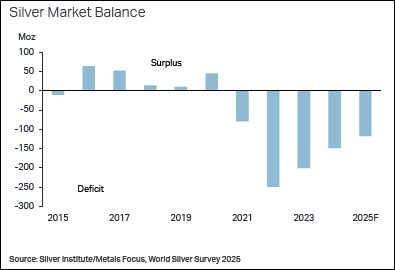

Silver market balance

Analysts: Silver is expected to have a supply and demand gap of 118 million ounces in 2025, the fifth consecutive year of deficit. The cumulative gap in the past five years has reached nearly 800 million ounces. Supply growth was weak, while demand grew strongly. Where will the future supply of silver come from?

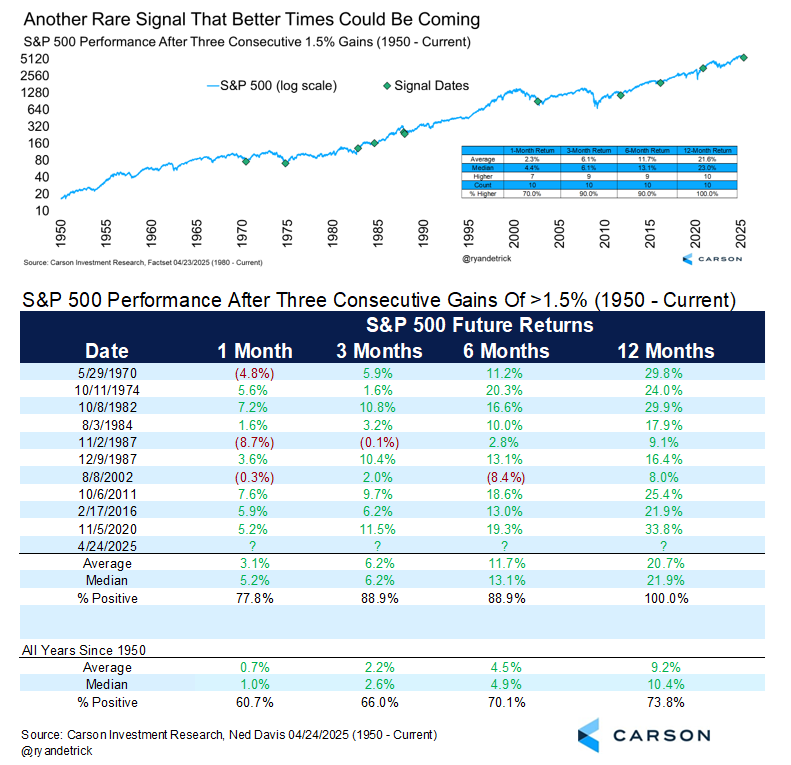

The US stock market started?

The S&P 500 has risen by at least 1.5% for three consecutive trading days. This trend is not a common phenomenon in bear market rebound or short cover, but is usually before the market starts that will usher in a strong performance in the future. Looking back on history,In the year after the past 10 events, the S&P 500 has risen in all 10 times, with an average increase of 21.6%.

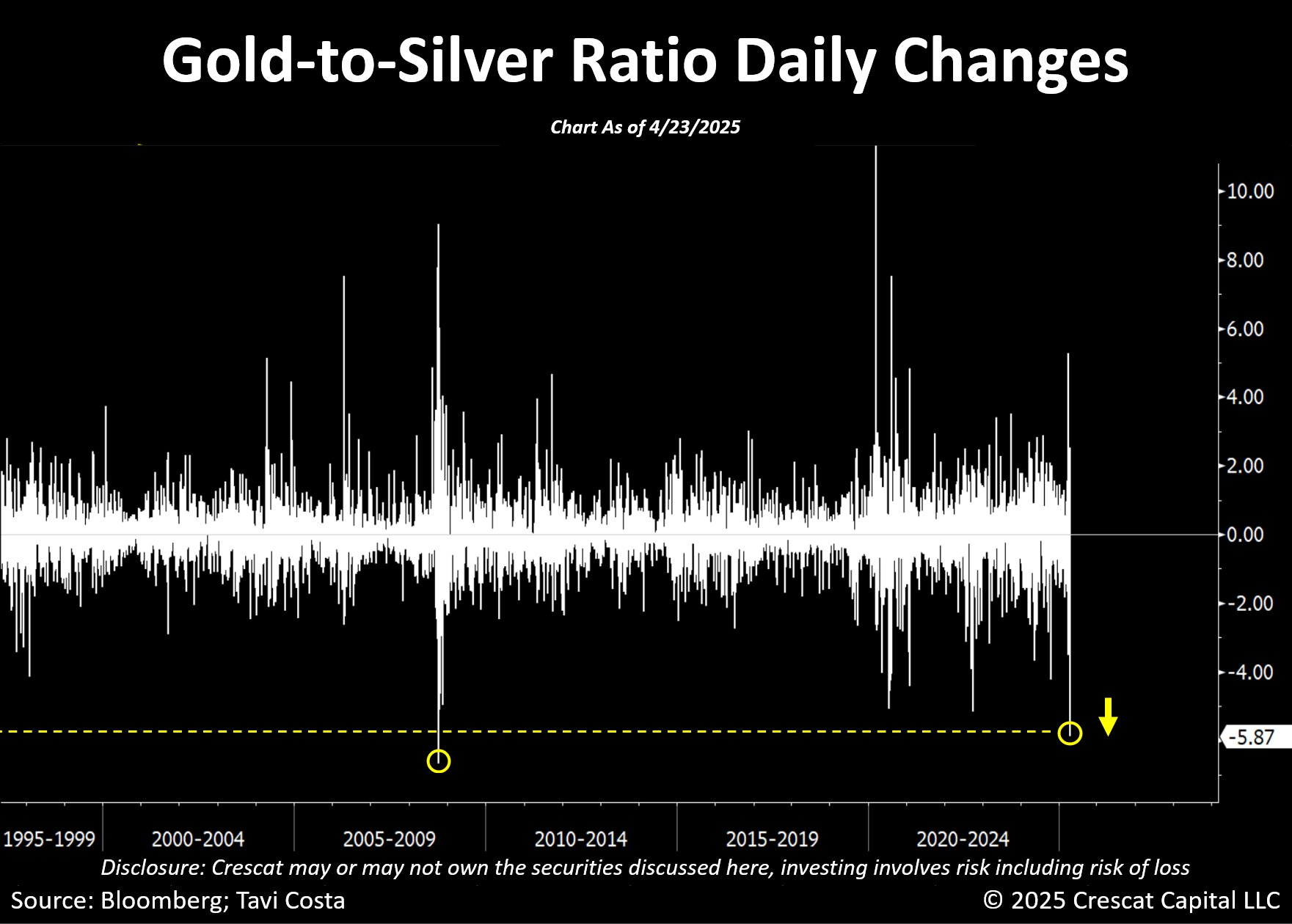

There is still room for downward gold and silver ratio

At present, we are witnessing the largest single decline in gold and silver ratio since 2008. Looking back at that year, that sharp decline marked the beginning of a long-term downward trend, and finally, the gold and silver ratio fell to 31 in the next three years. I think the current market structure is very similar – and this time we are starting from a more extreme position.

The gold-silver ratio has just fallen below 100, and the high in 2008 was only 85. In my opinion,There is still plenty of room for downward trend this round of trend.

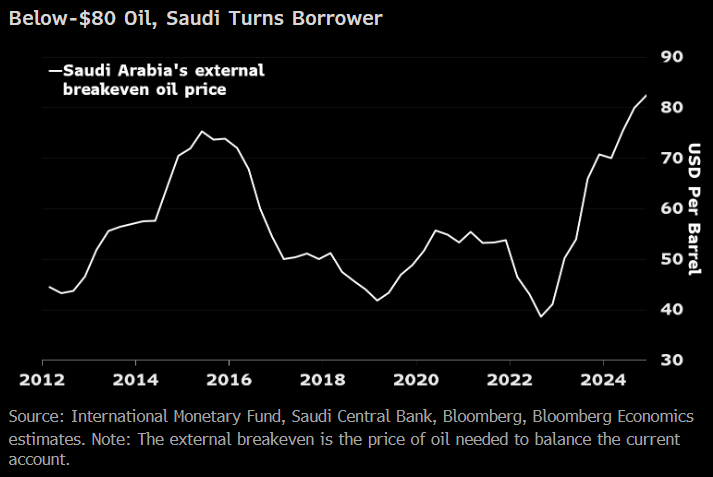

Saudi Arabia's ideals and reality

Saudi Arabia's current situation is: (a) reduce oil production; (b) significantly increase expenditures - invest in future cities, sports and entertainment projects. All of these spending drives up import demand, thereby increasing the “break-even point of oil price” that Saudi Arabia needs to cover foreign exchange spending. We estimate that Saudi Arabia's current breakeven oil price is $82 per barrel, the highest level since at least 2012.

The gap between Saudi Arabia's "ideal oil prices" and "market oil prices" is expected to continue to widen, and the IMF predicts that Saudi Arabia will continue to face an external deficit in the next five years. Trump is expected to visit Saudi Arabia in mid-May to seek a $1 trillion investment commitment, but he may return disappointed. Because when huge transactions are involved, Saudi Arabia's funds will not flow out easily.

Gold price channel

Analyst: In the past two days, many "experts" have been in a hurry to announce that gold has peaked. But let's look at the chart below - in fact, gold just stepped back to the channel that had previously broken through. Next is the stock market continuing to rise and put pressure on gold? Or is gold retesting the previous high?

————————

The "Macro Must-see Chart" series is exclusively updated on Inner Planet Daily, and researcher Lexie screens out the "God Pictures" shared by Wall Street masters every day.Scan the code to unlock all contents of this issue (at least 15 charts per issue), enjoy the benefits of referring to the planet within one year, and take a look at the series of contents such as macro strategy analysis, professional trader sharing, and key data prospects.

No comments yet