Bloomberg reported that the record gold rally has caused even greater waves in China, stimulating retail demand and sparking unprecedented trading volume.

As prices fluctuate, there are signsDay trading soars sharply, the volatility of futures denominated by RMB also hit a record high, and traders are at ease in the twists and turns of trade disputes. Meanwhile, funds flowing into exchange-traded funds (ETFs) surged, retail activity swelled, and local premiums were gaps.

As Asia's largest economy, the Chinese market has a huge influence because it is the largest consumer of gold and a major producer of gold.

Samson Li, an analyst at the Commodity Discovery Fund, said:“The gold bull market will last for a long time as the Chinese want to hedge geopolitical tensions.”Li noted that some forecasts believe gold will rise to $5,000 per ounce, including China International Capital Corp., the oldest investment bank in China.

Gold is the best performing major commodity this year, as the Trump administration's aggressive move to reshape the global trade order shocked the market and stimulated safe-haven demand for gold as central banks have become big buyers.

"The local media coverage of gold has amplified people's fear and greed," said Wu Zijie, an analyst at Jinrui Futures Co., Ltd.

He said that despite a brief sell-off in the middle of the week, most retail investors simply relaxed and did not really exit.

In a country that has traditionally viewed gold as a traditional household investment, there are obvious signs that a stream is emergingRetail craze, this coincides with the pattern that often appeared last year, and is even worse.

Over the past three trading days, the Shanghai Futures Exchange has traded far more than one million contracts a day, dwarfing the usual trading volume.

"Although we're seeing a big increase in volume, we're not seeing much increase in open positions -- so that tells me, it'sThe behavior of day traders。”

“We also heard a lot of reports about banks selling investment bulldozers,” Reed said. "therefore,Retail investment demand is undoubtedly very strong。”

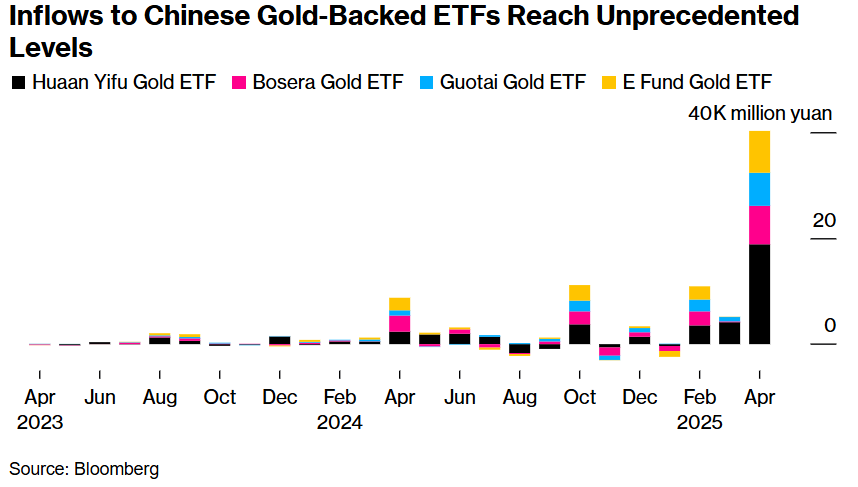

In addition to futures speculation, investors are also hoarding other types of gold.The funds flowing into local gold ETFs this month have exceeded the total increase in last year.In this boom, Shanghai Gold’s premium relative to the world has expanded to a record level.

Against the backdrop of hot Chinese market transactions, more and more people believe that even if gold has risen sharply, its upward trend may continue.Goldman Sachs predicts that gold prices may hit $4,000 per ounce by mid-2026.

In China, investors have been very excited. A large number of posts appeared on social media, including WeChat, encouraging retail investors with little investment experience to try. Some users post to invest their life savings in gold or to pursue higher prices by taking out loans.

In times of market turmoil, authorities often take cooling measures. On Monday, the Shanghai Gold Exchange issued a new warning about market volatility, urging investors to remain cautious.The next day, gold prices peaked and then plummeted.

No comments yet