Whether on Wall Street or on Main Street (referring to the traditional industrial economy outside the Wall Street financial system), gold business is very popular.

In the Diamond District of New York, dozens of jewelers crowded on the same block, gold seller Aaron Akyon could hardly say a few words, and customers would come to his display cabinet to ask about the necklace or ring.

"It was busier earlier. The last two months have been more busy than last year's one and a half years," he said.

Akion said that as the prices of such precious metals soared, more and more people came to his shop to buy and sell gold. Some people want to make a profit by selling their jewelry while others want to invest in rare investment projects that have not depreciated in the past few months.

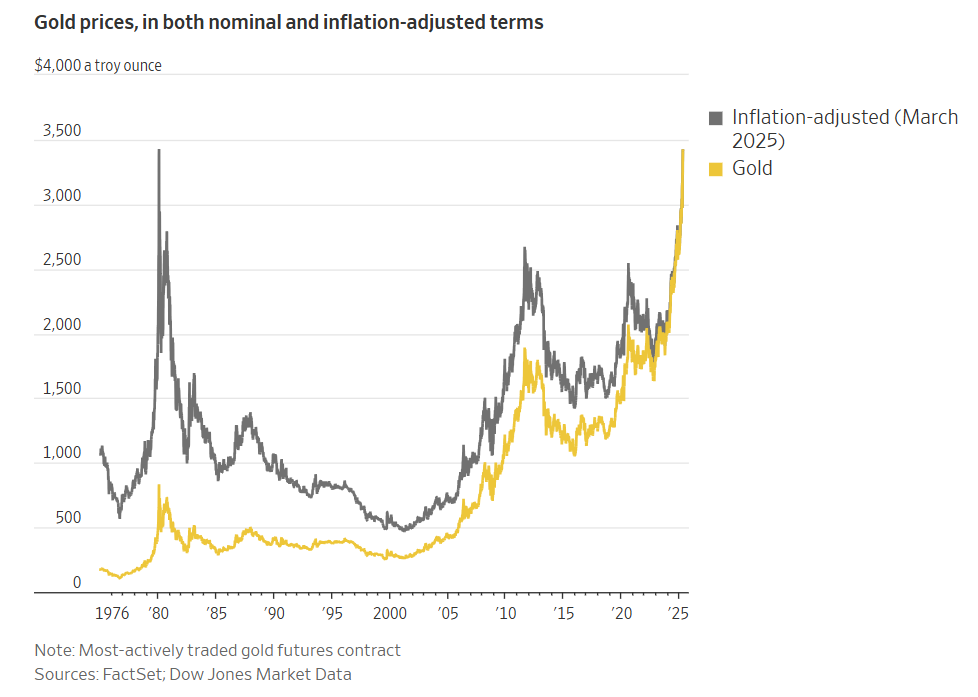

Trump's trade war and the shock wave it has brought to the global economy and financial markets have stimulated a significant increase in gold investment. As one of the most time-tested safe-haven assets in the market, gold prices hit a new high of $3,500 per ounce on Tuesday. Even after inflation adjustment, it is close to the historical record set in 1980.

The gold market is driven by a wide variety of buyers: individuals shopping at retailers such as Costco, traders investing in gold-traded open-end index funds (ETFs), and international central banks looking to diversify foreign exchange reserves.

The impact of rising gold prices has spread from financial markets to shops on West 47th Street, the center of New York’s purchase of gold, jewelry and gems. Customers and security guards who bought wedding rings wandered on the sidewalks filled with display cabinets and signs with “We buy gold” hangings. In the store, buyers bargained over the price of watches, while sellers took out gold bars from the safe from time to time.

Jewelry said gold trading has increased significantly in recent weeks. They believe this is largely due to recent market volatility.

"People are testing the market. They don't know what will happen to the economy," said David Gavriel of Fantasy Diamonds.

Gafriel said customers showed greater interest in buying pure gold in the form of gold bars and gold coins. He said: "They areLooking at this from an investment perspective。”

Investors have long regarded gold as an asset with a preservation effect during periods of economic uncertainty. But in recent weeks, gold has also become one of the few safe havens that can avoid violent stock market fluctuations. Traditional safe-haven assets like U.S. government bonds have also fallen along with stocks during recent market turmoil. The dollar, which usually strengthens when the stock market falls, also declines.

"It has a protective role that few assets can match," said George Milling-Stanley, chief gold strategist at State Street Global Investment Advisor. "Traditionally, it was believed that gold can provide some protection when macroeconomic instability and also when geopolitical instability -- and we currently have many instability factors in both."

Professional investors have also noticed this: In a survey of fund managers at Bank of America, nearly half of them pointed out thatIn early April, betting on gold was the hottest deal.The risk of such overheating of trading became very obvious on Wednesday, when gold prices saw their biggest single-day decline in nearly four years, down more than 3.6%.

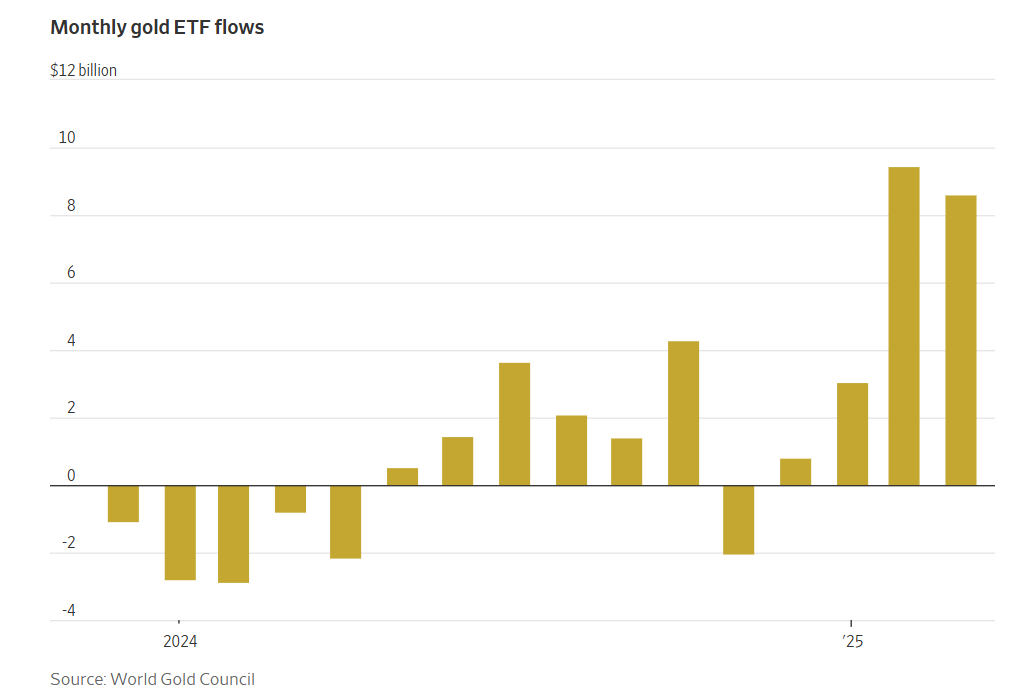

Suki Cooper, executive director of Standard Chartered Precious Metals Research, said the recent rise in gold prices was largely driven by large amounts of capital flows into gold ETFs. These ETFs allow investors to include gold into their portfolio by purchasing fund shares without having to buy physical coins, bars or jewelry.

According to the World Gold Council data, the first quarter of 2025 was the second highest inflow of global gold ETF funds in history. Investors injected $21 billion into these funds in the first three months of this year.

However, Stefan Gleason, CEO of online trading platform Money Metals, saidPeople's interest in physical gold has also increased.

Gleason said that as stocks began to fall for a long time in February, the number of people buying and selling gold on the site began to increase. Trading volume doubled the week after Trump announced a hike in global tariffs on Liberation Day.

"Now the stock alternative is no longer bonds, but gold," Gleason said.

No comments yet