Preface

Although US President Donald Trump's tariff policy has caused market turmoil and suspended Circle's listing plans for a time, it is advancing its expected IPO at a lightning speed.

Circle is actively deploying in multiple fields - payment networks, bank license applications, and institutional cooperation, and is gradually approaching the market leader Tether. Taking the data as an example, USDC issuers have narrowed its market share gap with Tether from 50 percentage points to just 35 percentage points.

In today's article, we will discuss:

USDC accelerates growth, narrowing the gap with Tether

How Circle's new payment network replaces outdated cross-border systems

Why Circle and other crypto companies suddenly compete to apply for bank licenses

How traditional banks prepare for counter-attacks on stablecoins

Let’s first explore why the competition for stablecoins is so important in addition to the cryptocurrency bubble.

2 trillion USD stablecoin competition

Competition for stablecoins is becoming increasingly fierce. As regulation becomes clear, traditional financial giants are preparing to take action, which could break the current dual-oligarchical landscape of Tether and Circle.

In the past five months, the combined market share of the two major stablecoins has dropped by 4 percentage points.

"We will see banks issue stablecoins because they meet MiCA requirements. By the end of this year, you may see over 50 new stablecoins."

A report from Standard Chartered Bank shows that by the end of 2028, the stablecoin market size may soar to an astonishing $2 trillion, almost ten times the current total supply of $235 billion.

Dozens of banks are privately drafting strategic plans for stablecoin plans, and most are expected to finalize their plans by the end of the quarter. "It will be interesting to see if banks develop on their own, or use platforms like Bank of New York Mellon that serve banks, or vendors like Fireblocks," Goldi noted.

This looming competitive threat explains why Circle is so eager to act in multiple areas. As traditional financial institutions prepare to enter the market, the window to consolidate market position is rapidly closing.

Stablecoin competition heats up

USDC’s intentions and quick moves are obvious: as of April 19, its market value climbed to more than $60 billion, up $17 billion from $44 billion at the beginning of the year, or about 40%.

By comparison, Tether's USDT market cap grew by only 8% over the same period. While Tether remains dominant with a market cap of nearly 2.5 times the USDC, the growth gap is closing rapidly.

Data shows that the preference gap between the two stablecoins is widening. Regulated entities and DeFi protocols prefer USDC because Circle's regulatory system is clear and transparent.

Its advantages are most obvious in Europe. USDC has obtained MiCA's license to cover 27 EU countries and covers regions with a total population of 450 million. In contrast, USDT does not.

Regulators are not the only obstacle to Tether's continued dominance.

Coinbase CEO Brian Armstrong recently said the exchange's new "large goal" is to replace Tether's USDT as the world's "No. 1 dollar stablecoin".

Other exchanges such as Kraken and Crypto.com have also removed USDT from the European market.

Break the bank track

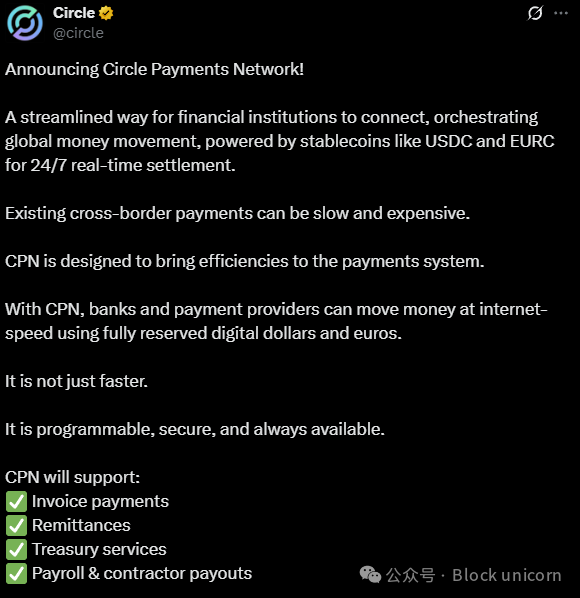

On Tuesday, Circle launched a product designed to reduce the cost and delays of cross-border fund transfers. Circle Payment Network (CPN) aims to use stablecoins as a bridge to remove the aging infrastructure of global finance.

Circle posted on X: “We are not just building stablecoins, we are also building a modern infrastructure for global payments.”

International banks are known to be slow, costly, and limited by traditional systems that are often closed at night and on weekends. Circle's alternative promises instant 24/7 transfers using fully reserved digital dollars (USDC) and euros (EURC).

Circle has introduced more than 20 design partners, including dLocal, WorldRemit, BVNK, Yellow Card and Coins.ph.

This partner lineup shows that its clear focus on emerging markets and high-traffic remittance channels—traditional banking sectors are particularly underperforming.

Circle's network initiative has a simple and fundamental reason to transform stablecoin issuers into critical financial infrastructure providers that move these assets at scale.

"Circle is launching a payment network with initially aiming to remit money, but ultimately aiming to compete with Mastercard and Visa," said a person familiar with the matter.

Bank layout

While launching the payment network, Circle is preparing to overcome regulatory difficulties and apply for a U.S. bank license or license, according to the Wall Street Journal.

However, Circle is not alone. BitGo, the custodian of the Trump family's stablecoin USD1, as well as Coinbase and Paxos, are also following the same path. The timing coincides with the evolving U.S. stablecoin regulations that may soon require stablecoin issuers to obtain licenses.

Why are you pursuing a bank license now?

A bank license will allow Circle to operate like a traditional bank, which may include accepting deposits and issuing loans.

But this also comes with high costs. Crypto company Anchorage Digital reportedly spent millions of dollars on obtaining a federal license to meet regulatory requirements.

But the rewards could be generous—that is, gaining permissions to the Fed’s main account, a “holy grail” that crypto-native banks such as Custodia have failed to achieve over the years. This permission will provide Circle with the closest access financial institutions can access to the U.S. money supply.

Our Views

Circle's multi-pronged strategy shows that it is preparing not only for the positioning before the IPO, but a deep-seated attempt to bridge the gap between traditional finance and crypto, which other stablecoin issuers have yet to successfully cross.

Circle’s institutional payment network, bank licensing ambitions, and USDC’s regulated position together build an unprecedented moat against Tether and its upcoming traditional financial competitors. Circle lays a solid foundation in the field of diversity to build significant differentiation from its competitors.

It is worth noting that Circle’s focus on emerging markets and remittance channels. As competitors compete for dominance in mature Western markets, Circle is also quietly expanding to build infrastructure in areas where financial inclusion is still difficult to reach.

Its list of partners—dLocal (South America), WorldRemit (Africa and Asian Remit), Yellow Card (Africa), Coins.ph (Philippines)—is the roadmap of the next generation of remittance market.

MiCA's license advantage over Tether is perhaps Circle's most undervalued asset. Contacting 450 million European users through regulatory compliance is undoubtedly a winner-takes-all situation.

Circle’s strategy demonstrates their understanding of the fundamental fact that the victory of the stablecoin war depends not only on market share, but also on infrastructure, regulatory positioning and institutional integration.

Knowing that it can’t surpass Tether’s market cap in the near term, Circle is building a completely different field that Tether, despite its massive scale, cannot compete with its existing capabilities.

No comments yet