Silver's volatile demand

The following figure is the fundamental reason for the current repeated oscillations of silver - because the current position is the key breakthrough point at the annual line level. Faced with such an important historical-level strong resistance range, it is completely understandable that the market needs time to digest it repeatedly.But from a long-term structural perspective, a major breakthrough that is expected to be recorded in history is gradually brewing.

Gold price target

We have been bullish since the gold price exceeded US$2,000 at the end of February 2024. Since then, gold has maintained its overall operation in the upward channel in the figure below, and has surged to a record high of $3,300 in recent days, hitting the upper edge of the upward channel.Judging from the current trend, our goal of $4,000 by the end of the year is becoming more and more realistic. If this goal is achieved, the medium-term target will be further raised: $5,000 will be seen by the end of 2026.

Revision and deviation of gold prices

Over the past 20 years, whenever gold prices deviate too much from their 200-day moving average (both up or down), corrections or consolidation will usually occur. In yesterday's "top-up" market, the spot gold price has exceeded 20% higher than the 200-day moving average.If historical experience is still of reference significance, gold may be facing a period of medium-term consolidation in order to make the 200-day moving average "catch up with" the price level and achieve technical repair.

However, it is worth noting that the continuous buying of central banks in various countries, the core force that has supported the rise in gold prices since 2022, is unlikely to be affected by such technical indicators.This round of trends may not be fully interpreted according to traditional technical logic.

Copper & crude oil

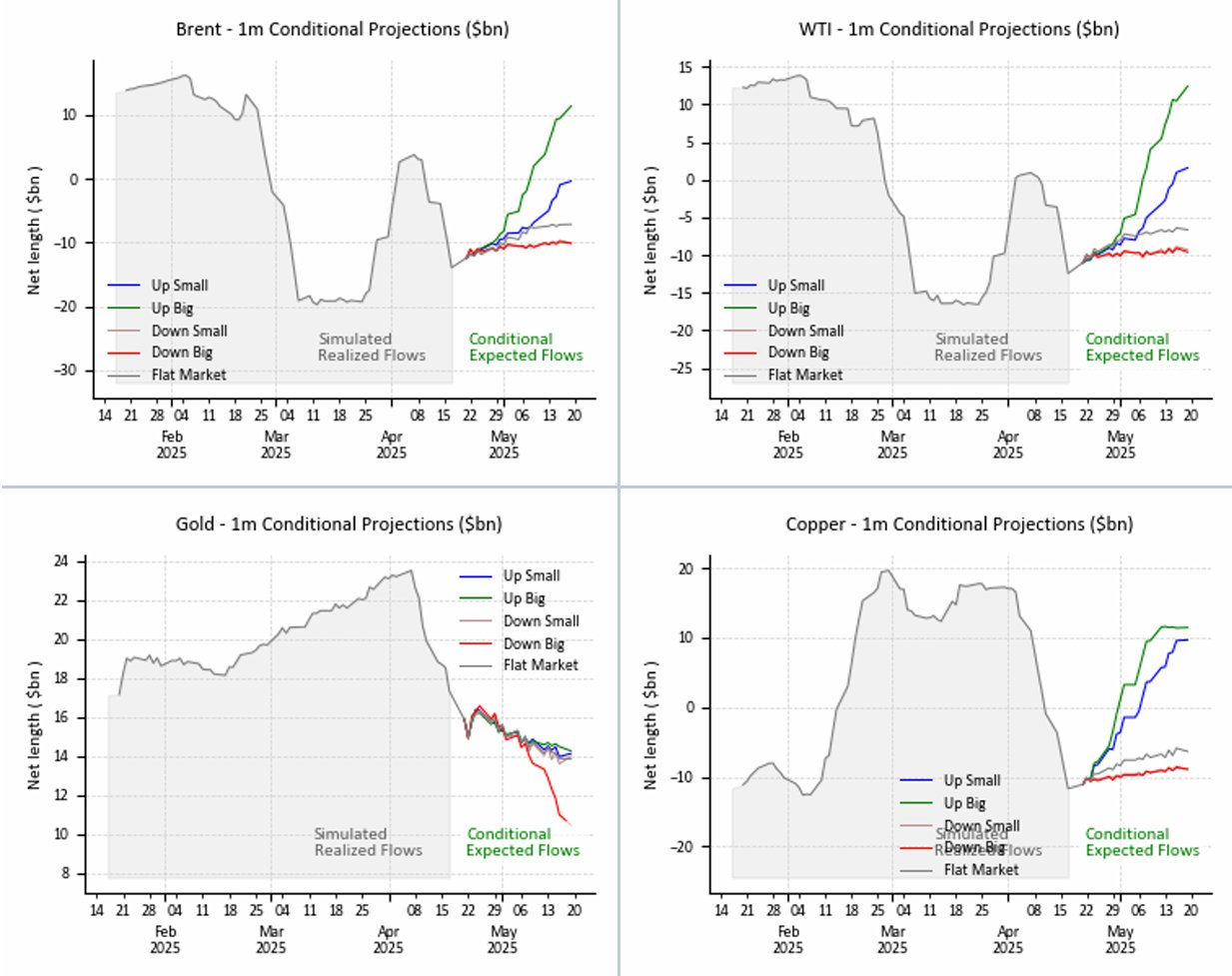

Currently in the crude oil and copper markets, the potential capital flow direction of CTA strategy is obviously biased towards longs. The algorithmic trading system currently supports long directions at this position.

Points of concern

Analysts: Against the backdrop of a rapid reversal after a surge in volume yesterday, gold needs to pay close attention to the following technical support levels in the short term:

——————

The "Macro Must-see Chart" series is exclusively updated on Inner Planet Daily, and researcher Lexie screens out the "God Pictures" shared by Wall Street masters every day.Scan the code to unlock all contents of this issue (at least 15 charts per issue), enjoy the benefits of referring to the planet within one year, and take a look at the series of contents such as macro strategy analysis, professional trader sharing, and key data prospects.

No comments yet