If you want to make big money with cryptocurrency in the next six months,

you absolutely can't miss these 10 topics.

Altcoins aren't dead—the opportunities have just shifted.

You just need to know where to look.

🧵: Top 10 Hottest Topics in the Crypto World Right Now. 👇

How to Use This Post:

Each tweet is quite long, so I recommend reading the entire post and bookmarking the tweets/sections that interest you most for in-depth study.

In each tweet, I will explain:

• My views

• The altcoins I'm researching

• Tools to help you delve deeper

If you want to gain an edge, choose 2-3 topics to study in depth.

1. Artificial Intelligence/Intelligent Agents

If you've followed me for a while, you'll know I've always placed great importance on the potential of artificial intelligence in the cryptocurrency space.

Earlier this year, we saw some promising use cases, but they haven't really materialized yet. I believe this is about to change.

A particularly compelling subfield within artificial intelligence is AI agents.

The AI agent space experienced rapid growth earlier this year and is showing strong momentum again.

This time, the catalyst is x402.

Essentially, x402 is like adding a wallet to the internet. It's a new web standard that allows websites to say, "Hey, pay me a small fee before I give you my data."

x402 transforms old, unused code into a powerful tool:

allowing websites, applications, or APIs to receive payments instantly, without accounts, subscriptions, or intermediaries.

(Explanation by @SuhailKakar)

This new use case is just one example of how AI agents are achieving a perfect product-market fit; they have many other practical use cases in personal finance management (PFM) (such as trading, automated research, etc.).

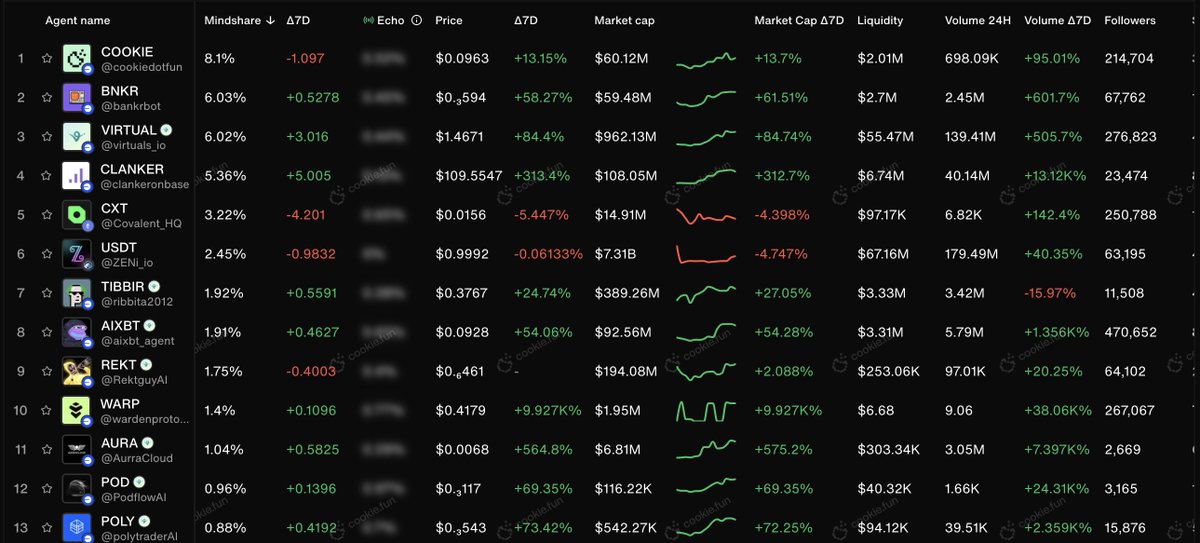

One of the best resources for tracking the entire AI agent space is @cookiedotfun—they have a dedicated AI agent tracking dashboard to ensure you don't miss any hot investment opportunities.

I particularly follow some projects in the AI agent space: @HeyAnonai, @cookiedotfun, and some lower-market-cap virtual technology companies. This is still an emerging field. So there's much more to come.

In the broader field of artificial intelligence, I'm watching the following major cryptocurrencies: $ATH, $TAO (and Eco), and $WLD.

(I will continuously add new low-market-cap cryptocurrencies and conduct research, so be sure to follow my account @milesdeutscher to stay updated.)

2. Robotics

Another hot subfield of artificial intelligence—robotics.

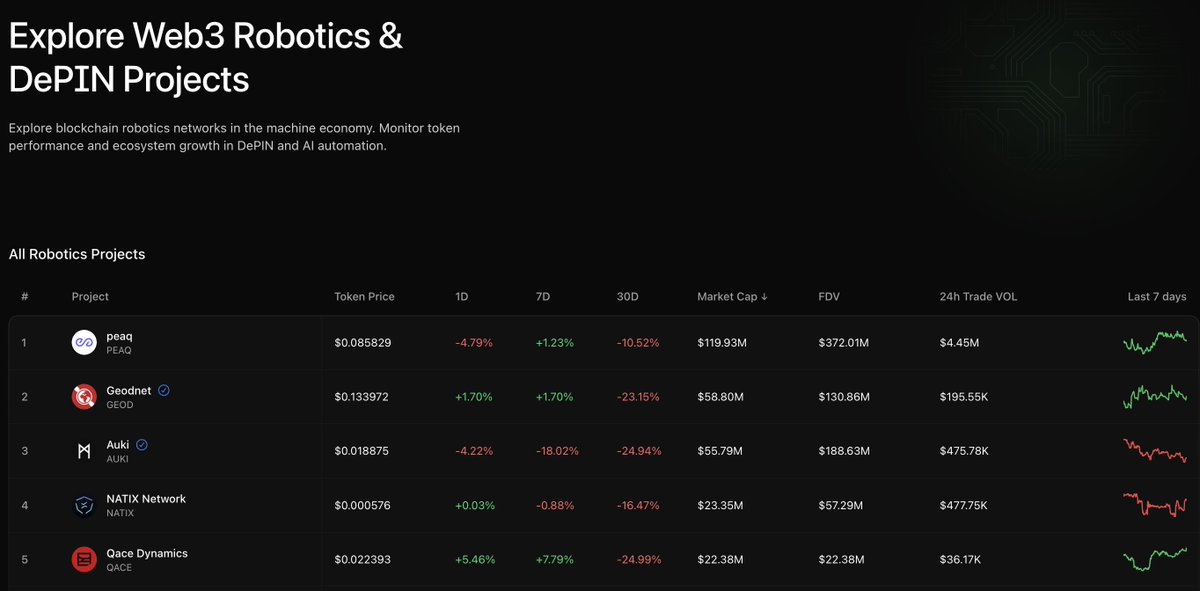

Web2 is investing billions of dollars in this field, but the total market capitalization of cryptocurrencies is less than $400 million.

The reason for being bullish on robotics is simple: as Web2 technologies are widely adopted in the real world, Web3 is likely to become one of the best verticals for speculating on the future development of robotics.

This is a relatively new field, so I advise against investing too much risk in it.

To better understand the development of robotics, @edgenetwork provides an excellent tool called Robotscan, which is like a deeper version of CoinGecko, covering the entire history of robotics development.

Instead of directly telling you which specific alternatives exist in this space, I suggest you visit their websites to see which bot protocols align with your personal philosophy.

3. Prediction Markets

Prediction markets have a very compelling bullish outlook:

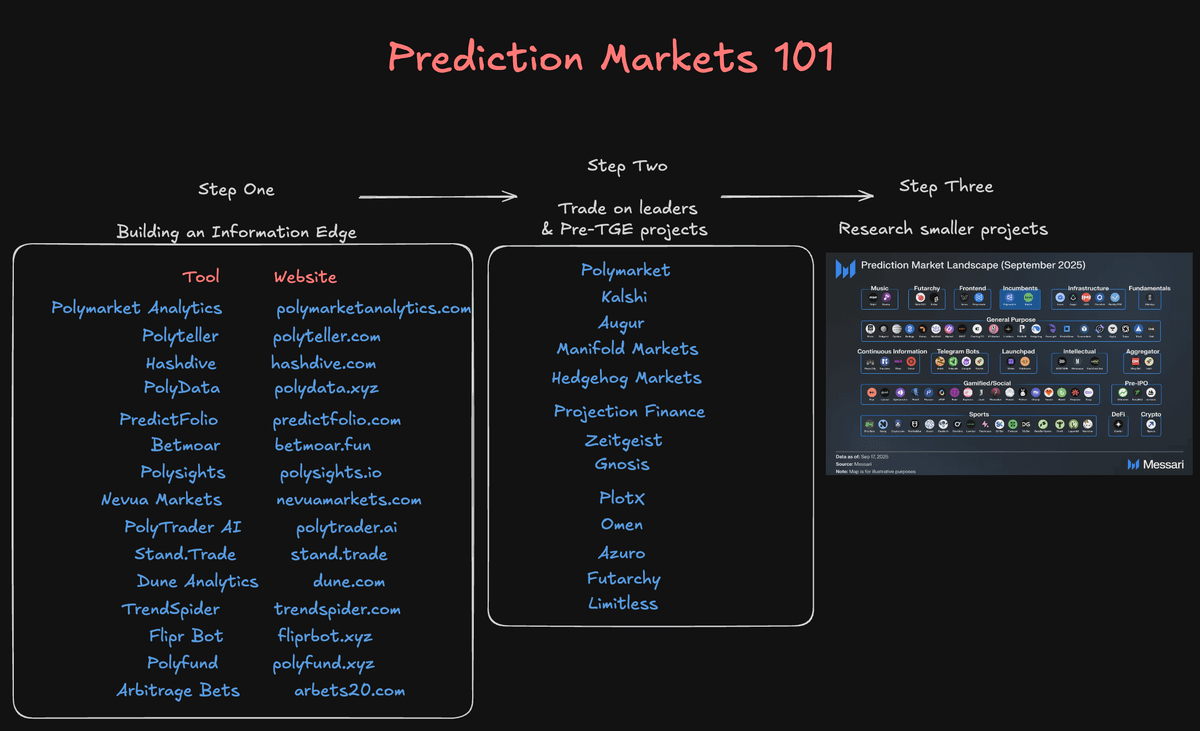

It's one of the few markets where ordinary people can truly gain an informational advantage.

It's also in a very early stage of development, with a large number of TGE (pre-total token) projects, making it a great opportunity to capture potential airdrops.

In this space, I primarily focus on the leaders: @Polymarket and @Kalshi (Polymarket's token is confirmed), but that doesn't mean I ignore smaller platforms/protocols.

Here's my guide to getting started in prediction markets (tools + how to build a real advantage in prediction market trading):

4. Privacy

a16z just published an excellent article on the strong demand for robust privacy protocols in the cryptocurrency space.

With the increasing adoption of Web3, the need for privacy protection is growing.

In this space, $ZEC is performing very strongly and is one of the cryptocurrencies I'm currently actively trading. Of course, there are many other options.

I recommend using @CoinMarketCap to gain a deeper understanding of this sector. It's the only tool (besides CoinGecko) with a dedicated privacy list.

5. Profit Protocols

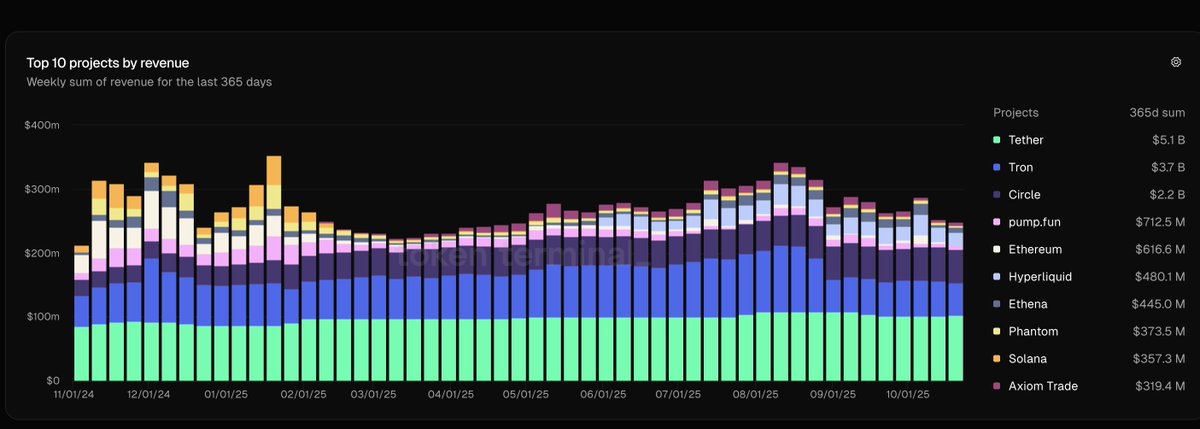

I believe that as we enter the final stages of this cycle, it's best to focus on projects that are truly generating revenue.

This time last year, the market was obsessed with memes. Now, it's the opposite.

This is the cycle of money flow. Projects that leverage revenue to create positive token flows through buyback/burn flywheel mechanisms will ultimately be the biggest winners.

You can track revenue and earnings using @DefiLlama, @Dune, and @tokenterminal, tools I frequently use to check project revenue status.

Excellent projects in this space include $HYPE, $PUMP, and $ENA.

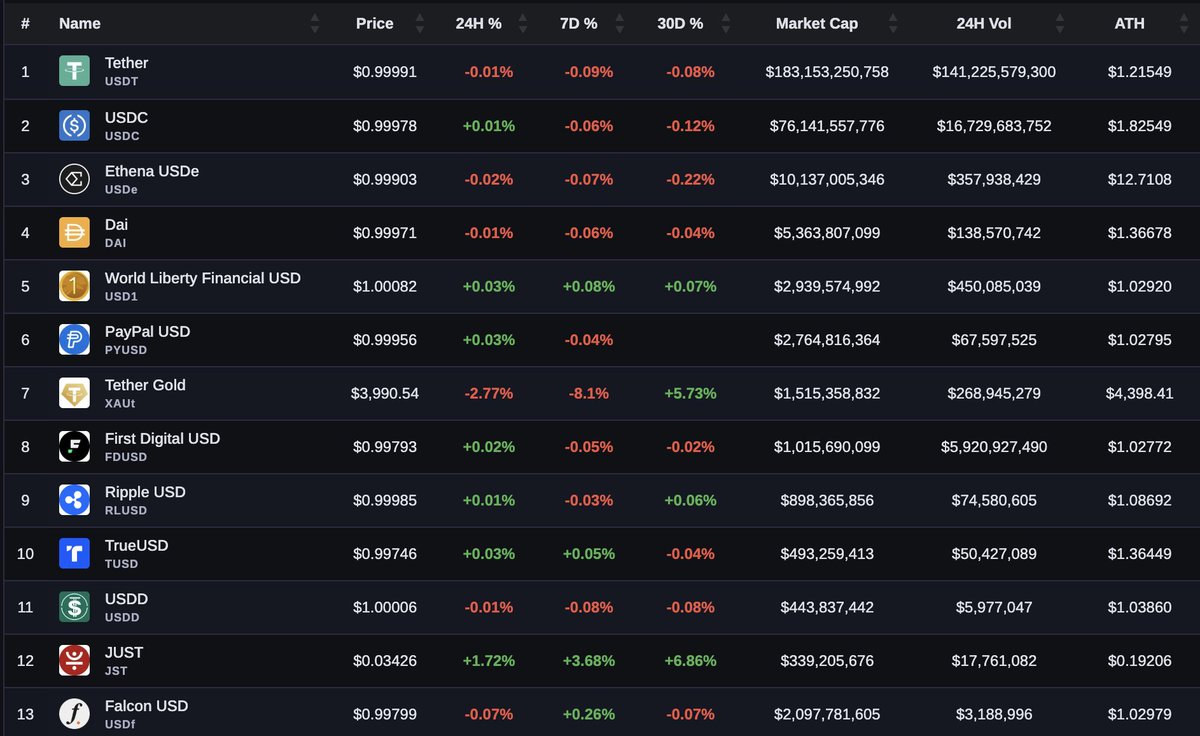

6. Stablecoins

Stablecoins achieve the best product-market fit in the cryptocurrency space.

Therefore, it would be a serious oversight if this sector wasn't included on my list.

Capturing upward opportunities in this sector is not easy.Because stablecoins trade very differently from other cryptocurrencies.

I recommend focusing on excellent projects/chains dedicated to building the future of stablecoins and considering trading their native tokens.

@CryptoSlate is a great resource for filtering top stablecoins and related projects.

Pro tip: You can also look for high-yield stablecoin investment opportunities to profit in this space and make the most of your idle stablecoins.

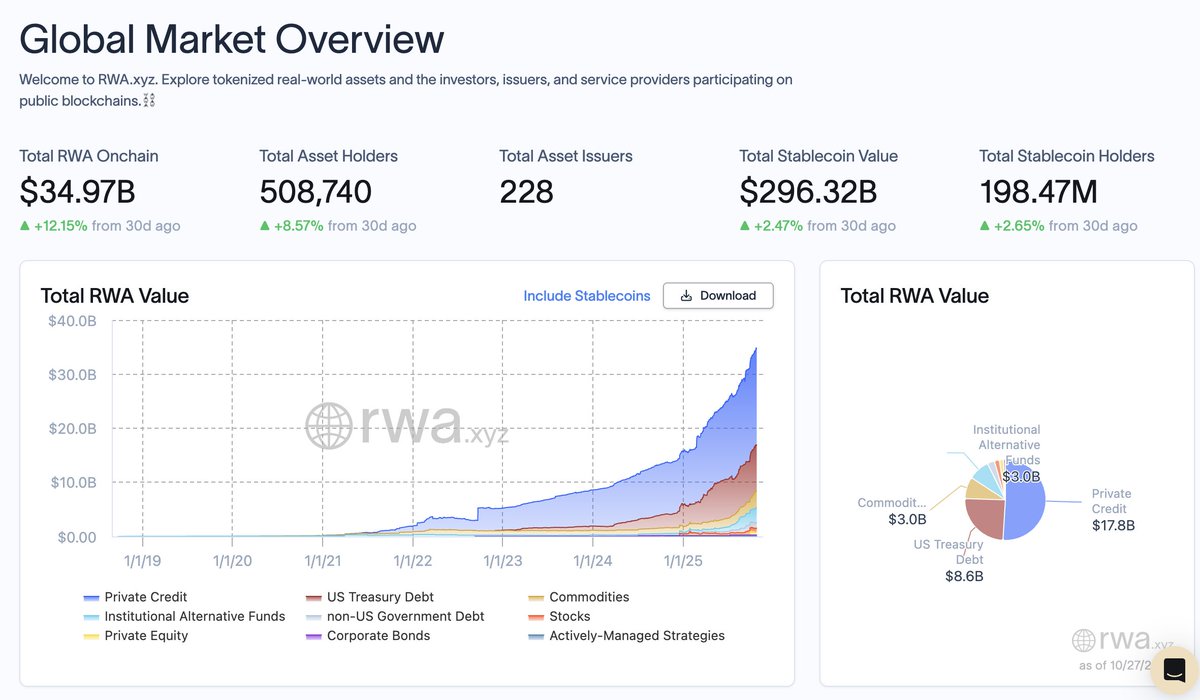

7. RWA/Tokenization

Similar to the AI agent space, RWA also experienced a strong surge earlier this year. I believe that when it rises again, the price could rebound significantly from its lows.

Given the current strong demand for On-Chain Real Assets (RWA), I would definitely not overlook this space.

One of my favorite research tools is @RWA_xyz.

They have a fantastic dashboard for tracking private credit markets, commodities, and many other areas.

Some projects I like that are shaping the future direction of RWA: @maplefinance, @ChintaiNetwork, @ClearpoolFin, @pendle_fi, and @multiplifi.

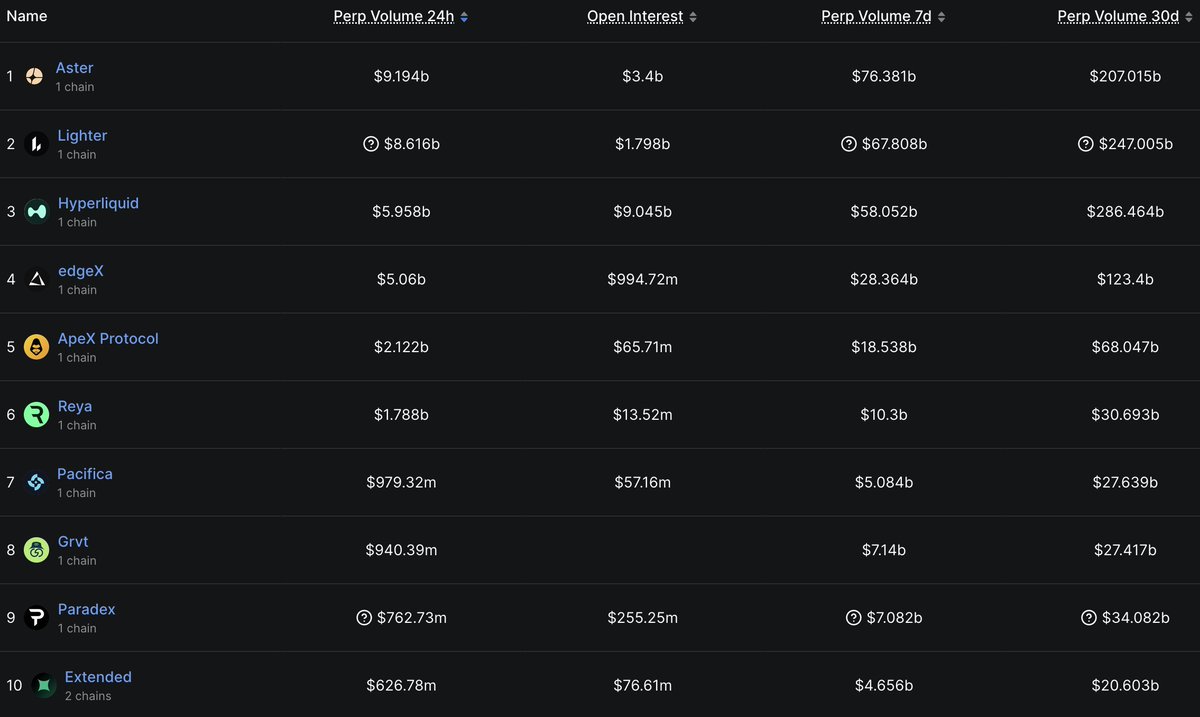

8. Perpetual Decentralized Exchanges (Perp DEX)

While this space may seem a bit saturated, I still believe there are opportunities.

My bullish rationale stems primarily from the large number of protocols still conducting massive S1/S2 airdrops.

On the other hand, you need to be more careful than ever in choosing the specific protocols you want to trade and/or actively mine.

@DefiLlama provides a very convenient dashboard for scanning for opportunities on top Perpetual Decentralized Exchanges (Perp DEXs). You can also use their "Airdrop" tab to scan for tokenless protocols.

9. Digital Asset Tokens (DAT)

This is one of the areas I rarely see discussed.

Digital asset tokens.

Essentially, these are tokens acquired by large companies and added to their asset treasuries.

I think there are still many asymmetries here. Several very clever protocols are leveraging DAT to their advantage (for example, $ATH has an interesting operating model that I think is worth investigating).

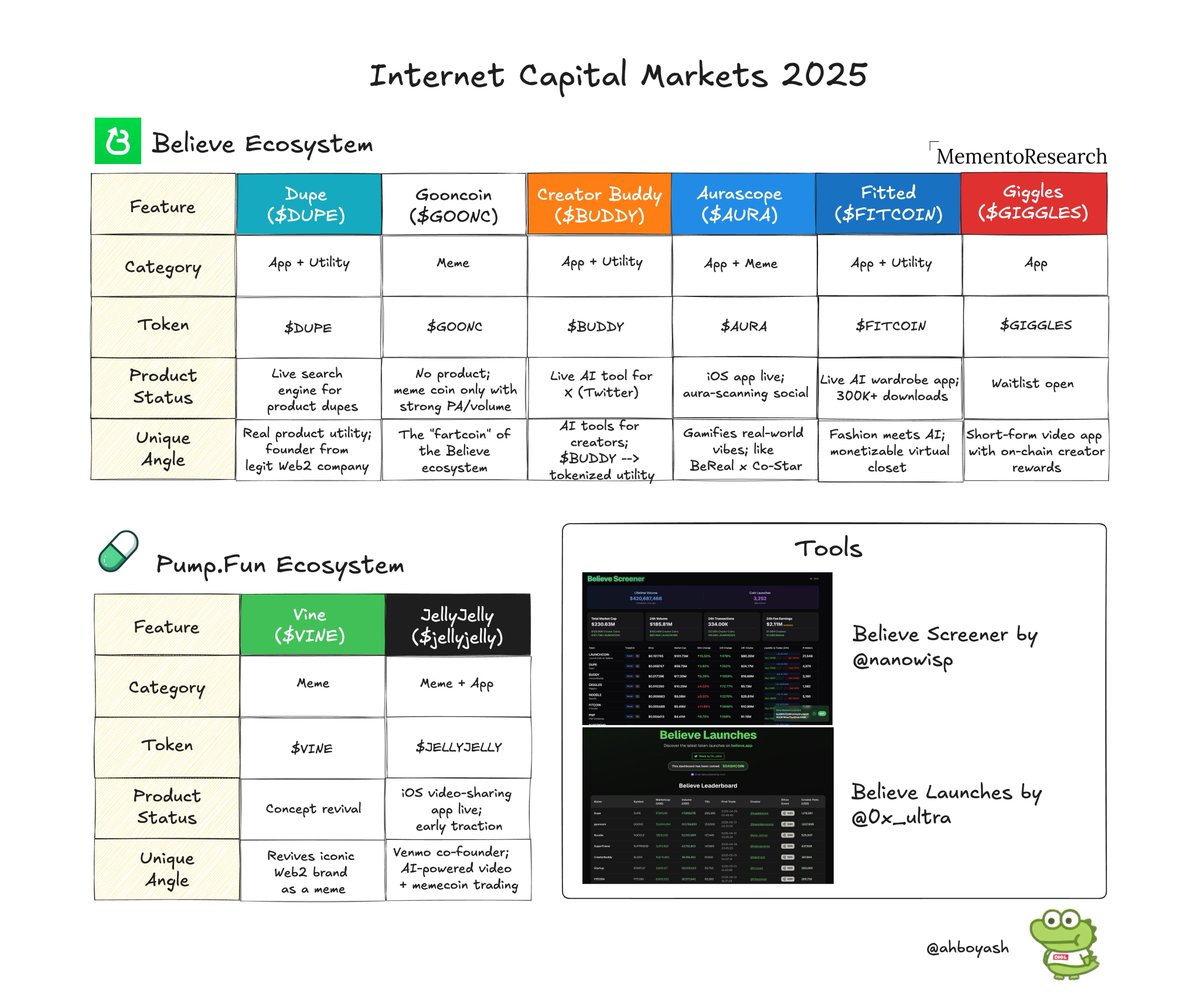

10. ICM

Finally, I decided to include Internet Capital Markets (ICM) on this list because I still believe it has some room for growth.

@ahboyash created a fantastic infographic showing how to capitalize on this trend.

Recommended tools: Believe Screener and Believe Launches.

The chart also lists some potential altcoins worth watching right now.

But beyond existing altcoins, I think the key is to closely monitor companies launching on blockchain platforms.

Many startups choose Web3 because it helps them raise funds and enter the market faster.