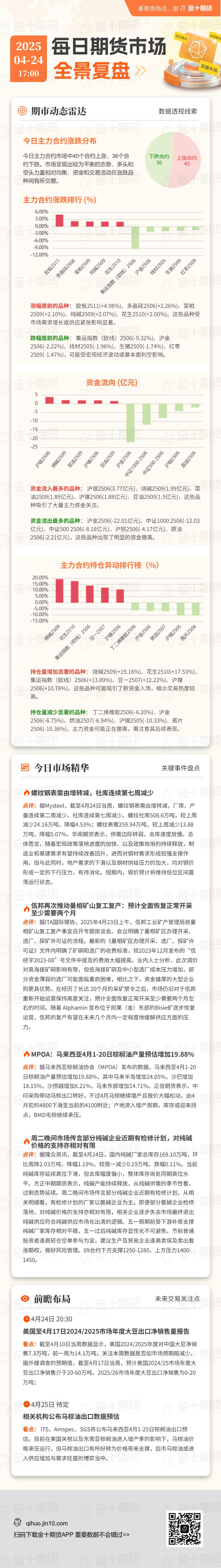

Popular varieties of institutions

1. Main contract of the European Consolidation Line: The spot is weak and has not improved yet, and there is a further reduction in freight rates.

The European futures in the coal transportation industry fell sharply today, hitting a new phased low, closing down 9.40% on the day to 1358.4 points.

Yide Futures said,Trump admitted that tariffs on China were too high and may be significantly reduced, and US Treasury Secretary Becent also hinted that Sino-US relations would ease, and said that market sentiment has been boosted due to macro factors such as the unsustainable tariffs on China. On the spot side, transportation demand growth was weak before May Day, and most shipping companies continued to use market quotes from March to April. The booking prices for some voyages in early May were even lower than the end of April. The weak spot state has not improved yet. We will continue to pay attention to changes in ship loading rates and cargo volume. As European industry and retail industries are expected to start a summer stocking cycle, it is expected that active replenishment of inventory will have a certain boost to transportation demand. Combined with the estimation of the second quarter of the European line contract signing price in the second quarter, it is not advisable to be too bearish about the peak season contract valuation in terms of strategy.

Guotou Futures believes thatThe current spot freight rate continues to decline, ONE's latest quotation fell to US$996/1702 (formerly 1056/1802), and the spot price center has fallen back to $1900/FEU (equivalent to about 1330 points on the market). Currently, only HPL, MSC, and CMA maintain the quotation of $2000+/FEU, and there is an expectation of further reduction. However, the White House has repeatedly sent out signals of easing tariffs on China. Yesterday, foreign media reported that the US is considering a significant reduction in tariffs on China to ease the trade war, and tariffs may be reduced to between 50% and 60%. If the tariff war cools down, it may alleviate the overflow supply pressure of the US line to a certain extent. It is expected that the market will continue to fluctuate due to the combined influence of weak reality and news disturbances, and maintain the "near weak far strong" term structure, and play the possibility of long-term tariff loosening.

Galaxy Futures said,From the fundamentals, the demand side, from the seasonal perspective, the European line shipping market gradually entered the traditional peak season in May, but this year the United States imposed high tariffs on China, suspending 90 days of tariffs to other countries and opening negotiations and giving tariff exemptions for some commodities. Due to the tariffs, the volume of goods in the traditional peak season is expected to be suppressed. In addition, Trump recently said that it may reduce tariffs on China, and we still need to pay attention to the specific implementation trends of subsequent tariffs. On the supply side, the average monthly weekly capacity of April/5/Jun in this period (4.21) is 276,33/288,1/300,900 TEU, of which WK17 has deployed a large number of single-week capacity, mainly due to the heavy fog in Ningbo, which was delayed for three to four days, and some ships were postponed. In addition, OA and PA US-line ships have been transferred to the European line recently, and the capacity allocation has been re-allocated to suppress peak season expectations. Medium- and long-term freight rates are highly unlikely to be affected by the recession caused by the trade war.

2. Rapeseed meal main contract: aquatic products demand recovers, and supply becomes tighter after imports tighten

The main contract of rapeseed meal futures rose strongly today, rising for the fifth consecutive trading day, closing up 2.10% on the day to close at 2,725 yuan/ton.

Guotou Futures believes thatTrump has once again reversed his tariff attitude towards China, causing commodity futures to rise overall, driving rapeseed oil to continue to rise. The domestic rapeseed pressing rate continues to decline, and rapeseed meal production declines. In terms of rapeseed meal demand, except for some aquatic products, it is rigid, and later, as the amount of soybean meal can form a certain substitution. The supply side weak situation shown by the long-term trend may alleviate the supply of forward rapeseed meal due to the formation of new trade flows between my country and other countries. At the same time, soybean futures were affected by the customs clearance of imported soybeans, and simultaneously rose to form a response. At present, the cuisine market is difficult to form a unilateral trend, and it is mainly fluctuating. Investors pay attention to risks and continue to pay attention to the direction of tariff policies.

Tongguan Jinyuan Futures pointed out thatThe precipitation in the US soybean production areas decreased significantly after the 26th compared with the previous period, which helped accelerate the sowing progress, eased trade concerns, and US soybeans closed higher. The tight spot pattern continues, prices rise, and there is an expectation of looseness after the holiday, and continuous meal may continue to fluctuate. Rapeseed meal rebounded strongly, and supply tightened after imports tightened. Coupled with the recovery of aquatic demand, the price difference between rapeseed meal shrinks, and rapeseed meal may fluctuate strongly in the short term.

3. Glass main contract:With the arrival of off-season from June to September, unconsumed inventory in the peak season will bring greater pressure

Today, the main contract of glass futures continued to fall, closing down 0.96% on the day to 1,135 yuan/ton.

Everbright Futures believes thatFrom a fundamental perspective, the daily melting volume of glass has stabilized at 157,800 tons in recent days, and the actual impact of the supply side on the market is limited, but the market's concerns about the increasing disturbance of glass supply in the future still remain. Demand sentiment has improved, and spot transactions continue to rise driven by rising market sentiment. Yesterday, the spot production and sales rates in mainstream areas exceeded 100%, while the production and sales rates in Shahe area were close to 160%. Before the May Day holiday, there are still expectations for stocking in the middle and lower reaches, but if the market is not driven by other new positive factors, the middle and lower reaches will remain cautious, and original glass companies will also focus on shipments. Overall, the short-term glass futures market bottomed out and rebounded, and an upward breakthrough in the later period requires more positive results. Pay attention to macro sentiment, policy trends, and spot glass transactions.

Galaxy Futures believes thatGlass production has declined slightly, and as prices have dropped, manufacturers have turned to wait and see, the trend of resumption of production has slowed down. It is currently in the pre-holiday replenishment period. During the peak season of the construction phase, glass prices fluctuate with the narrow range of production and sales, making it difficult to show a trend. However, with the arrival of the off-season from June to September, unconsumed inventory in the peak season will bring great pressure, and the operating pressure of manufacturers will increase by then. Compared with the low profits of manufacturers last year, the current price still has room for continued decline to promote the market-oriented clearance of the industry. On the macro side, the market focuses on signals from the Politburo meeting at the end of April, including the further relaxation of purchase and sales restrictions in core cities, the increase in the scale of collection and storage, and the pace of special bond issuance, but overall, the pull on post-cyclical products for real estate is limited. Pay attention to the opportunity of glass rebounding and short-term prices will be restored.

GF Futures said,Macroeconomic sentiment is restored, spot goods have strengthened again. Market sentiment led to a rebound, spot production and sales strengthened, 09 was too long in the short term, and the trading logic was re-evaluated after delivery.

No comments yet