The United States is not managing debt; it is creating it.

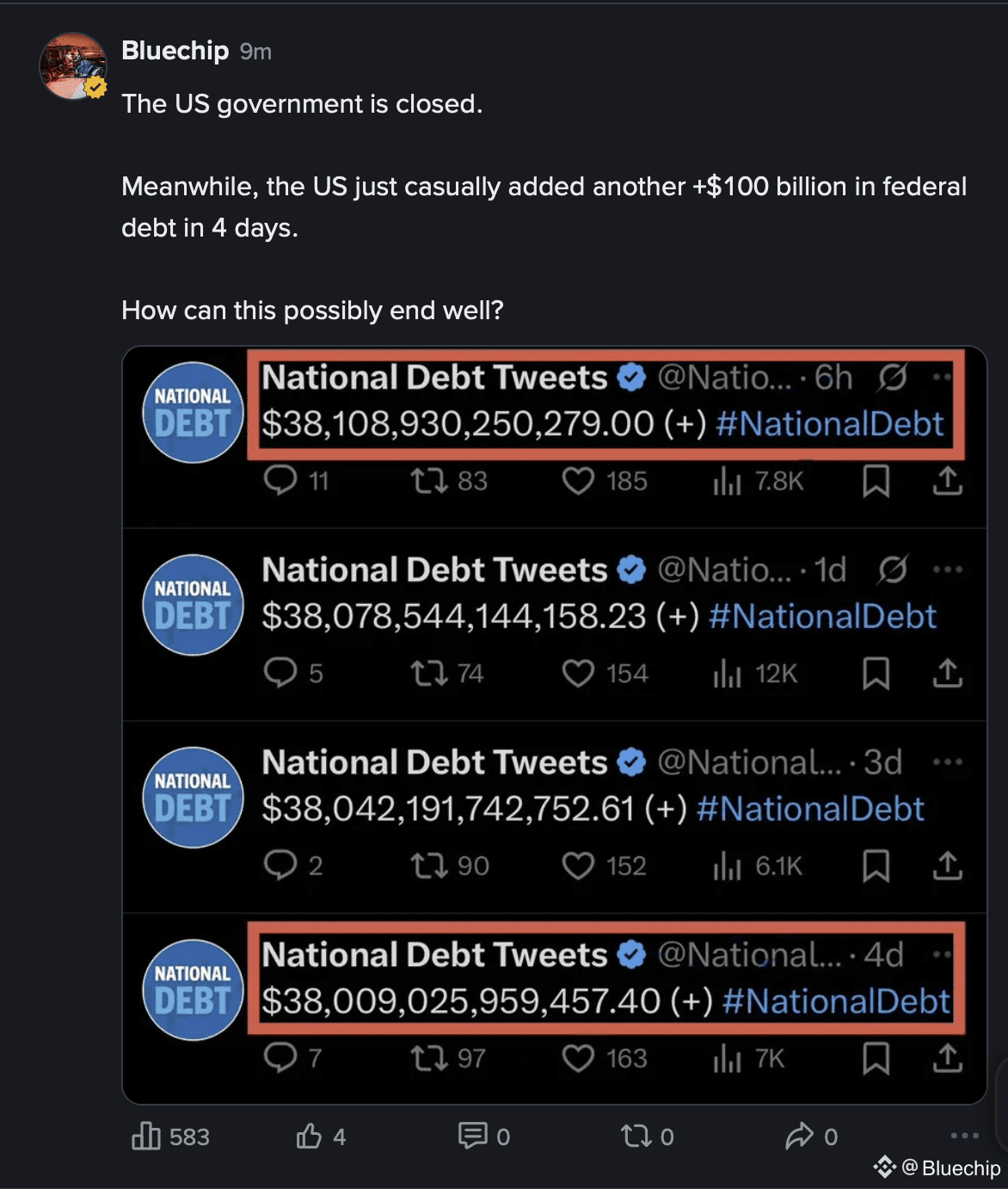

In just four days, the US national debt increased by over $100 billion, equivalent to $1 billion per hour. The government shut down, but borrowing never stopped. This is the hidden mechanism of imperial decline… debt is monetized into illusion, and illusion is weaponized into currency. The strength of the dollar no longer stems from productivity or trust, but from inertia. Today, every expansion requires more debt in exchange for less growth. When a system cannot stop borrowing, it no longer funds prosperity, but survival.

The emergence of Bitcoin is the antidote to this systemic decay because it operates outside the debt mechanism. Unlike the dollar, Bitcoin cannot be printed, inflated, or politically exploited. Its fixed supply of 21 million enforces a discipline that the fiat currency system abandoned decades ago.

In a world where debt is money and money is illusion, Bitcoin represents mathematical truth, a form of value independent of government promises or central bank credibility. As global confidence weakens and the dollar's momentum diminishes, Bitcoin offers individuals and nations a parallel exit strategy—a transparent, deflationary standard applicable to this debt-ridden era.