原文标题:Are US Treasuries Really Losing Their Safe-Haven Appeal?

Original author: Alice Atkins & Liz Capo McCormick, Bloomberg

Original translation: Felix,

Investors often flock to U.S. Treasury bonds to avoid turmoil in financial markets. During the global financial crisis, the 9/11 incident, and even during the downgrade of the United States' own credit rating, U.S. Treasury bonds rebounded.

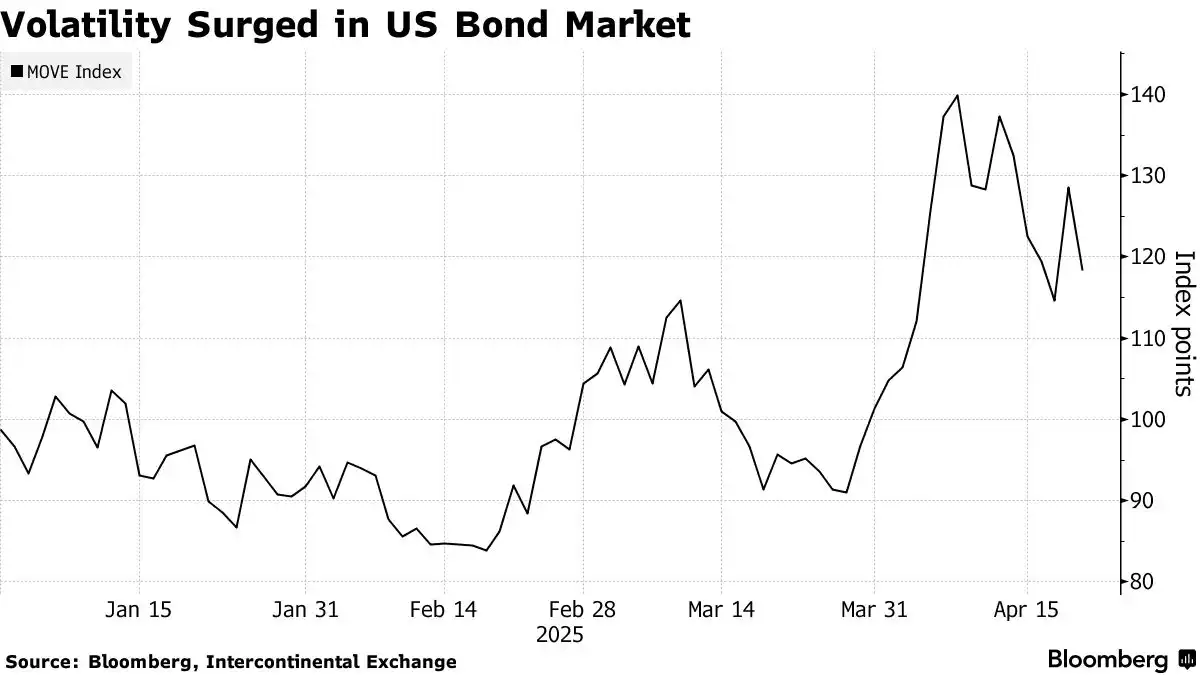

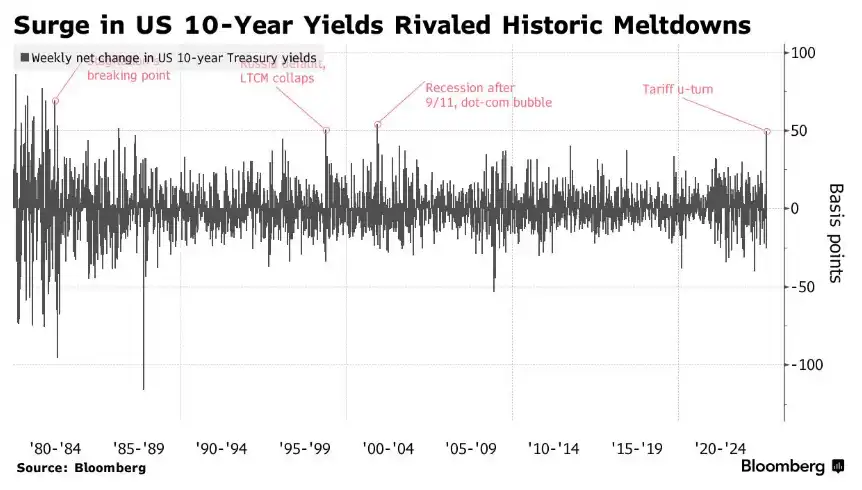

However, in early April, something unusual happened amid the chaos caused by President Trump's "reciprocity" tariffs. As risky assets such as stocks and cryptocurrencies plummeted, the price of U.S. Treasury bonds not only did not rise, but fell. U.S. Treasury yields hit the biggest single-week gain in more than two decades.

The US Treasury, with a market size of $29 trillion, has long been regarded as a safe haven in market turmoil, which has been a unique advantage of the world's largest economy. For decades, it helped the United States control borrowing costs. But recently, U.S. Treasury trading has performed more like a risky asset. Former Treasury Secretary Lawrence Summers even said that U.S. Treasury bonds perform just like debts from emerging market countries.

This has a profound impact on the global financial system. As a global "risk-free" asset, U.S. Treasury bonds are used as a benchmark for pricing various assets, from stocks to sovereign bonds and mortgage rates, and also serve as collateral for trillions of dollars in loans per day.

Here are some of the views investors and market forecasters have made to explain the abnormal volatility of US Treasury bonds in April, as well as some potential alternative "safe havens."

Tariff-driven inflation

Even if Trump suspended the implementation of most "reciprocal" tariffs for 90 days, the tariffs imposed on China are still far higher than previous expectations. And tariffs are still imposed on cars, steel, aluminum and various commodities from Canada and Mexico, and Trump also threatens to impose more import tariffs in the future.

There are concerns that companies will pass these tariff costs on consumers in the form of price increases. The inflation shock will hit demand for Treasury bonds because it will erode the future value of fixed income payments provided by Treasury bonds.

If prices surged along with falling economic output or zero growth (the so-called stagflation), monetary policy would enter a new period of uncertainty and the Fed would be forced to choose between supporting economic growth and suppressing inflation.

Chase cash

Some investors may have sold off U.S. Treasuries and other U.S. assets in favor of the ultimate haven: cash. As the Federal Reserve delays rate cuts, assets in U.S. money market funds continue to soar and hit record highs in the week ending April 2. Money market funds are often considered cash-like, and there is an added benefit: they generate returns over time.

Policy uncertainty

Investors demand higher returns when investing in countries with political turbulence and economic instability. That’s one reason why Argentine government bonds yielded as high as 13% in mid-April.

Trump's unexpected political strategies and radical tariff policies make it difficult to predict how friendly the US investment environment will be in a year.

Another factor that drives money into the United States is the belief that the power of the U.S. judicial system and other national institutions can bind the U.S. government and ensure a certain degree of policy continuity. Trump's daring to challenge lawyers who hinder him and forcing the Fed and other independent agencies to succumb to his will could undermine some's confidence in the checks and balances that once helped the U.S. become the world's largest foreign destination.

Financial pressure

In the mid-1970s, the US dollar replaced gold and became a world reserve asset, and central banks in various countries purchased US Treasury bonds to deposit US dollar reserves. Treasuries are seen as a solid investment because the federal government has never violated its debt repayment commitments.

U.S. Treasury bonds currently account for 121% of GDP. Trump has bets on reducing budget deficits by stimulating economic growth from his office, and recently he hinted that tariff revenues will also help reduce budget deficits.

But there are also concerns that his policies will only exacerbate national debt. In addition to the additional tax cuts he planned, Trump is trying to permanently implement the tax cuts he implemented during his first term. If tariffs cause the economy to fall into a recession, the government may face pressure to increase spending.

In view of this, Fidelity International fixed income investment manager Mike Riddell said the spiral of U.S. Treasury bond yields may herald a "capital flight" as foreign investors are increasingly reluctant to fund the U.S. deficit. "The global "bond volunteers" are obviously still active."

U.S. debt levels are expected to rise

The International Monetary Fund predicts that by 2029, U.S. debt will account for 131.7% of GDP.

Foreign sell

While it is difficult to prove in real time, when U.S. Treasury prices fall, people often speculate that foreign countries are selling. This time, some people think this is a response to Trump's tariff policy. China and Japan are the largest holders of U.S. Treasury bonds. Official data shows that the two countries have been reducing their holdings for some time.

Given that China's trading activities are strictly confidential, it is difficult to guess the role of the Chinese government in it. But strategists often point out that China's holdings of U.S. Treasuries may be a potential bargaining chip for the United States — even if a massive sell-off could depress the value of China's foreign exchange reserves.

Hedge Fund Trading

The basis trading could be one reason for the surge in U.S. Treasury yields in early April. This is a popular hedge fund strategy that makes profits through the spread between cash Treasury bonds and futures.

This spread is usually small, so investors usually use a lot of leverage to fund transactions. Problems can be raised when market turmoil strikes and investors are eager to close their positions quickly to repay their loans. The risk is that this could trigger a ripple effect that leads to a spiral of yields and, worse, stagnation in the Treasury market, as it happened when basis trading closed positions in 2020.

Others pointed out that the previously prevalent bets of "U.S. Treasury bonds outperform interest rate swaps" suddenly collapsed. In fact, interest rate swaps performed well because banks cleared bonds to meet their customers’ liquidity needs and then added swap contracts to maintain a certain exposure when the bond market could rise.

If it weren't for U.S. Treasury bonds, what would it be?

Fund managers in Europe and Japan have found that in addition to buying U.S. Treasury bonds, there are reliable solutions now, which may attract them to shift their fund allocation to markets with seemingly stable policy outlook. German bonds are one of the main beneficiaries in the wider turmoil.

Gold, a traditional safe-haven asset, soared to record highs in April, outperforming nearly every other major asset class. For some time, central banks have been hoarding this precious metal in order to diversify their assets and reduce their dependence on US dollar assets. Unlike bonds, however, investing in gold does not bring about fixed income. Investing in gold will only bring returns when prices rise.

Ultimately, no investment can provide as strong liquidity and depth as the US Treasury market. It will take years, not weeks, to really withdraw funds from the US Treasury market. However, some market observers believe that market trends in April may herald a shift in the global landscape and a re-evaluation of assets that are crucial to the dominance of the U.S. economy.

No comments yet