As Web3 enters a new round of adjustment period, initial token issuance (TGE) is no longer just a simple financing method, but has become a place for projects and market games. Especially in the current environment of liquidity shrinking and insufficient investor confidence, how to start and in what way has become a topic that project parties must carefully consider.

IDO is a common way of TGE. From early platforms such as Coinlist, many king-level projects have been born through IDO. However, as the number of projects increases, the wealth effect of IDO has decreased. And Binance's every move always stirs the nerves of the market. Since 2025, Binance Wallet IDO has become the choice for many project launches. Its characteristics of "light threshold, high heat, and strong flow" quickly became the focus of the market, attracting the attention of a large number of startup projects and communities, but it also exposed a series of fundamental changes in the new currency market structure, valuation system and project logic.

However, is this model really suitable for every project? Which projects can quickly amplify the narrative and complete the cold start through it, and which projects may encounter the dilemma of "opening high and closing low" after the market is hustle and bustle? The Klein Labs Research team conducted systematic data research and structured dismantling of 10 Binance Wallet IDO projects that have been launched, trying to help project parties make smarter judgments from a strategic perspective.

1. Background: What kind of market cycle are we in?

From the past few months we can clearly observe the evolution of market investment preferences:

- Early preference: high valuation + low circulation model (VC-dominated, short-term speculation)

- Medium-term fanaticism: Full circulation Meme Coin model (zero threshold hype)

- Current Trend: The market is returning to focus on projects with strong fundamentals and sustainability

At the same time, the structure of the TGE model is undergoing three stages of evolution:

- Early model: low-valuation issuance + market value discovery mechanism (narratively driven)

- Medium-term model: high valuation issuance + insider arbitrage (selled through OTC or after release)

- Current status: Return to the low-valuation opening (lack of buying, no one is willing to "take over")

The most intuitive reflection of this market status is that we have seen the Binance Wallet IDO project launch undervalued. The project party must exchange a very low valuation and release ratio for a little market attention. And behind this is an important logic:

TGE's valuation is not a reflection of the "future value of the project", but a current comprehensive mapping of market liquidity, expectations, narrative intensity and market making system.

2. The traffic effect of Binance Wallet IDO is still strong, but rhythm control becomes the key

Judging from the data, Binance Wallet IDO has brought obvious market attention and brand exposure to the project:

- The average number of participants was 80,965;

- The single fundraising is 60,000 – 443,000 BNB;

- The oversubscription rate is between 6,900% – 36,500%.

Among them, KiloEx even reached a super-recruitment rate of 36,492%.

Binance Wallet IDO can easily leverage the attention of 100,000 users, and even when the market is generally cold, it can still attract inflows of tens of millions of dollars of assets of equivalent value.

Although the user's participation threshold has been increased with the optimization of the mechanism, it can effectively screen out high-quality users with more long-term value and stickiness, bringing a healthier user structure and community foundation to the project party, and helping subsequent community operations and user conversion.

With the support of Binance Wallet's light-touch mechanism, the project party can still obtain strong cold start momentum, greatly reducing user acquisition paths and cold start costs.

3. The TGE model is being deleveraged, and Wallet IDO projects are generally undervalued and started

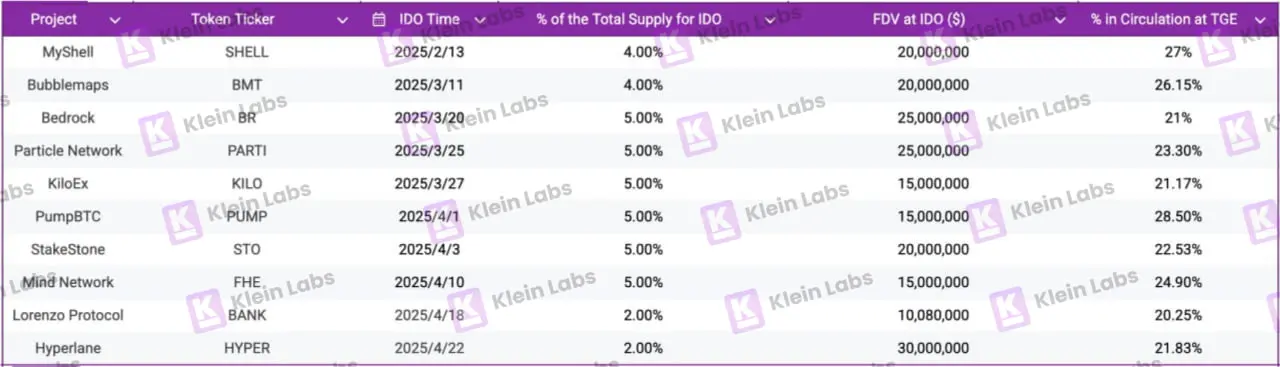

Through the analysis of the data, we found that the Binance Wallet IDO project has very obvious commonalities in token economy:

- The proportion of token releases in the IDO stage is generally low, with a range of only 2% to 5% of the total supply, an average of 4.44%;

- The circulation ratio during the initial issuance (TGE) phase is usually between 20% and 30%, ensuring that initial market liquidity is not overly diluted;

- The full dilution valuation (FDV) corresponding to the IDO phase ranges from $10 million to $30 million. Overall, it is a relatively reasonable or even slightly lower valuation range.

The project party is still willing to perform TGE through Binance Wallet IDO at this stage, and there are some considerations:

- The product has been formed and needs to issue tokens to access usage scenarios/incentive systems/settlement systems;

- It is necessary to obtain community attention and transaction support in a low-cost way, which is equivalent to a large-scale market launch to form a starting point for liquidity;

- Adhere to the long-term concept and accept low valuation, low release, and slow-paced growth.

The Binance Wallet IDO project at the current stage has to accept the low valuation pressure brought about by the decline in market confidence. But at the same time, it can reserve more room for market value to increase for excellent project parties.

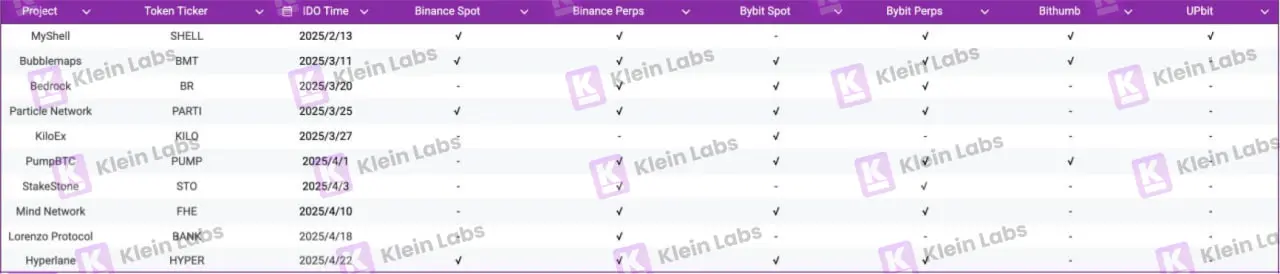

4. Exchange performance: Binance Wallet IDO is an entry ticket to Binance, not a terminal

In the imagination of many teams, Wallet IDO means "Login Binance". However, the reality is far from that:

- Binance's spot online rate is 40% (SHELL, BMT, PARTI, HYPER);

- About 90% of projects landed on the Binance Futures market;

- Bybit spot online 70%; contract online 80%;

- The current online rate of the Korean exchange is not high and is relatively non-standard.

Binance Wallet IDO does not mean Binance is listed. Binance Wallet IDO provides more like a trial operation ticket to enter the Binance traffic ecosystem. Whether it can be "turned into the spot market" depends on the data performance after the project is launched, user feedback and internal evaluation of the Binance trading team. The project party must regard it as a "rehearsal before the main stage" and make full preparations for subsequent listing and secondary liquidity support.

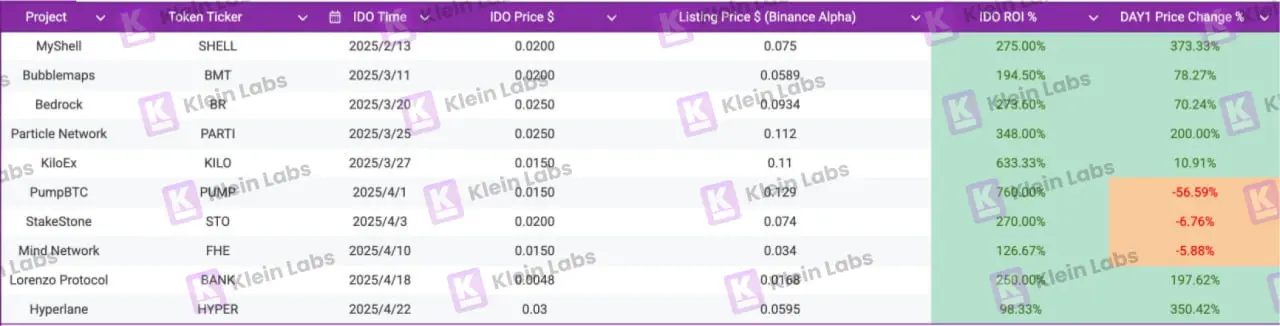

5. Price trend: a strong start, long-term performance depends on operations and market strategy

Judging from the current data, most Binance Wallet IDO projects performed well on the first day of their launch, and the return on investment (ROI) was generally impressive:

- PumpBTC rose as much as 760% on the first day, and KiloEx's return performance was also eye-catching.

- Although the price fluctuates greatly on the first day, the project's medium- and long-term performance depends more on continuous operational capabilities, market management strategies and clear long-term development plans.

- It is worth noting that some projects (such as MyShell, Bubblemaps, PumpBTC) chose to actively expand the Korean market after IDO to promote subsequent growth.

Although the Binance Wallet IDO project is often very popular in the early stages, if the project party lacks long-term planning, it will be difficult to withstand multiple challenges in the current market environment - including weak buying, investors' attitude towards short-term circulation trading no longer chasing highs, as well as insufficient support for medium and long term fundamentals, and early overdraft of narrative value. Against this background, the market performance of different projects gradually showed obvious differentiation.

Although short-term popularity is easy to obtain, what really determines whether the project can go long-term is still continuous operational capabilities and market management strategies. Project parties need to plan the control rhythm of the secondary market in advance and investor relations management to avoid rapid price declines and achieve steady release of long-term value.

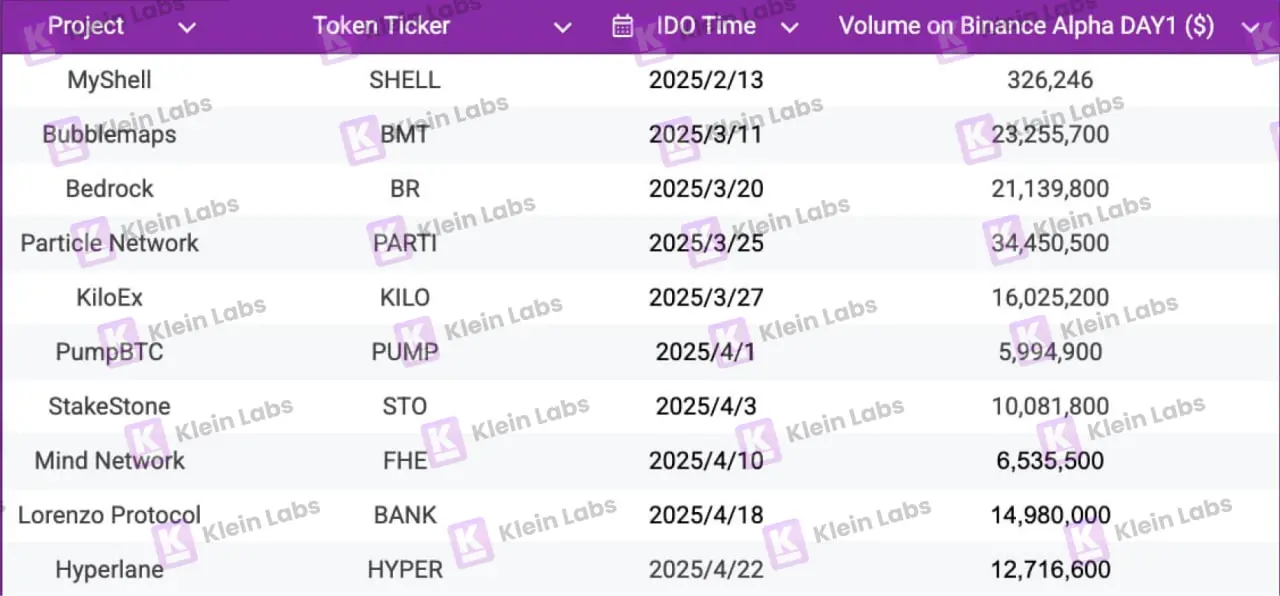

6. Trading popularity performance: the true reflection of market attention and capital momentum

The market performance of the Binance Wallet IDO project varies from project to project, but the overall transaction popularity is generally high:

PARTI, BMT and BR are outstanding, with first-day trading volumes exceeding $20 million

The emergence of high transaction volume is not only related to the initial traffic, but also closely related to the project's narrative intensity, token economic design, and market expectations management;

IDO is just the "ignition point" of popularity, and whether it can maintain its popularity and ignite the secondary market depends on the execution ability and operation rhythm control of the entire project. Many underperforming projects are quickly silent after TGE, either maintaining topic popularity due to lack of continuity content output, or a rapid decline in confidence due to market management out of control.

Summary: Binance Wallet IDO is a "value filter" and also a narrative verification

Binance Wallet IDO is a structured, highly leveraged cold start method for the current Web3 project to start narrative, build consensus, and amplify attention. It gives project parties a set of "starting scripts" that leverages large volumes through small costs, but it also puts high requirements on the team's execution ability, operation planning and market management capabilities.

The data performance of Binance Wallet IDO reflects the profound evolution of the entire market valuation logic and issuance model. It is not the end point, nor is it a pass, but a window that can verify the product vision and trial and error market mechanism at low cost.

It is precisely because the market is currently in the late stage of low confidence + low liquidity + high vigilance that projects that are truly willing to build for a long time are needed to showcase their product value, narrative rhythm and operational capabilities with the help of Binance Wallet IDO.

It's not for everyone, but for thoseTeams with clear stories, clear rhythms, and long-term construction intentionsIn other words, it is an important springboard to enter the Binance ecosystem and mainstream market perspective. During the window period when the bubble bursts, the market returns to its origins of value. This is a benign signal for teams who really want to do things and have a long-term vision.

Just like all platform IDOs, how can the feast continue after a brief joy? This is also a question that Binance Wallet needs to think about. Simply put, if Binance Wallet IDO can continue to be the preferred launch platform for quality assets, its life cycle can be extended as much as possible. And behind this is the understanding of "high-quality assets". What projects does the industry need? Which projects are suitable for development in this world? Each of us needs to think deeply.

No comments yet