Long-term holders are selling $260 million worth of #XRP daily: Details. 🧵🧵🧵

A recent report from Glassnode indicates that long-term holders are increasing profit-taking, which is one of the factors putting pressure on XRP's price.

Despite recent positive macroeconomic factors such as the Federal Reserve's 25 basis point rate cut, confirmation that quantitative tightening will end in December, and easing US-China trade tensions, the cryptocurrency market has remained sluggish in recent days.

Even so, the total market capitalization of the cryptocurrency market has still evaporated by $170 billion in the past four days, falling below the $4 trillion mark. While XRP has also been affected by the overall market crash, it appears to be more resilient than most cryptocurrencies, rising more than 1% in the past 24 hours.

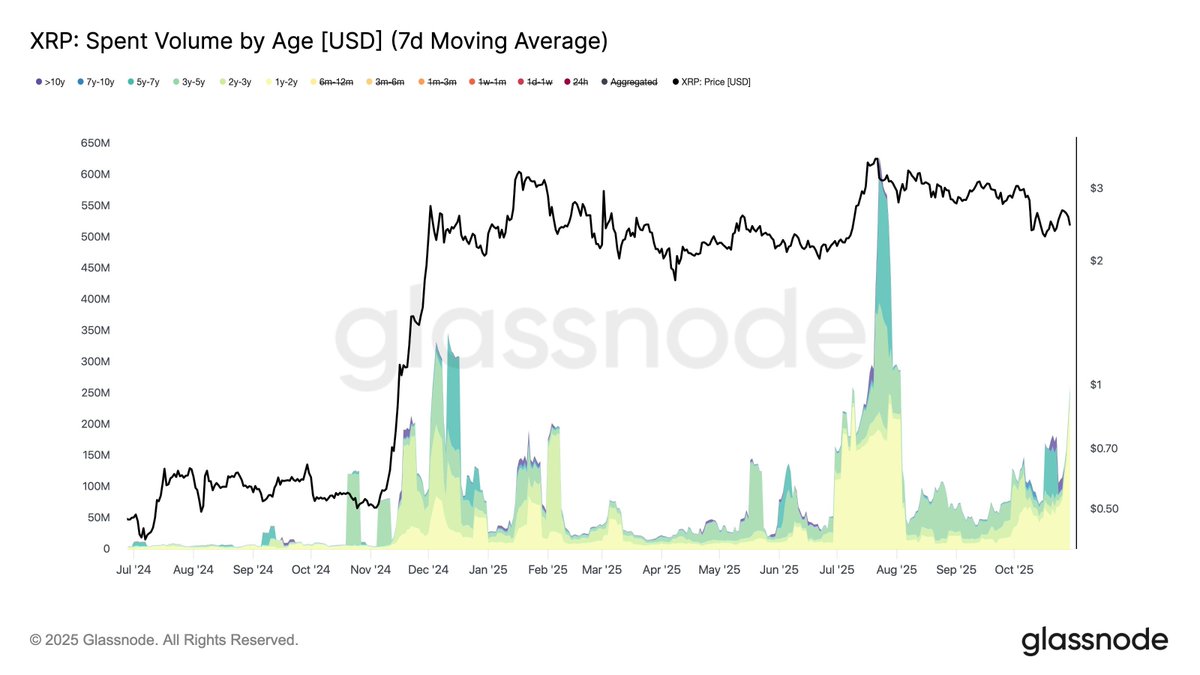

Glassnode recently confirmed that profit-taking by long-term holders has exacerbated the price pressure on XRP due to its current low price. According to the market analysis platform, long-term holders who bought XRP before its November 2024 breakout have been accelerating their profit-taking since August 2025.

For reference, prior to November 2024, XRP's price briefly fell below $1 due to the collapse of the Terra ecosystem in May 2022. For over two years afterward, the altcoin's price mostly fluctuated between $0.4 and $0.6, occasionally reaching $0.8 and periodically dipping to $0.3.

Interestingly, during this period, while others abandoned XRP, some investors took advantage of the price drops to buy more tokens at lower prices. After XRP's price surged 281% in November 2024, approaching $2, these long-term holders who bought before the breakout now reap huge profits.

Currently, some investors have begun taking profits, especially given that XRP's price has been hovering around $2 for an extended period. According to Glassnode data, these investors are selling an average of $36 million worth of XRP daily.

However, XRP plummeted from its high of $3.66 in mid-July, and attempts to rebound in early August failed. Since then, long-term holders have significantly increased profit-taking, by approximately 580%, with daily sales surging from $36 million to approximately $260 million.

The attached chart confirms this. Notably, profit-taking surged during the rally from November 2024 to January 2025, but subsequently subsided between February and July. However, following the July rally and pullback, profit-taking surged to over $500 million daily in early August before settling back to the current $260 million.

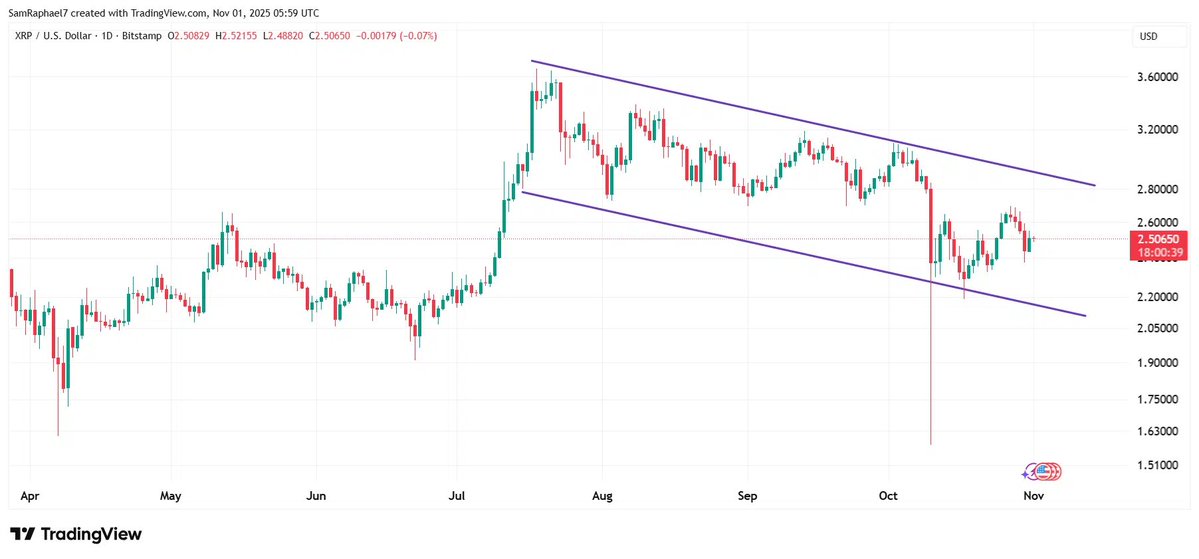

The impact on XRP's price is evident. Specifically, since the July crash, XRP's price has continued to decline, forming a descending channel on the daily chart. It's worth noting that if profit-taking decreases while whales increase their buying activity, XRP may experience a much-needed rebound, breaking through the current channel.