author:Tiger Research

Summary of key points

- Web3 companies use IPO as a strategic tool for building a formal regulatory framework, which not only wins the trust of institutional investors and regulators, but also achieves in-depth connection with traditional financial markets.

- The token financing model exposes structural defects such as violent price fluctuations, regulatory ambiguity and liquidity management pressure, highlighting the necessity of transformation to IPO

- It is expected that centralized exchanges (Bithumb, Kraken), stablecoin issuers (Circle, Paxos), and Web3 solution providers (Chainalysis, Nansen) will lead the IPO wave, expand institutional funding channels and strengthen global competitiveness through listing.

1. From tokens to stocks: IPO transformation trends in the Web3 industry

Circle, a stablecoin issuer, filed an initial public offering (IPO) application to the U.S. Securities and Exchange Commission (SEC), a move that has attracted widespread attention from the Web3 industry on the IPO path.

Web3 companies have always preferred token financing models: directly reach retail investors through ICO (initial token issuance) and IDO (first release on decentralized exchanges), and sell future token equity to institutional investors through SAFT (Simple Agreement on Future Tokens).These methods have helped the early explosive growth of the Web3 industry, but the sharp fluctuations in token prices and regulatory uncertainties continue to plague institutional investors, and the token model seriously restricts institutional investors from achieving investment returns.

Against this background, IPOs have become an alternative.Web3 companies can obtain more stable and long-term financial support through IPOs, reduce legal uncertainty through proactive compliance, establish a standardized corporate valuation framework, and reach a wider range of investors. This report deeply analyzes the core motivations of Web3 companies' shift from token model to IPO, and evaluates the impact and future prospects of this transformation on the industry ecosystem.

2. The deep logic of Web3 enterprise choice IPO

2.1 Regulatory Trust as a Strategic Asset

Web3 companies have built IPOs as a "regulatory compliance certification mark".Just as food companies have won consumers’ trust through quality certification, IPOs allow Web3 companies to clearly demonstrate their compliance efforts to the market, this strategy is particularly effective in trust-driven business areas such as stablecoin issuance and custody services.

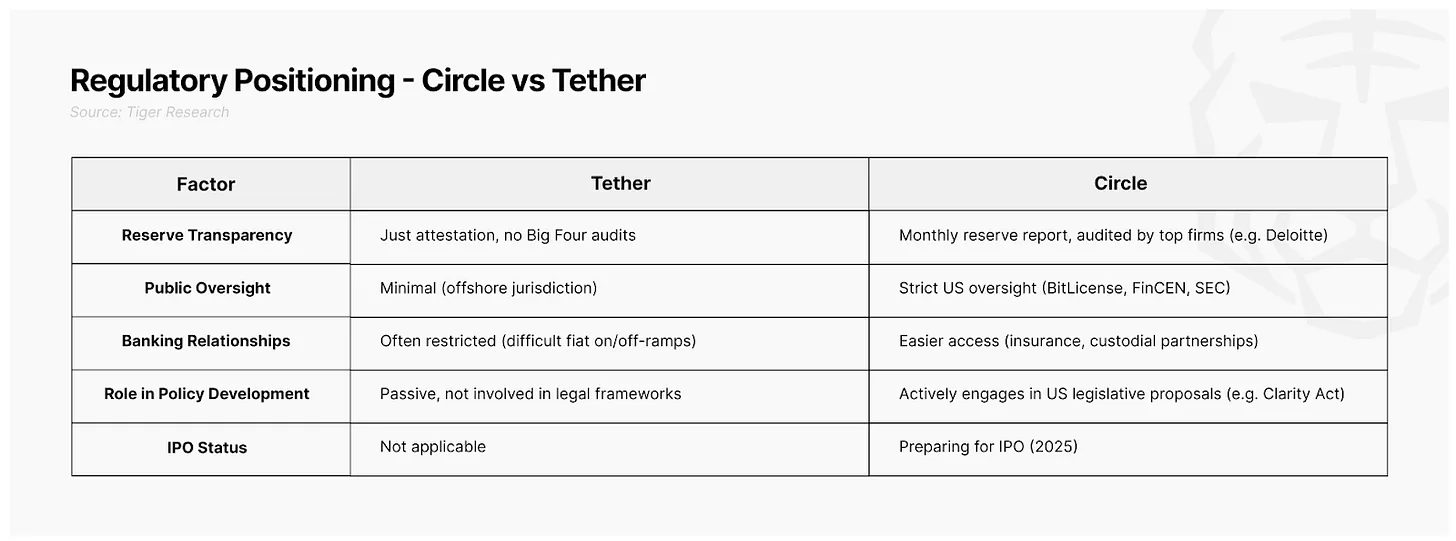

Circle continues to promote the IPO process to confirm its strategic value. The company failed to try SPAC listing in 2021 and plans to hit IPO again in early 2025. Since 2018, Circle has established stablecoin credibility by obtaining BitLicense, New York State, and regularly publishing reserve reports, but has only gained limited trust without formal market verification.The IPO allows Circle to formally establish credibility through the SEC standardized disclosure framework, which is a "market access passport" that allows Tether to cooperate with global financial institutions and enter a wider traditional market.

Coinbase verifies the strategic value of compliance through IPO. The exchange insisted on strict legal compliance before its IPO, and quickly expanded its territory after its listing: established strategic cooperation with BlackRock, provided ETF hosting services, and established contacts with more than 150 government agencies. This development trajectory shows that institutional investors formally acknowledge Coinbase’s compliance efforts through IPOs, which translates into a key competitive advantage in building trust.

2.2 Structural dilemma of token financing

Token financing plays a key role in the early development of the Web3 industry and provides fast and efficient financing channels. However, after issuing coins, enterprises need to deal with unique complexity: they must rely on centralized exchanges (CEXs) to expand investor coverage, while exchanges use opaque and subjective standards to create major uncertainties; after listing coins, they need to provide direct liquidity or ensure market-making cooperation.In contrast, traditional IPO processes follow standardized procedures and clear regulatory frameworks.

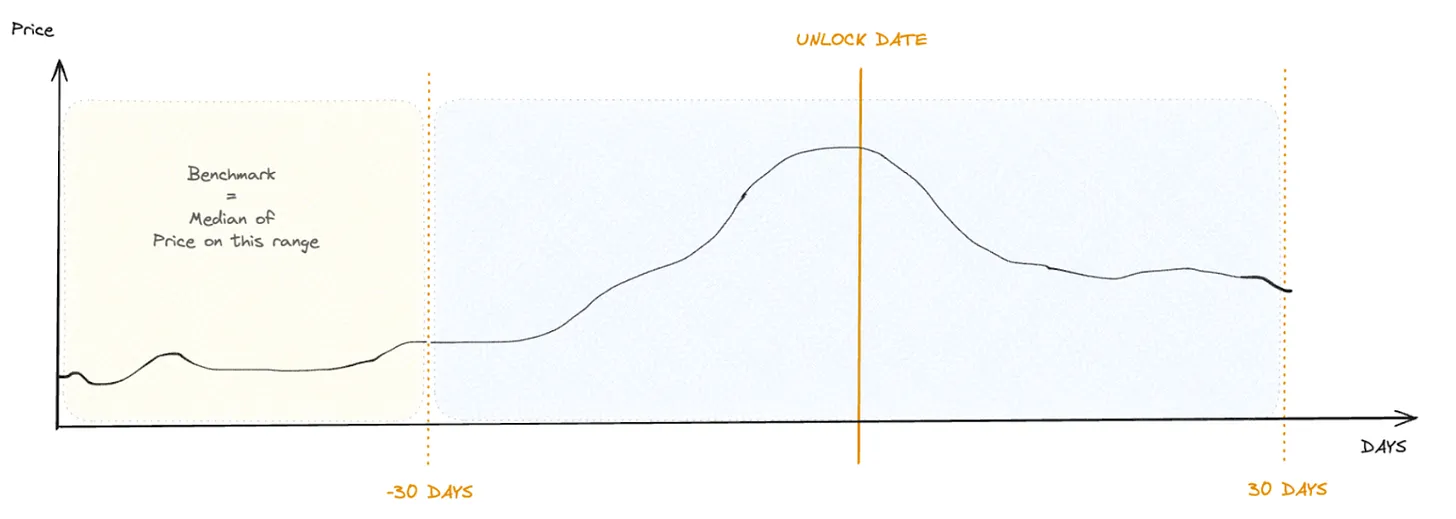

Token unlocking events are often accompanied by sharp drops in prices, source: Keyrock

Price fluctuations pose another core issue. Large-scale token unlocking triggered serious market price fluctuations. Keyrock data shows that 90% unlocking events caused prices to decline, and team token unlocking triggered an average of 25% of the price plummeted.This price collapse makes it difficult for institutional investors to achieve return on investment and strengthen their negative perception of the token model.

Crypto VC financing declines sharply: 2021-2025, source: Decentralised.co

This trend is substantially changing the crypto venture capital market landscape. According to data from Decentralised.co, the global crypto venture capital fell by more than 60% from 2022 to 2024. Singapore ABCDE Capital recently suspended new project investment and fund fund raising, indicating a visible change in the market.

It is difficult for enterprises to effectively connect the token economic model with their operations. Aethir and Jupiter achieve considerable revenue in the Web3 industry, but these business achievements rarely link with token prices, which often blur the business focus. Fireblocks and Chainalysis mainly provide centralized services rather than token products, and the issuance of coins lacks the degree of organic compatibility and clear necessity. Designing and verifying the utility of tokens has become a major challenge, which not only distracts existing business focus, but also brings additional regulatory and financial complexity, prompting Web3 companies to turn to IPOs and seek breakthroughs.

2.3 Expand the dimension of investor coverage

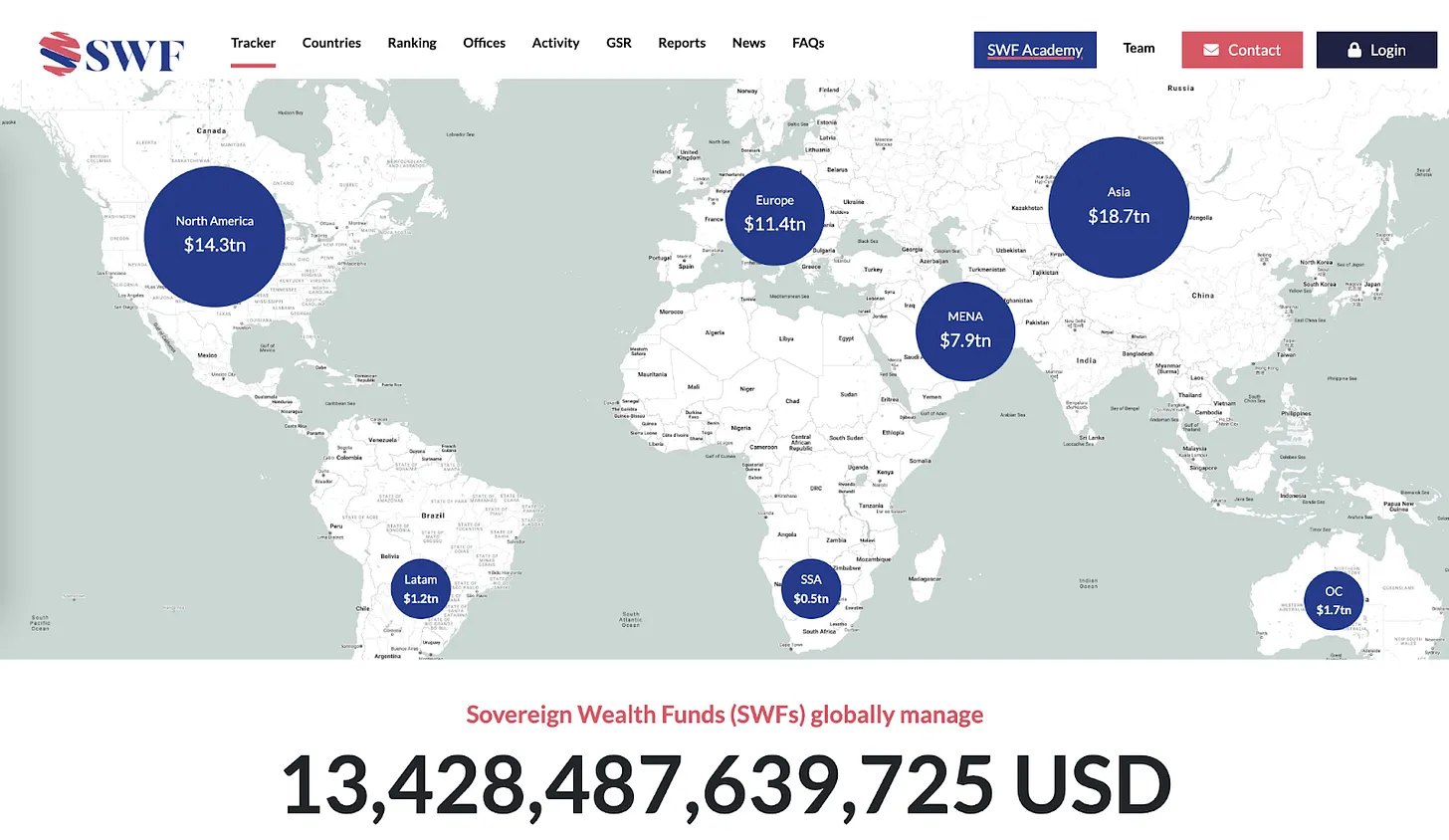

Global sovereign wealth fund management scale exceeds US$13 trillion, source: globalswf.com

IPO provides Web3 companies with the greatest advantage: reaching large institutional capital that is difficult to reach token financing.Due to internal compliance policies, traditional financial institutions, pension funds, and mutual funds cannot directly invest in cryptocurrencies, but can invest in stocks of listed companies in regulated securities markets.Global sovereign wealth funds manage approximately $13 trillion of assets, which reveals the potential fund pool size that Web3 companies can reach through IPOs.

Even in areas with strict crypto-regulation such as South Korea and Japan, IPOs can create effective indirect investment channels. Although Korean institutional investors cannot directly invest in Bitcoin ETFs, they can indirectly participate in the crypto market through listed companies such as Coinbase and MicroStrategy; Japanese investors can avoid high crypto trading taxes and obtain efficient crypto asset investment opportunities through Metaplanet stocks. This accessibility expansion will promote diversified investor participation and provide legal and stable investment tools within the regulatory framework.

2.4 Strategic Value as a Flexible Financing Tool

IPO enables enterprises to effectively obtain large-scale capital.Coincheck and Coinbase successfully raise funds through IPOs and implement aggressive business diversification:Coincheck uses the Nasdaq listing funds to acquire Next Finance Tech; Coinbase enhances global competitiveness through the acquisition of FairX (Derivatives Exchange), One River Digital (Asset Management Company), and BUX Europe (EU Market Entrance). Although the specific contribution of IPO funds to these acquisitions has not been disclosed, it is likely to provide an important foundation for expansion strategies.

IPOs also give companies the ability to use stocks as a means of payment for mergers and acquisitions.Listed companies can conduct mergers and acquisitions through stock consideration to reduce their dependence on cash or volatile crypto assets. This operation realizes efficient capital management and strategic cooperation construction. After listing, enterprises can continue to use diversified capital market tools such as new stock issuance, convertible bonds, and share allotment to achieve continuous and flexible financing that matches their growth strategies.

3. Future Outlook of the Web3 Industry IPO Market

IPO activity in the Web3 field will be significantly enhanced in the coming years, reflecting the acceleration of Web3 institutionalization process, and benefiting from successful stories such as Coinbase to acquire huge amounts of funds through public offerings and achieve global expansion. Centralized exchanges, custodians, stablecoin issuers and Web3 solution companies will lead this wave of IPOs.

3.1 Centralized exchanges and custodians

Exchanges such as Bithumb, Bitkub, and Kraken and custodial service providers such as BitGo are the main candidates for IPOs. These companies build competitive advantages through compliance construction and asset security guarantee, and need to improve institutional credibility and market strength through IPOs. Its revenue is highly correlated with the crypto market cycle, and IPO funds will help it expand new businesses to achieve stable revenue.

3.2 Stablecoin Issuer

Following Circle, compliant stablecoin issuers such as Paxos may follow up on IPOs. The stablecoin market attaches importance to transparency in reserves and clear regulation. IPOs can not only demonstrate compliance frameworks but also build market trust. As global regulation such as the EU MiCA and the US stablecoin bill continue to evolve, IPOs will give issuers important strategic advantages.

3.3 Web3 Solutions Company

Web3 analysis companies such as Chainalysis and Nansen are also key candidates for IPOs. These companies provide professional services to government and institutional clients, and need to enhance market credibility and consolidate global leadership through IPOs. The funds raised by the IPO will be invested in technology upgrades, international expansion and talent introduction to build a foundation for sustainable development.

4. Conclusion

The rise of IPOs in the Web3 industry marks a clear shift to mainstream capital markets.Web3 companies not only obtain funds through IPOs, but also achieve formalization of regulatory compliance, attract institutional investors, and enhance global competitiveness. Amid the continued shrinking crypto venture capital, IPOs provide stable and flexible financing alternatives.

But IPOs are not suitable for all Web3 companies.Even companies that choose to IPO are unlikely to give up token financing altogether. Although IPOs can provide a wider range of funding channels, stronger credibility and easier global market access, they need to invest a lot of compliance costs, internal control construction and public disclosure. The token model supports rapid early financing and cultivates an active community ecosystem.

Enterprises can combine two models strategically:The exchange has built institutional trust through IPO to achieve global expansion, while using tokens to increase user engagement and loyalty. Web3 companies need to carefully choose the optimal combination of IPO and token issuance based on their business model, development stage and market strategy.

No comments yet