Original title: "WOO X Research: Bitcoin returns to 90,000! Which copycats are worth looking forward to? 》

Original source: WOO

Background: Bitcoin is back to its senses, and the copycat is still at a low point

Bitcoin returned to the 90,000 mark on April 23. On the one hand, due to the gradually clearing of the tariff war, US Treasury Secretary Bescent said that the tariff deadlock is unsustainable and the situation is expected to ease in the near future.

On the other hand, Trump has recently publicly put pressure on Fed Chairman Bautil, strongly demanding interest rate cuts, and even expelled him (Powell) if he does not cut interest rates. This move has caused the global market to doubt the independence of the Fed, which has triggered distrust of the US dollar. The latest situation is when the media asked about Trump about the matter, Trump said: "I have no intention of firing him (Powell). I just hope he can be more active in the interest rate cut."

When Trump asked Powell to step down, it rarely played the risk-averse function of "digital gold", and the trend was highly related to physical gold. Now that Powell's career crisis has been lifted, US stocks have rebounded sharply, Bitcoin continues to rise. At this time, Bitcoin enjoyed the dividends of liquid assets premium, rising 12% in the past seven days.

We mentioned in the previous article that the Bitcoin rise this time, altcoins did not keep up, and the current Bitcoin market share is as high as 64.2%, setting a four-year high. Although it is still uncertain when the copycat season will arrive, we can observe which altcoins are stronger than Bitcoin during the turbulent market cycle, so as to find out capital preferences. The high probability of the future may continue the strong trend.

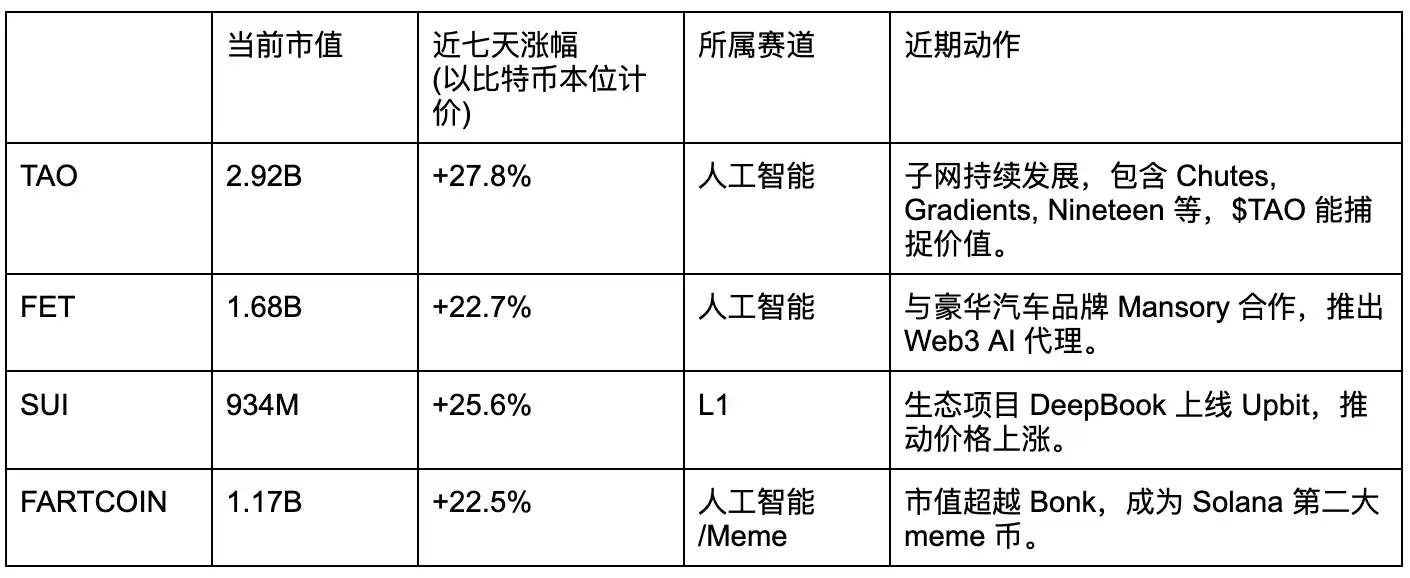

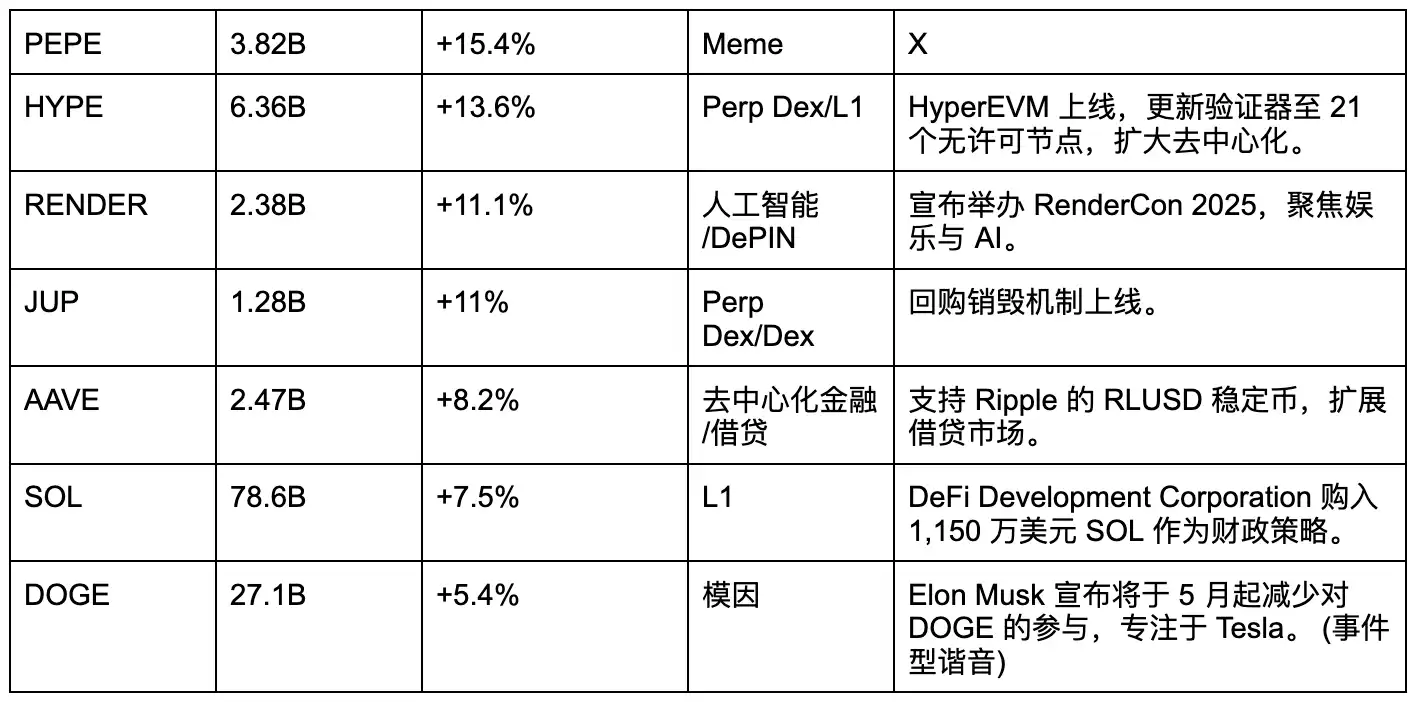

The top 100 market value in the past seven days are stronger than BTC currency

The following table is a list of the top 100 tokens with market value and has a stronger trend than BTC in the past seven days. In fact, it is not only the following 11 tokens. As Bitcoin rose sharply on April 23, Bitcoin's market share fell slightly (0.2%), representing the general increase in some altcoins. Therefore, there are many currencies that have fallen for a long time, overtaking Bitcoin's seven-day gains overnight, but this increase should be interpreted as a spillover of liquidity, not the result of capital choice.

Therefore, in order token selection, the currency will be excluded from the overnight surge, and instead choose to steadily surpass BTC's altcoins in these seven days.

Which tracks should you pay attention to?

The above tokens will focus on the intersection of the track, and the focus will be on: AI, L1, Meme and DeFi

· AI: The last wave of narrative was initiated by AI, starting with the combination of GOAT and memes, and later explored more possibilities and applications, which brought bubbles under the AI fanaticism, and the bubbles also burst under the Trump family's consecutive issuance of coins. In the end, most AI tokens fell by more than 90%, reshaping the valuation.

The bursting of the bubble does not mean the end of the track, but rather the mechanism for eliminating projects of mixed quality in the market. It means that with the continuous development of Web 2 AI, the Web 3 AI projects have undergone a round of reshuffle. If we believe that Web 2 AI can be transmitted to Web 3, then the valuation of the AI track is relatively cheap now, and the fundamentals of the remaining projects have been tested. If the copycat season comes in the future, the track is expected to undertake the liquidity spillovered by Bitcoin.

Representative currencies other than tables: VIRTUAL, ARC, ALCH, SWARMS, Zerebro

· L1: Public chain coins have always been a relatively stable choice when the copycat season comes. The overall logic is that the development of public chains determines the ceiling of its ecological projects, and can also capture the most liquidity.

But unlike 2021, funds no longer pay for "EVM copy posting", but instead look for public chains where TPS and developer tools can truly bring new applications. Once specific catalysis (on listing on trading platforms and institution inventory) occurs, the price elasticity is significantly higher than that of the old brand L1.

Emerging public chains without coin distribution: Monad, MegaETH

· Meme: Bitcoin is the largest meme coin in the entire currency circle. Meme coin has become a prominent academic in this cycle and is also highly likely to survive in the future. The key factor is that meme coin is the carrier of consensus and culture. The meme coin on the heads of each public chain can also be regarded as a leveraged version of the public chain coins. Most meme coins are native to the chain, and the pricing power is not monopolized by centralized trading platforms, and it is prone to wealth effects. As long as there is a wealth effect in the currency circle, there will be an indefinite liquidity and participants.

· DeFi: In the currency circle, DeFi is a rare track with real business model. Perp Dex and Dex earn transaction fees; borrowing and lending can earn interest rate spreads between deposits and loans; Yield Farming earns deposit and withdrawal fees; LaunchPad earns token issuance fees. HYPE, JUP, and AAVE in the table are all the dominant parties in the DeFi field. More importantly, they also have token repurchase mechanisms, which means that with the arrival of the copycat season, liquidity recovery will increase transaction volume. Since the top DeFi protocols have network effects, it will also drive the overall project to have higher profits, and higher profits means stronger repurchase efforts. As the demand for tokens increases, the probability of prices continuing to rise also increases.

Conclusion: Pay close attention to Bitcoin market share

The launch of the copycat season means that funds flow from Bitcoin to more risky altcoins with smaller market capitalization. Therefore, there are two key observation indicators: First, whether Bitcoin can stand firmly above 90,000, providing a stable anchor for confidence for the market; second, and more importantly, whether Bitcoin market share (BTC.D) can begin to decline, reflecting that capital preferences begin to spread.

On April 23, Bitcoin rose sharply to 90,000, but BTC.D only fell slightly by 0.2%, indicating that it is still in the stage of "funding is concentrated on BTC and steady growth at the standard." However, if BTC.D begins to decline significantly next, for example, return to the 57% level at the beginning of this year, it will be a signal that funds officially spill over to the counterfeit market, and then the "rotating market" will have the opportunity to fully unfold.

In other words, the real starting point of the copycat season is not only the continuous high of Bitcoin, but also the process of rising risk appetite and the spread of funds from BTC to other theme tracks. When these two happen at the same time, we have the opportunity to see the overall market activity. Now is the time to observe, screen and layout. Whether the counterfeit craze is coming, the trend of BTC.D will give the answer.

No comments yet