One of Wall Street's biggest bulls has abandoned optimism about U.S. stocks and believes tariffs have hit American businesses the hardest.

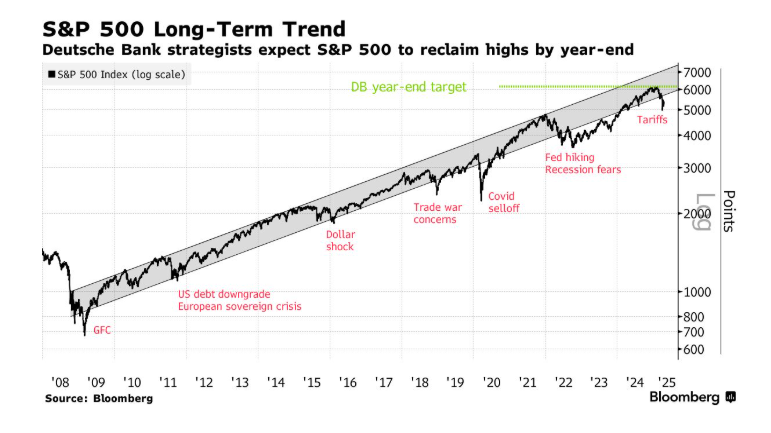

Deutsche Bank AG strategists led by Bankim ChadhaThey cut their year-end target for the S&P 500 by 12% to 6150 points. Although this still has 14% upside from Wednesday's closing price, it means the index can only recover its decline since its February peak. Before making this adjustment, they had one of the most optimistic views on the benchmark index.

Chada's team also expects thatThe S&P 500 companies' earnings will fall by 5% this year, while the market generally expects an increase of 8%.

"Given the potential impact of the announced tariffs and may have a disproportionate impact on U.S. companies, we lower our earnings per share (EPS) forecast for the 2025 S&P 500 index from $282 to $240," the strategists wrote in a note. They also added that there is a risk of a further downgrade in the market.

Radical trade policies have put the U.S. stock market at the forefront and weakened people's confidence in U.S. assets. The initial tariff statement's pause triggered a rebound, but the S&P 500 has fallen nearly 9% this year, BloombergUSD IndexIt fell 6.5%.

Analysts are already pessimistic about the earnings outlook due to the risk of a slowdown, with the margin of earnings corrections for the U.S. benchmark index (i.e., the ratio of expected up-to-down) approaching the downward extreme.

The strategists estimate that the newly revised tariff rate will increase the effective tax rate for commodity imports from 2.3% to 26.4%, which actually means an increase of $800 billion in tax revenue. They said this is in sharp contrast to the total US federal corporate tax revenue of approximately $500 billion in 2024.

In the short term, they expect the S&P 500 to fluctuate in a wide range of 4600 to 5600 points, because stock holdings have dropped to the bottom of the historical range - this meansOnce positive news comes out, the market is prone to rebound.The current trading point of the index is 5376 points.

For situations to improve for a lasting period, the U.S. government needs to abandon its current trade policy. These strategists believe this is likely to happen as the economy starts to worsen and the pressure on the government continues to rise. However,The longer the delay, the greater the chance that signs of recession will begin to appear.

Chada and his team wrote: “To make the government credible concessions,Trump's approval rating may need to drop significantly.After the initial honeymoon period, approval ratings tend to be consistent with the economic situation, especially consumer confidence. ”

No comments yet