Author: 0xTodd Source: X, @0x_Todd

A few days ago, I saw a post saying: "Now the amount of Solana stake has exceeded the amount of ETH stake. Does it mean that the security of the Solana chain has exceeded the amount of ETH?"

This statement is so confusing that many people really believe it.

Actually, it is not the case.

Let's look at some data first:

The pledge data of ETH is 34M ETH, worth about US$61 billion;

Sol's pledge data is 388 M SOL, worth about US$58.7 billion.

SOL does reach the same level as ETH, and if it was before ETH rebounded a few days ago, it was even slightly lower than SOL.

(Data source: Beaconcha & Solana Beach).

Considering that the attack threshold of PoS mechanisms of both are about 33%, it seems that the theoretical attack difficulty is consistent.

33% can block the block, 51% can create the new longest chain, and 67% can double-spent directly.

However, in terms of practical difficulty, the difficulty of attacking ETH is much greater than that of Solana.

PS: Of course, assuming the success rate of attacking SOL is 0.001%, the difficulty of attacking ETH may be 0.0001%. Although there are many differences, it is important to note that both are still extremely likely events.

The reason is (1) node concentration (2) staking infrastructure maturity.

1. Node concentration

Let’s first assume a situation: there was a magical hacker who used the 0day vulnerability to successfully hack the computer rooms of Amazon and mainstream cloud service providers.

Then, controlling Solana > 50% requires getting the top 43 nodes at the same time. It's hard, but not impossible.

For ETH, a single node can pledge up to 32 ETH, so you need to get 1,187,000 nodes, which sounds like an impossible task.

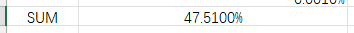

Of course, this is unfair to Sol, because ETH is essentially run by many node operators, and an entity may have tens of thousands of nodes. So, from the current operators included on Rated...

You will find that all registered ETH node operators are only 47.5% together, and they can’t even touch the 50% threshold. Still an impossible task.

The reason is that ETH, as an ancient public chain, has really seen real PoS attacks in ancient times, and has indeed made a lot of preparations to prevent this potential danger, such as encouraging retail investors to participate in staking.

The threshold for 32 ETH for Ethereum is not high, while Solana has high server requirements, and the monthly cost is 5-10 times that of ETH, and this is just a starter. Therefore, if retail investors want to break even, they must pledge at least 10K SOL and the yield is lower than Jito.

2. Infrastructure maturity

Many ETH staking infrastructure, including @LidoFinance @Obol_Collective, have also done a lot of homework.

For example, Lido requires nodes to use less Amazon’s computer rooms and more niche computer rooms. Use less mainstream clients and more support for niche clients. In addition, Lido has specially put out 4% ETH to DVT infrastructure such as Obol and SSV.

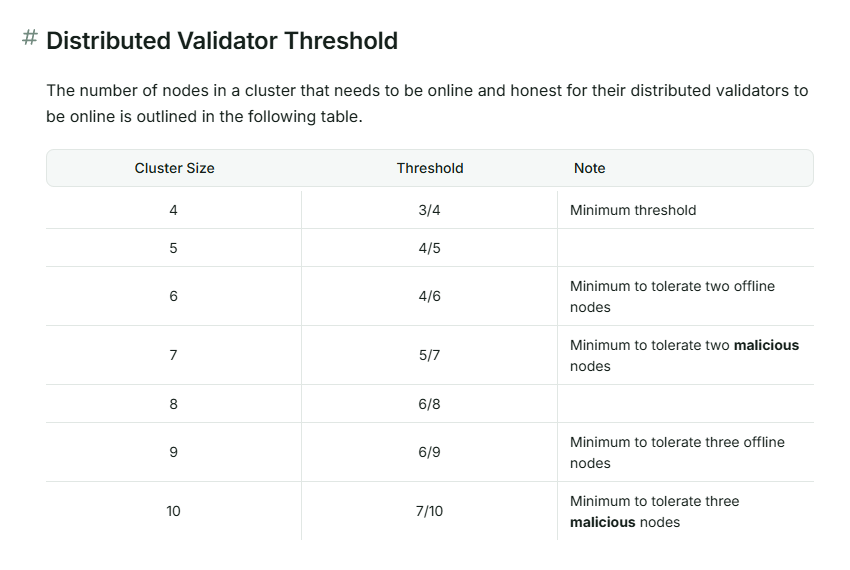

In Obol, it is DVT technology. You can understand it as your nodes are managed by a cluster, not a single entity.

For example, if you have 4 people co-manage the node, you can ask it to be a 3/4, so that once a certain node is disconnected, other nodes can be immediately raised. If you set it to 10, you can set it to 7/10, and tolerate up to three nodes falling off.

Note: On ETH and most PoS chains, disconnection is also one of the forms of [evil]. If 33% of nodes are disconnected, the chain will be paralyzed.

Moreover, the uniqueness of Obol is that it implements the cluster through a client, so your private key (fragmentation) will not be uploaded to the chain, which is more secure. This is achieved through DKG (you can share DKG if you have time in the future).

Recently, Obol has just been on the main website. If you are interested, you can dig it out, just @ebunker_eth.

Therefore, infrastructure such as Obol, which is specially prepared for staking, is currently not available to Solana.

Of course, it’s not like stepping on one hand, both chains are very safe. However, although the capital bet has reached the same level, ETH is still slightly better in terms of security due to node concentration and infrastructure maturity.

No comments yet