SUI rallied to a one-month high, after expanding by 60% in the past week. The L1 platform traded as an undervalued asset, before getting a boost from ETF filings and expanding DeFi lending.

SUI broke out from its recent lows to trade at a one-month high. The token added 60% in the past week alone, reaching $3.39 with rapid expansion. SUI achieved an all-time high above $5.30 in January, a level not too far off. This sparked speculations SUI could extend its gains for new all-time highs above $7.

The biggest boost for SUI comes from the series of ETF applications currently under review. Canary Capital is one of the applicants, but more exposure came from 21Shares, the newly formed entity aiming to build a BTC and crypto treasury.

VanEck and Grayscale already launched SUI-based products as a test for wider adoption. Grayscale’s SUI Trust launched just a day ago, adding to the project’s exposure and the token rally .

Grayscale Sui Trust is open to eligible accredited investors seeking exposure to $SUI, a third-generation blockchain designed to help address scalability and transaction costs.

Learn more, see important disclosures, or reach out to us: https://t.co/7wTZubYK28 pic.twitter.com/gq1SuDI8zN

— Grayscale (@Grayscale) April 24, 2025

For now, the product is still only accessible to accredited investors. However, SUI is also aiming at a wider user base. The bullish scenario for SUI is to rival Solana as a cheap and fast chain for building apps and real economic activity.

SUI grows the DeFi lending sector

SUI is a multipurpose L1 chain, which adapted to the shifting Web3 demand. Previously, the chain marketed itself through NFT collections. SUI also carries meme assets and Bitcoin-based DeFi tokens, including several types of wrapped BTC.

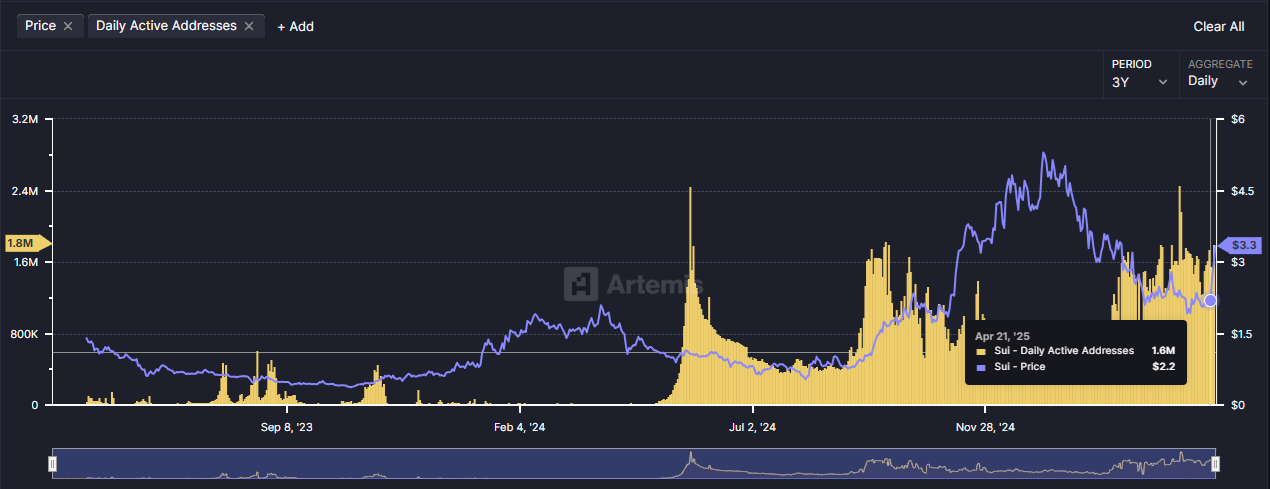

SUI total value locked increased by nearly 40% in the past week, tracking the token’s rally. Currently, the protocol carries $1.63B locked in lending protocols and in the form of stablecoins. SUI has been a long-running project, going through multiple bull and bear cycles. In Q1 2025, SUI expanded its daily active addresses, with a baseline of 1.5M to 2.5M daily active users.

SUI receives over $125M flowing in from the Ethereum ecosystem. Of those inflows, over $115M come from stablecoins, with around $10M from other tokens.

Despite the slowdown, SUI is now boosting its liquidity. The stablecoin supply on SUI grew from $714M in the past week up to a new high of over $879M. Most of the growth comes from USDC inflows, as the SUI protocol aims to track Solana’s success in building liquidity.

SUI also carries a growing array of tokens, including BTC liquid staking tokens. The chain carries Lorenzo stBTC, as well as Lombard Staked BTC (LBTC). The SUI ecosystem currently carries 165 tokens with significant liquidity.

Other native SUI tokens linked to memes and DeFi expanded between 45% and 145% in the past week. Cetus Protocol (CETUS) is up 49.6% in the past day, recovering to $0.21 after months of trading near all-time lows.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More

No comments yet