Original title: "Synthetix has introduced another repair measure. Can sUSD be restored? 》

Original author: Azuma,

Synthetix's stablecoin sUSD has recently attracted much attention from the market due to its long-term dean.

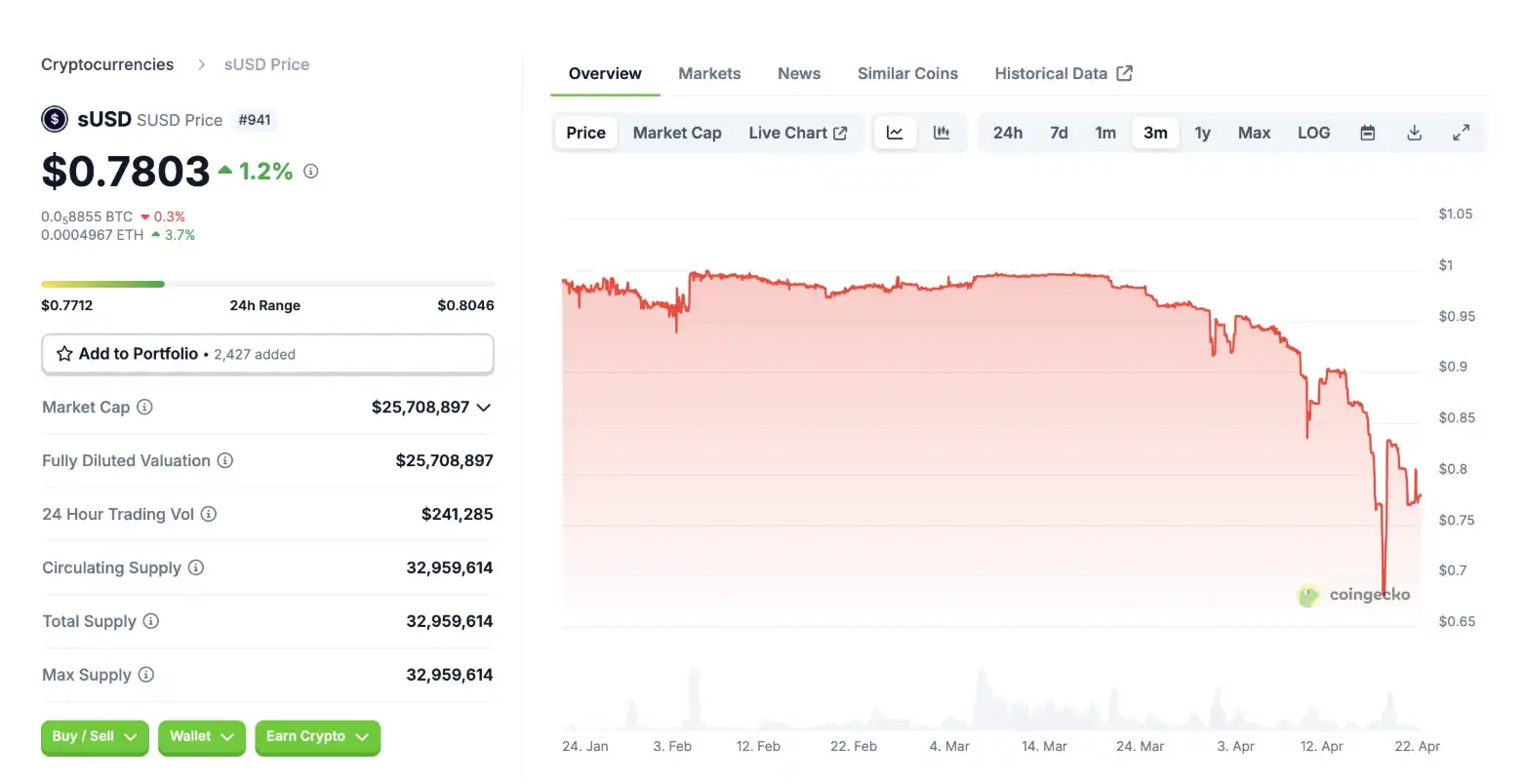

Since the initial signs of deaning were revealed on March 20, the sUSD's deaning range has continued to increase, falling below US$0.7 for a time, and as of the time of publication, it was temporarily reported at US$0.78. With Synthetix launching various fixes, sUSD seems to have shown some signs of stabilization at the low level, but whether it can be restored to the anchor is still a very complicated issue.

A brief analysis of the reasons for deaning

The deaning of sUSD needs to start with Synthetix's positioning transformation and protocol changes.

Synthetix's original positioning is the Synthetix (Synths) protocol, which allows users to mint synthetic assets that track the performance of different assets (such as BTC, ETH) through over-solidation. sUSD is the only synthetic asset that still has a wide range of utility today, because Synthetix has gradually abandoned the original synthetic asset model and turned to perpetual contract DEX.

Previously, Synthetix users had to mint SNX and mint sUSD at a mortgage rate of 750%—that is, mint 1 USD for every $7.5 SNX that can be minted. The casting mechanism of synthetic assets is similar to the lending market. The collateral will be locked, while synthetic assets will become loans that will generate debts. The debt of sUSD is denominated in US dollars, but the debt of synthetic assets such as Bitcoin is denominated in Bitcoin and fluctuates with the price of the token. SNX stakers need to bear the corresponding proportion of global debt in the system, which requires Synthetix to design complex hedging strategies to avoid the risks brought by price fluctuations. This hedging demand, extremely high mortgage rates and system complexity make SNX stakers have a lack of interest, so Synthetix recently launched a new model with the SIP-420 proposal.

In early 2025, SIP-420, aiming to simplify the sUSD casting process and improve the sUSD casting efficiency, was approved. SIP-420 introduced a shared debt pool mechanism, and plans to gradually shift the minting method of sUSD from the personal mortgage model to the collective fund pool model within 12 months. SNX pledgers no longer need to mint sUSD separately and assume personal debts, but can entrust funds to the public pool, thereby achieving a structure without liquidation and personal debts. Meanwhile, SIP-420 will also reduce the collateral rate of sUSD from 750% to 200% to significantly improve the system's capital efficiency.

However, with the exemption of personal debt, when the sUSD price deviates from the anchor value, the SNX pledgers no longer have the motivation to repurchase sUSD to repay debts at a low price (previously the individual pledgers could buy sUSD to repay debts at a discount to stabilize the price), and the original self-anchoring adjustment mechanism of the agreement failed. This is also the root cause of sUSD deanning.

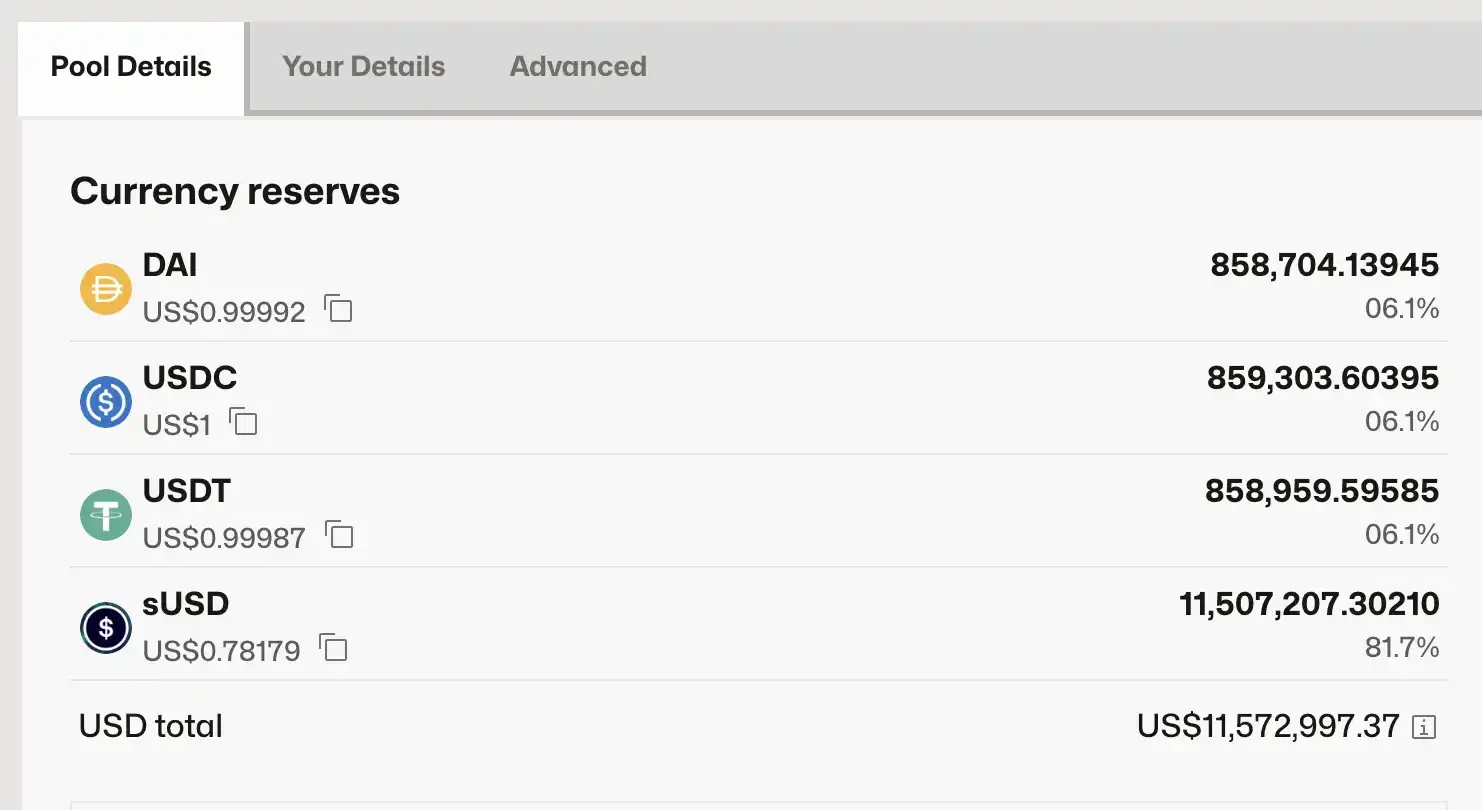

The reason why the deaning situation gradually intensifies is that sUSD liquidity is not as sufficient as imagined. Taking the largest pool on Curve (sUSD/USDC/DAI/USDT) as an example, the sUSD pool share accounts for about 81.7% of the total liquidity of about US$11.51 million - which means that the actual exit liquidity has been consumed heavily during the dean process.

Synthetix's response plan

On April 2, Synthetix founder Kain responded to sUSD’s deanstination for the first time. Kain mentioned that deaning is because the main driver of buying sUSD (debt management) has been eliminated and the new mechanism is in transition, thus a brief deaning occurs.

As mentioned earlier, SIP-420 hopes to achieve mechanism transition within 12 months, but it is obvious that the community cannot wait for 12 months with a deanchored stablecoin. To this end, Synthetix has recently introduced several additional measures to try to fix the price of sUSD. The common keyword of these measures is "incentive".

The first measure is to provide incentives for the liquidity of sUSD. In terms of the latest incentive measures, the yield of sUSD/sUSDe LP on Convex has reached 49.18%;

The second measure is to provide incentives for sUSD deposit behavior through another project developed by the same team, Infinex, which lasts for six weeks and distributes 16,000 OP rewards to users with deposits of more than 1,000 sUSD per week;

The third measure is the latest plan, which allows users to pledge sUSD to 420 pools. After pledging, the position will be locked for one year, but 5 million SNX will be provided as an incentive.

Obviously, the above three measures are all to solve the problem of "insufficient sUSD purchase demand" mentioned by Kain. By providing additional incentives for some pan-locked behaviors, Synthetix hopes to stimulate sUSD's purchasing demand and limit the potential selling pressure of sUSD, thereby gradually pushing the back anchor of the stablecoin price.

Especially for the third measure with stricter requirements and greater incentives, Kain also posted a document yesterday to mention his expectations for this measure, and emphasized that the problem is completely solveable. The team will gradually solve the problem of deaning by optimizing the incentive mechanism.

It is worth mentioning that Kain also mentioned that if SNX stakers do not adopt the newly launched staking mechanism to help solve the problem of sUSD (SUSD) dean, they will be "stick" - or suggest that after multiple incentives, they will be put into pressure on users who are still not "cooperating with" the repair action through penalties.

Since Synthetix does not provide a user interface for sUSD staking, the staking operation still needs to be handled manually by the team, so it is not possible to know how many users will participate in sUSD staking under incentives, which will greatly affect the repair effect of sUSD.

Judging from the current situation, it is difficult to determine whether Synthetix can stabilize the situation. Although there are some bottom-buying voices on the market, I personally do not recommend "take the money from the fire". If you can't help but the temptation of discounts, you need to pay close attention to SNX's price performance - to prevent the death spiral of "price drop, insufficient mortgage, intensified discounts, panic selling".

Alternative arbitrage opportunities

Compared to betting back to anchor, there seems to be another arbitrage opportunity in the market - forecasting the market.

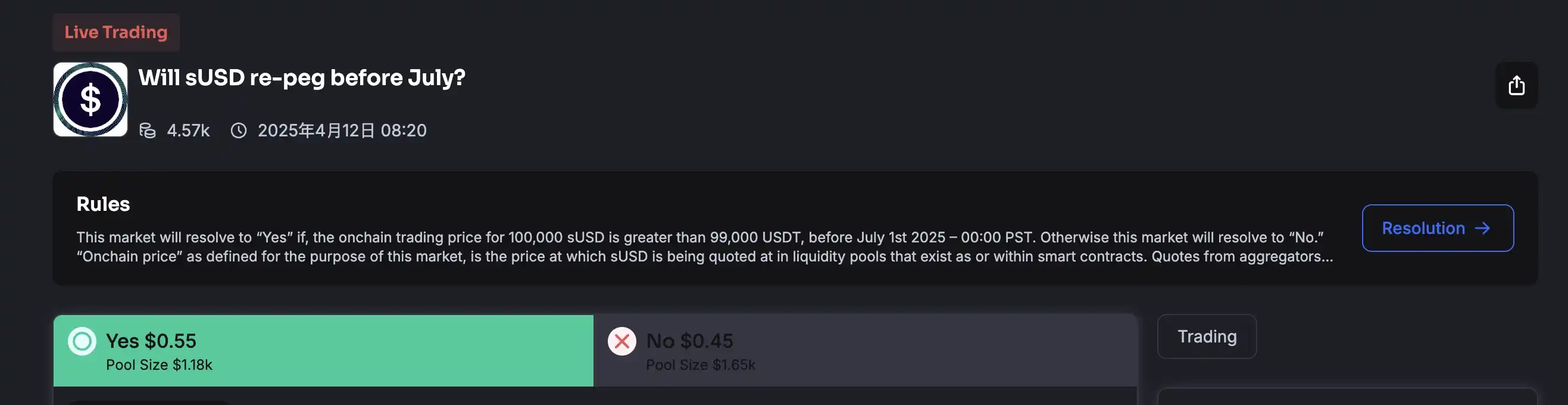

Forecast Market Truemarket has launched a forecast pool on whether sUSD can anchor back by July, with the current Yes share quoted at $0.55 and the No share quoted at $0.45.

Since sUSD is currently quoted at $0.78, the price per unit of sUSD will be repaired to $1 after anchoring, and the Yes share per unit can also change from $0.55 to $1. The existence of this spread provides a certain amount of arbitrage space.

However, the depth of the prediction pool above Truemarket is relatively small and cannot undertake large-scale transactions, so the actual operation space of this strategy is not large. It is recommended to pay attention to whether other more mainstream prediction markets such as Polymarket will open similar prediction pools and look for potential arbitrage opportunities.

No comments yet