This month, centralized institutions such as BlackRock, Mantra Chain, Ondo, Alchemy Pay, Yala, Ant Digital Technology, and decentralized public chain projects and protocols have all promoted and tried various asset types and protocol infrastructure types for the RWA track.

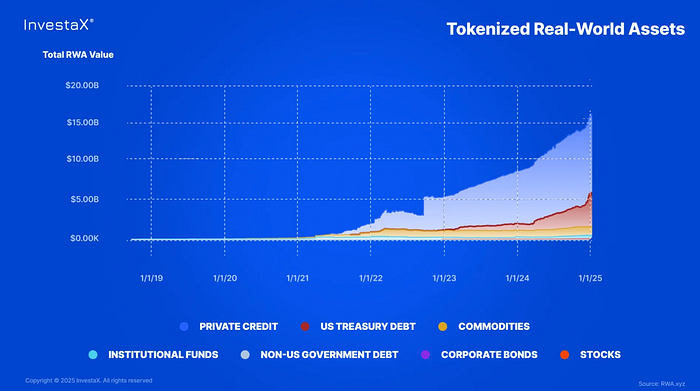

Now The scale of the RWA track has reached US$36.5 billion, and the industry growth rate has increased by about 60% year-on-year, the tracks involved mainly include private credit, US bonds, commodities, real estate, stocks and securities, etc., while the RWA involved in Hong Kong, China mainly focuses on new energy assets.

Although RWA still has many difficulties and obstacles, and compliance implementation, the problem of global mobility needs to be solved. However, the intervention of traditional financial giants and accelerated attempts by governments in various countries have made RWA hope to truly change the hollowing out and scale of blockchain finance.

The value capture problem faced by the traditional blockchain world. RWA, as a blockchain financial derivative in the traditional asset world, just makes up for the shortest shortcomings in the blockchain world, so we believeRWA is an important bridge for traditional financial cryptography and cryptocurrency tradition。

In the Three-Body World, Luo Ji used his own life as the trigger mechanism to deploy nuclear bombs in the orbit of the sun, and used the laws of dark forests to build a deterrent system against the Three-Body civilization.

In the human world, he is the sword-holder of the earth.

"Dark Forest" is also the nickname for blockchain by most people in the circle, which is also the "original sin" born with the decentralized characteristics.

For some special areas,RWA may be able to act as a sword-holder in this parallel world。

RWA is in full swing. RWA’s real goal is to seamlessly link traditional finance and decentralized finance. While reshaping traditional finance, it can also bring opportunities contained in the real world to the chain, rather than a bunch of private agreements stored on the public chain. At the same time, we look forward to RWA bringing us a global boundless asset investment method and financial expression method. It is conceivable that we can buy Nasdaq stocks during the day in Hong Kong, deposit money into the Russian Federal Savings Bank in the early morning, and the next day, we can jointly invest in Dubai real estate with hundreds of shareholders in the world who don’t know each other’s names.

Yes, we think RWA can build a world on a real asset public ledger! A greater world without boundaries!

1. Recent market trends and key events

Market related news

1. Market Size Trend

As of April 21, 2025, the total market value of the RWA market reached US$36.5 billion, an increase of 0.7% in the past 24 hours, showing continued investor interest. The number of RWA-related crypto tokens has exceeded 185, with a total market value of more than US$10.62 billion (March 2025 data), an increase of 61% year-on-year.

Traditional financial giants such as BlackRock and Fidelity have begun to focus on the RWA field and explore the possibility of asset tokenization through blockchain technology.

BlackRock, a large fund management company, is nowSeek regulatory approvalIts bond and stock tokenization, while JPMorgan has launched an internal tokenization platform and actively explores risk-weighted asset (RWA) opportunities. The rise in market interest indicates further growth, and the scale of the field is expected to exceed the trillion mark in the next five years.

2. Promote regulatory compliance

Projects such as Mantra Chain have been licensed by the Virtual Assets Service Provider (VASP) of Dubai Virtual Assets Regulatory Authority (VARA), marking positive progress in regulatory compliance for RWA projects, making Mantra Chain the first DeFi platform to obtain the license.

Mantrais a Layer-1 blockchain built specifically for RWA, which allows ecosystem participants to build licensed applications in a license-free environment.

This dual model allows regulators to maintain regulation while allowing developers, institutions and retail investors to take advantage of DeFi. Platforms that adopt this approach will have unique advantages that meet global compliance requirements without stifling innovation.

Mantra Chain allows ecosystem participants to develop and use time-sharing risk-weighted assets (RWA).

Recently, Mantra Chain has reached a partnership with Damac, a well-known real estate developer with a diversified portfolio, aiming to tokenize at least $1 billion worth of assets in its portfolio and use these assets for investment through time-sharing ownership.。

3. Stellar blockchain cooperation expansion

Stellar Blockchain announced partnerships with Paxos, Ondo, Etherfuse and Societe Generale SG Forge.

Lauren Thorbjornsen, chief operating officer of the Stellar Development Foundation (SDF), said that the Stellar Stellar blockchain will push the real-world assets to be held at $3 billion by the end of 2025, which means it will increase by more than 10 times the size of the $290 million RWA on the Stellar chain by the end of December 2024.

4. Alchemy Pay products will integrate RWAs

On April 1, crypto payment company Alchemy Pay announced that its products will integrate real-world assets (RWAs). By cooperating with mainstream RWA providers, it will introduce high-quality traditional financial assets such as U.S. Treasury bonds and blue chip stocks into the crypto ecosystem, supporting users in multiple regions to purchase using fiat currency.

Alchemy Pay said that the business is committed to building a compliance channel connecting traditional finance and decentralized finance, providing users with diversified investment options and reducing the threshold for global users to participate.

5. The Yala RealYield platform launches

On April 5, the Bitcoin liquidity protocol Yala officially launched its innovative product - Yala RealYield, the first structured income market platform based on Bitcoin and integrated real-world assets (RWA), aiming to provide users with highly flexible investment autonomy by aggregating diversified RWA providers.

The RealYield platform hopes to allocate BTC liquidity to tokenized high-quality interest-bearing RWAs (such as U.S. Treasury bonds, private credit, corporate bonds and real estate mortgage assets) to provide Bitcoin holders with institutional-level stable income channels.

Users can freely select and combine various interest-generating assets on the premise that the assets are fully linked.

6. RWA REAL UP Dubai Summit 2025 will be held in Dubai

On April 30, RWA REAL UP Dubai Summit 2025, led by Ant Digital Technology and jointly participated by Solana, Sui, ZKsync, Pharos, ChainIDE, Chainlink, ZAN, AAVE and other Web3.0 partners, will meet you in Dubai.

Dynamic tracking of technological innovation

1. Quant Network launches Overledger, it is an interoperable blockchain operating system that supports multi-chain applications, which enhances the liquidity of RWA between different blockchains. The multi-chain method can realize the liquidity and interoperability of RWA assets between different assets, and can greatly stimulate the issuance of RWA in multi-chain forms.

2. Securitize launches sToken Vault function, enhances the liquidity and composability of RWA, and collaborates with Elixir’s “deUSD RWA Institutional Program”.

sToken Vault launched by Securities is an innovative feature based on ERC-4626 vault technology, mainly used to enhance the liquidity and composition of Real World Assets (RWA) in decentralized finance (DeFi).

Core role:Allow institutional investors to hold RWA issued by Securities while obtaining liquidity in the form of deUSD (decentralized USD tokens) in DeFi and continue to earn profits from underlying assets.

Cooperation model:This capability is provided in partnership with Elixir’s “deUSD RWA Institutional Program” with the goal of connecting Traditional Finance (TradFi) with DeFi.

BUIDL tokens and other assets currently supporting BlackRock, such as Hamilton Lane's SCOPE, are planned to expand in the future.

Project financing related news

1. Plume received US$20 million in financing to build a real-world asset finance ecosystem.

2. Tether announced an investment in Quantoz, planning to launch stablecoins that meet MiCAR regulatory standards and expand its tokenization capabilities through Hadron by Tether Tech.

Hong Kong and China RWA development events

1. Conflux Network and Ant Digital Technologies reach cooperation

Conflux Network cooperates with Ant Digital Technologies to drive RWA's growth in Hong Kong. The two sides jointly participated in China's first renewable energy battery exchange RWA project, located in Hong Kong, using blockchain technology to build a safe, transparent and compliant digital infrastructure.

2. Hong Kong Monetary Authority (HKMA) launches the "Digital Bond Appropriation Program"

The Digital Bond Grant Scheme aims to encourage the adoption of tokenization technology in the capital market.

In addition, HKMA has launched the "Project Ensemble" sandbox project to support institutional experimental tokenization applications, including traditional securities and RWA.

3. The 2025 Web3 Festival is held in Hong Kong

At this year's Web3 conference, RWA tokenization became the focus of the topic.

During the meeting, the Hong Kong Monetary Authority’s “Project Ensemble” initiative was discussed, which aims to explore innovative market infrastructure to support settlement using tokenized currencies and identify practical application cases at home and across borders.

A stable regulatory environment and a diverse supply of products (including virtual assets and tokenized RWA) have attracted a large number of investors. However, retail investors' participation remains limited due to strict requirements.

4. Tokenized funds of China Pacific Insurance (CPIC)

China Pacific Insurance (CPIC) investment management company launched a tokenized dollar money market fund (eStable Money Market Fund, MMF) on HashKey Chain.

The fund raised $100 million on its first day, focusing on USD-denominated short-term fixed income assets and money market tools. The fund is only for professional and institutional investors, with a tokenized issuance platform being PAC, and fund management services are provided by standard Chartered Bank.

CPIC plans to continue to use compliance-driven blockchain platforms to tokenize more traditional assets, which shows that China's exploration in the RWA field is still continuing.

2. Industry observation and thinking

The main dilemma of the current development of the RWA industry

(1) Regulatory uncertainty

There are significant differences in laws and regulations on Web3 technology and asset tokenization in different countries and regions, resulting in a lack of a unified regulatory framework. This not only affects RWA’s global rollout, but also may increase compliance costs. Large institutions tend to invest in fiat currencies rather than on-chain assets due to regulatory uncertainty.

European and American countries focus on compliance thresholds. Although Asia and the Middle East have attracted projects through experimental policies, the compliance threshold is still not low. Therefore, the current status of RWA protocol is that it can exist on public chains, but it must be supplemented by various scale-based blocks to adapt to the compliance framework. These compliance agreements do not interact directly with traditional DeFi protocols, and secondly, based on the jurisdiction, an agreement that complies with the Hong Kong Compliance Framework cannot interact with compliance agreements in other regions. Judging from the current situation, the RWA protocol does not have sufficient accessibility and is extremely lacking in interoperability. Its shape is like an "island" and runs contrary to the ideal form.

In 2025, some regions such as Dubai have begun to try regulatory frameworks (such as Mantra Chain is licensed by VASP), but global consistency still takes time.

Different countries and regions now adopt different regulatory frameworks, making it difficult for RWA to circulate globally.

The article is accompanied by a description and summary of regulatory frameworks from different countries and regions.

(2) Obstacles of adoption

RWA requires acceptance and use by a wider user base, including users of different ages and backgrounds. This includes using cryptocurrencies as a payment method, and overcoming the learning curve of new technologies. Now, the participants and promoters of RWA are mainly institutions, both in the United States and Hong Kong, and are mainly large institutions to promote implementation. The industry standards have not been established yet, resulting in many retail investors not participating yet, and ordinary investors lack the understanding of RWA.

(3) Sustainability and volatility

RWA tokenization may trigger excessive speculation, resulting in unreasonable price fluctuations in originally stable assets (such as real estate or bonds), which may lead to market instability and affect long-term investor confidence.

(4) Technical Challenges

Vulnerabilities in smart contracts and scalability issues of blockchain platforms may affect the security and reliability of RWA. For example, handling large numbers of RWA transactions requires efficient infrastructure, and existing technologies may not fully meet the needs. Technical risks can lead to asset security issues and weaken investor trust. Quant Network and DECO are developing privacy protection and scalability solutions, but it still requires time to verify.

(5) Liquidity issues

Certain RWAs (especially low liquidity assets such as real estate or artwork) may still face insufficient liquidity after tokenization, especially when market conditions are not good. Especially after the first financing of RWA tokens, which are mainly engaged in institutional participation in Hong Kong and China, basically lost liquidity.

Although standardized assets such as U.S. Treasury bonds provide a definite starting point for RWA, their on-chain is more of a technical package and does not release structural value. The key to RWA in the future is to activate "silent assets" that are free from the traditional financial system for a long time, difficult to value and lack liquidity, and realize their value expression and free circulation through the chain, and create new market momentum. This will make RWA an opportunity window for funds to take risks in investment, attract more types of funds to be chained, and achieve a dual qualitative change from the "asset side" to the "fund side".

(6) Investor confidence

Building investor trust is key to RWA development, but lack of transparency, security and regulatory compliance may undermine confidence.

DePINone Labs Observation and Thinking

(1)Centralized pre-on-chain supervisionandDecentralized circulation after being put on the chainIt is the final expression of RWA

Taking Hong Kong as an example, Hong Kong has now established a coordinated mechanism of the Mainland-Hong Kong-Singapore three-layer structure.

The first floor isDomestic rights confirmation layer, carry out data on domestic data asset trading platforms, standardize processing, complete asset preparation through sandbox mechanisms, and ensure domestic rights confirmation of core data.

The second layer isOffshore Issuance Layer, Hong Kong licensed institutions packaged the processed data assets into compliant fund products, and completed the private placement issuance based on license No. 9.

The third layer isGlobal circulation layerSingapore takes advantage of its RMO license to undertake secondary market circulation and achieves compliant cross-border circulation through the China-Singapore International Data Channel.

The innovative value of this architecture is reflected in three dimensions: First, the domestic links strictly adhere to the bottom line of data security and avoid the regulatory risks of Document No. 38; Second, Hong Kong leverages the professional advantages of licensed institutions to focus on primary market issuance; Third, Singapore opens the secondary retail market and activates global capital participation.

(2)Activate the secondary market vitality of RWA, is the beginning of the RWA industry's takeoff

Now RWA is facing the primary market phenomenon of "assets are silent when they are launched". Given that various compliance and regulatory systems have not been implemented, the liquidity of the secondary market is difficult to release, which suppresses RWA's market vitality.

To this end, we believe that distributed digital identity (DID) systems will form important strategic watersheds.

Taking BlackRock's research as an example, BlackRock clearly positioned DID as the infrastructure of inclusive finance in its public documents, trying to break the barriers between institutions and retail investors through a verifiable credit system.

RWA development should never be limited to the professional investor market. Building underlying capabilities such as digital identity authentication and on-chain clearing will be the most important infrastructure conditions for introducing liquidity in the secondary market.

(3) RWA can both encrypted currencyTraditional financial tokenization, can alsoCryptocurrency Traditionalization

The two are moving towards each other, not going against each other.

Traditional assets are rushing towards blockchain to release value and on-chain flow;

What cryptocurrencies are rushing towards traditional finance is the niche construction and value capture of currency, rather than the memecoin that was previously worthless.

RWA can truly realize the process of transforming bad coins into bad coins, making the crypto world truly valuable support, rather than a mirage built between decentralized dreams.

PT: Details of regulatory frameworks for RWA in major jurisdictions around the world as of April 2025

USA

Regulatory agencies: SEC (SEC), CFTC (Commodity Futures Trading Commission)

Core Regulations:

- Securities tokens: It is necessary to pass the Howey Test to determine whether it belongs to a securities. The registration or exemption clause of the Securities Act 1933 (such as Reg D, Reg A+) is subject to it.

- Commodity tokens: regulated by CFTC, Bitcoin, Ethereum, etc. are clearly classified as commodities.

Key measures:

- KYC/AML: BlackRock's BUIDL fund is only open to qualified investors (net assets ≥$1 million), with mandatory on-chain authentication (such as Circle Verite).

- Expanded securities recognition: Any RWA involving dividends may be considered a securities. For example: SEC's penalties on tokenized real estate platform Securities (unregistered securities issuance in 2024).

🇭🇰 Hong Kong

Regulatory agencies: HKMA, China Securities Regulatory Commission (SFC)

Core framework:

- The Securities and Futures Ordinance includes securities tokens in regulation and must comply with investor suitability, information disclosure and anti-money laundering requirements.

- Non-security tokens (such as tokenized commodities) are subject to the Anti-Money Laundering Ordinance.

Key measures:

- Ensemble Sandbox Plan: Test the dual-currency settlement of tokenized bonds (HKD/offshore RMB), cross-border real estate mortgage (cooperation with the Bank of Thailand), and participating institutions include HSBC, Standard Chartered, Ant Chain, etc.;

- Stablecoin Gate Policy: Only use of stablecoins approved by the HKMA (such as HKDG, CNHT) is allowed, and unregistered currencies such as USDT are prohibited.

🇪🇺 EU

Regulatory authority: ESMA (European Securities and Markets Authority)

Core Regulations:

- MiCA (Crypto Asset Market Supervision): Effective in 2025, RWA issuers are required to establish EU entities, submit white papers and undergo audit.

- Token classification: Asset reference tokens (ARTs), electronic currency tokens (EMTs), and other crypto assets.

Key measures:

- Liquidity Limitation: Secondary market transactions require license, and the DeFi platform may be defined as a "virtual asset service provider" (VASP).

- Compliance shortcuts: Luxembourg fund structures (such as Tokeny Gold Tokens) become a low-cost issuance channel, with the compliance costs of small RWA platforms expected to increase by 200%.

🇦🇪 Dubai

Regulatory authority: DFSA (Dubai Financial Services Authority)

Core framework:

- Tokenized Sandbox (launched in March 2025): It is divided into two phases (intention application, ITL testing group), allowing the testing of securities tokens (stocks, bonds) and derivative tokens.

- Compliance path: exempt some capital and risk control requirements, and a formal license can be applied for after 6-12 months of the testing period.

Advantages: Equivalent to EU regulation, supports the application of distributed ledger technology (DLT), and reduces financing costs.

🇸🇬 Singapore

- Securities tokens are included in the Securities and Futures Law and exemptions apply (small issuance of ≤5 million SGDs, private placement of ≤50 people).

- Functional tokens must comply with anti-money laundering regulations, and MAS (Monkey Office of Singapore) promotes pilot projects through a sandbox.

🇦🇺 Australia

- ASIC (Securities and Investments Commission) classifies RWA tokens granted to income as financial products and requires a Financial Services License (AFSL) and discloses risks.

Special statement: All articles by DePINone Labs are for information and knowledge purposes only and do not constitute any investment advice.

This report is produced by DePINone Labs. Please contact us for reprinting.

No comments yet