On April 23, BlackRock once again dropped a bombshell on the market. Its spot Bitcoin exchange-traded fund (ETF), iShares Bitcoin Trust (IBIT), recorded a single-day net inflow of $643 million on Wednesday, a new high since January 21. At the same time, the total net inflow of all Bitcoin ETFs in the United States reached $936 million, indicating that institutional funds are flowing back into the crypto market on a large scale. For many investors, this is not just a surge in numbers, but also a reconstruction of confidence.

Since it was approved by the U.S. Securities and Exchange Commission (SEC) in early 2024, spot Bitcoin ETFs have gradually become a bridge between traditional finance and the crypto world. However, in the past few weeks, due to macroeconomic uncertainty and the pullback of global risk assets, the inflow of funds into Bitcoin ETFs has slowed down, and even there have been net outflows for many days.

However, starting this week, the Bitcoin ETF market seems to have suddenly pressed the "recovery button". According to Farside Investors data, the total inflow of Bitcoin ETFs in the United States has exceeded US$2.3 billion in just four days this week, far exceeding the total of US$1 billion for ten consecutive days in March. In particular, the strong performance of IBIT has not only consolidated its leading position in the market, but also made the entire market full of expectations for the future of the ETF mechanism.

As a compliant investment channel, ETFs have not only attracted institutional funds to enter the market, but also become a signal carrier for changes in policy attitudes. With the Trump administration returning to power, the regulatory atmosphere in the United States for crypto assets has begun to show signs of warming. Many policy advisers have publicly supported the expansion of Bitcoin ETFs, and there have even been calls for ETF investments to be included in the scope of pension allocation.

James Butterfill, head of research at Coinshares, pointed out that "the recent rebound in capital inflows is a direct response of the market to regulatory clarity." He believes that this "return of funds" marks the transition of institutions from waiting to action, and may also pave the way for a new round of upward cycle in the crypto market in the coming months.

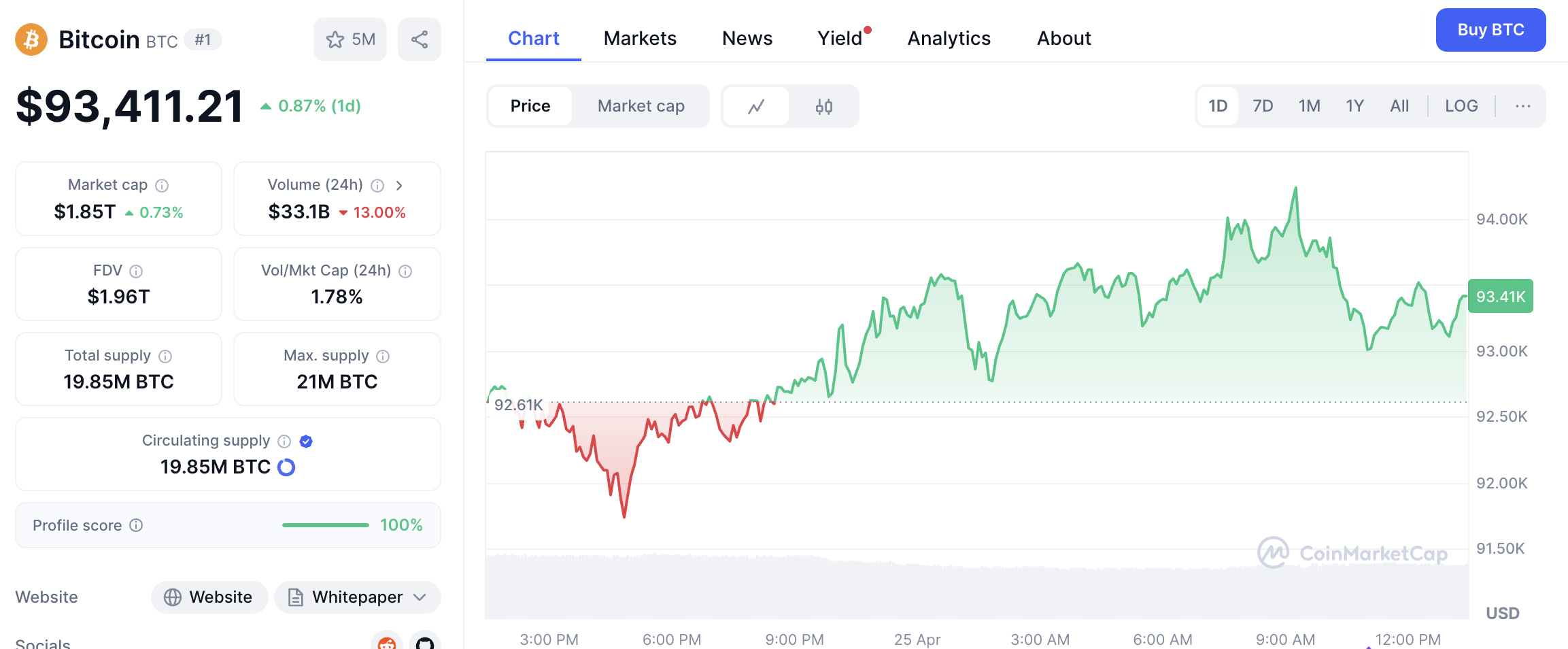

Bitcoin Price Trends

As funds flowed back, the price of Bitcoin also rebounded. In late April, BTC once reached a high of $94,000, and then consolidated around $92,000. As of now, the price of Bitcoin is $93,411.

Judging from the on-chain data, this round of rise is not accompanied by excessive leverage, but more from spot demand and whale addresses' increased holdings. Glassnode data shows that Bitcoin's MVRV index has risen to a healthy level, and most holders are in a profitable state.

In addition, the Fear and Greed Index continued to rise to the "greed" area, and market sentiment has improved substantially. ETF inflows have become a trigger for "confidence recovery", activating the repricing logic of Bitcoin assets by institutions and high-net-worth individuals.

It is not just the "funding effect" of ETFs that has driven this round of rebound. The Global Economic Outlook recently released by the International Monetary Fund (IMF) predicts that inflationary pressures in the United States are still rising and global economic growth will slow further. Against the backdrop of tariff uncertainty, this macro concern has become a new "tailwind" for Bitcoin. Alex Svanevik, CEO of Nansen, said: "Bitcoin has been surprisingly resilient in the context of the trade war, especially after the Treasury Department was exposed to be studying the conversion of part of its reserve assets into Bitcoin."

Changes in policy signals and regulatory attitudes

The ETF capital surge is not only the result of market competition, but also a reflection of changes in regulatory expectations. Since the Trump administration came to power, the U.S. Congress and the SEC have become more rational in their attitudes toward crypto assets. Several lawmakers have suggested that ETFs be included in long-term allocation recommendations such as pensions, indicating that the policy makers have increased their recognition of the "regulatable crypto investment path."

BlackRock's compliance design in IBIT products is also regarded as an industry benchmark. From custody arrangements, liquidity emergency mechanisms to information disclosure standards, IBIT has set a highly replicable institutionalized template.

At the same time, companies such as Coinbase, Ripple, and a16z have stepped up their lobbying efforts, making crypto asset issues appear more and more frequently on the agenda of legislators. Grayscale, 21Shares, and others are also constantly applying for more ETFs based on Solana, XRP, Dogecoin, etc., trying to replicate a new round of product prosperity with existing success.

IBIT contributed the most to the net inflow of $936 million this time, accounting for more than 60%. Following closely behind were Fidelity's FBTC, which recorded a net inflow of $124 million, and ARK 21Shares' ARKB, which attracted $129 million in funds. At the same time, VanEck's HODL and Grayscale's Mini Bitcoin Trust also achieved net inflows.

Although Bitwise's BITB had a net outflow of $15 million, overall, the flow of funds showed a trend of "head concentration and tiered diffusion." Nick Ruck, director of research at LVRG, pointed out: "The recent strong inflows into ETFs indicate that investors' confidence in Bitcoin as a store of value is returning." He also predicted that in a macroeconomic environment filled with uncertainty, Bitcoin's future price trends may be highly synchronized with gold.

Conclusion

As BlackRock IBIT continues to lead, followed by "second-tier stars" such as ARKB and FBTC, the competition landscape of the Bitcoin ETF track is also quietly evolving. For investors, this is not only a diversification of product choices, but also an opportunity to verify different strategies and different risk control systems.

In the future, as more ETF products are approved, more institutions intervene, and more funds are unfrozen, the "compliant crypto finance" represented by ETFs will become an important engine to further promote the rise of Bitcoin prices and market value. And this capital frenzy caused by ETFs may just be the beginning.

No comments yet