Gas fee trading model offer enhanced safety and efficiency, making it worth exploring.

Conclusion: The Trust Game in Web3

Bitget has pledged to release a comprehensive VOXEL incident report soon to clarify the truth and address community concerns. However, as of April 27, 2025, the report remains unpublished, and the community awaits further transparency. CoinWorldNet will continue tracking the incident's developments to provide readers with the latest updates.

The Bitget VOXEL incident reflects a trust game between centralized exchanges and their users. In the era of AI and Web3 convergence, technical innovation and robust risk management are equally critical. Hopefully, this incident will propel the industry toward greater transparency and security. For readers seeking high-win-rate trading, exploring decentralized platforms may offer a blend of safety and efficiency.

No Comments