October 24, 2025

Hello everyone, a work report:

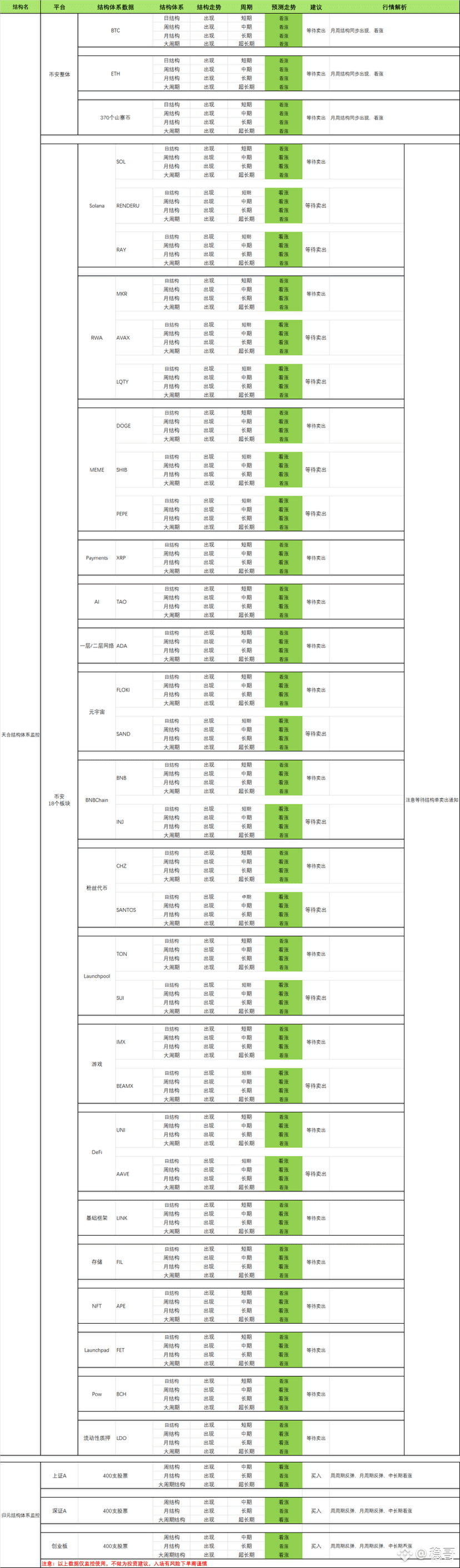

Currently, Tianhe monitoring status is as follows:

Spot Signals:

Monthly structure appears, bullish, consensus sentiment is 55

Greater than 50—monthly structure appears.

Weekly structure appears, bullish, consensus sentiment is 56

Greater than 50—weekly structure appears.

Daily structure appears, bullish, consensus sentiment is 60

Greater than 50—daily structure bullish.

Shorts still dominate the short-term trend, and bulls are continuing their initial counterattack. Within the larger cyclical uptrend, bullish momentum will gradually increase, but the initial phase will not be smooth. Hold on to your positions and ignore all shorts. Wait for takeoff. Wait for Tianhe's sell notification.

Based on Tianhe's structure system, a rally is expected in November, and Tianhe's structured orders will be shipped out in batches as opportunities arise!

Waiting is the safest trading method. No one wants to wait, because patiently waiting is against human nature. The capital market understands this well, and therefore repeatedly challenges human nature. Everything has its cycles, and patterns are inherent within these cycles. Chasing trends doesn't conform to these patterns, and will inevitably lead to a loss of wealth.

Patience is the cornerstone of all trading!

When the market pulls back within the structured trading range, buy the dip immediately.

========Attention‼ ️Bottom Pick, Bottom Pick, Bottom Pick ==========

Contract Signals:

BTC and ETH Contracts Waiting

Short Opportunities: Waiting

Long Opportunities: Waiting

========Attention‼ ️Fourth Group Begins ==========

The fourth group is scheduled to begin in November, with 10 participants. Students will learn the Tianhe structured trading system for 2-3 years. Only those who stay are truly committed to learning Tianhe.

At the same time, the fifth group training course will be suspended.

⚠️Attention! All orders issued are based on personal experience and are not intended as investment advice. Trading carries risks, so enter with caution.