Author:XBIT News

In the volatile world of cryptocurrencies, market shifts often trigger cascading effects. The recent Bitcoin crash once again highlights a fundamental fact: despite years of innovation and diversification efforts, the entire cryptocurrency market still closely follows Bitcoin's lead. Understanding this dynamic is crucial for investors navigating these fluctuations. This article will explore the impact of Bitcoin's dominance, its impact on altcoins, and strategies for building a more resilient portfolio amidst cryptocurrency market volatility.

The Causes of the Bitcoin Crash: What Triggered This Decline?

As the leading cryptocurrency, Bitcoin has experienced countless ups and downs since its inception. The recent Bitcoin crash, resulting in a significant decline in its value, reflects broader economic pressures and shifts in investor sentiment. Factors such as regulatory uncertainty, macroeconomic trends, and waning institutional enthusiasm exacerbated the decline. For example, Bitcoin's failure to maintain its reliable store of value as "digital gold" further amplified selling pressure.

Source: CoinMeta

This event is not isolated; it echoes similar patterns in previous cycles where external events such as interest rate hikes or geopolitical tensions amplified price declines. Particularly noteworthy is the rapid shift in sentiment, highlighting the fragility of cryptocurrency valuations. For those searching for insights into the Bitcoin price crash, identifying these triggers can help predict future volatility and make informed decisions.

Chain Reaction: How BTC Dominance Shapes the Entire Cryptocurrency Market

One of the most striking characteristics of the Bitcoin crash is its immediate impact on the entire cryptocurrency ecosystem. Historically, Bitcoin has accounted for a significant portion of the total cryptocurrency market capitalization—often exceeding 50%. This BTC dominance means that when Bitcoin stumbles, the entire market often follows suit, affecting everything from mainstream tokens to niche projects.

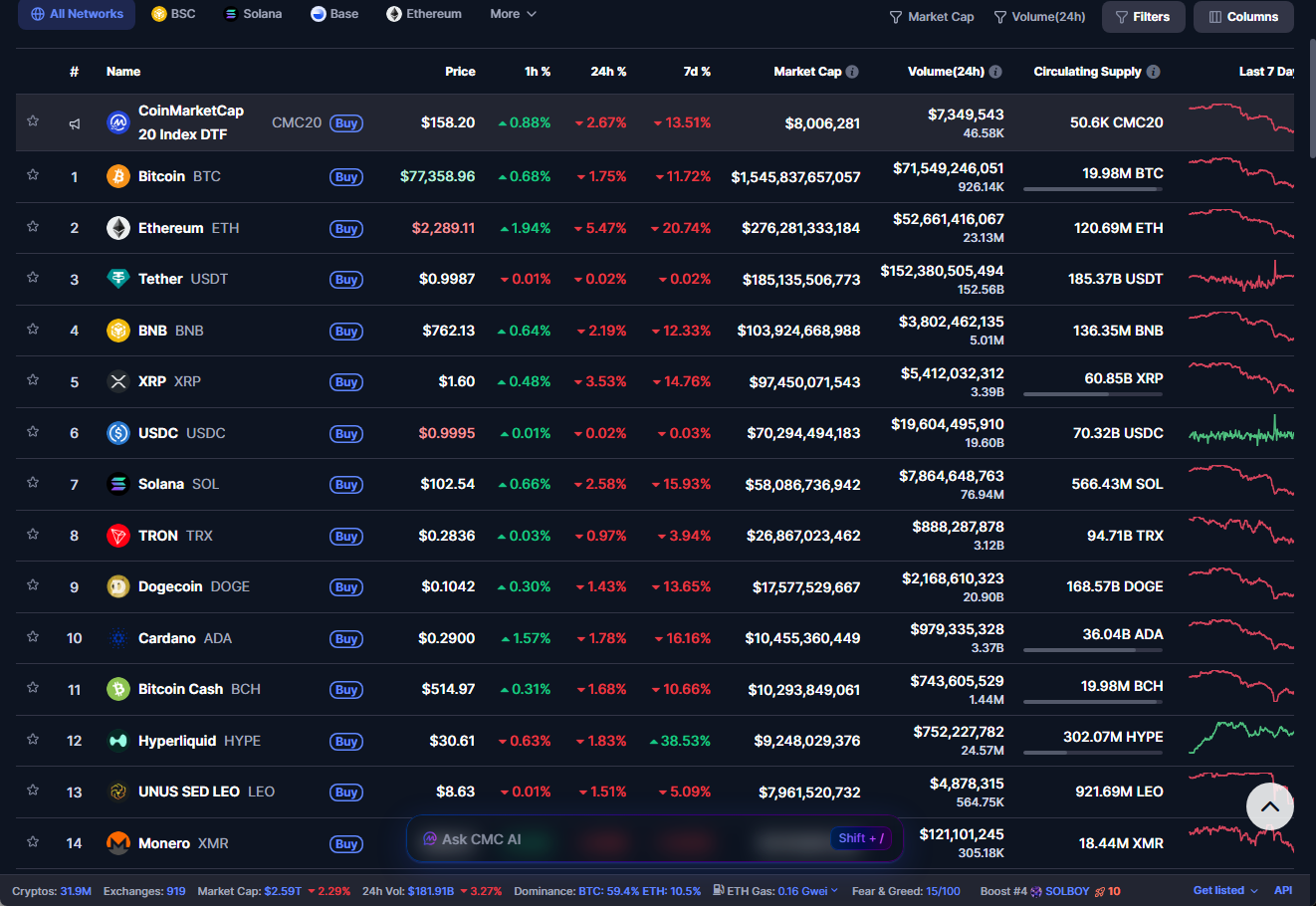

Recent market analysis data shows that various crypto sectors, including decentralized finance (DeFi) and smart contract platforms, have experienced parallel declines. For example, AAVE, the token of Aave, a leading Ethereum-based lending protocol, fell 22.4% in 30 days. Hyperliquid's HYPE, however, performed uniquely, rising 25% in a month even after its price fell from $34.80 to $30.60, largely thanks to the booming tokenized gold and silver trading. This lack of decoupling highlights a key challenge: true diversification in cryptocurrencies remains a distant dream. Investors hoping altcoins will provide a buffer against Bitcoin volatility are often disappointed because the correlation remains high. For those studying cryptocurrency market trends, this interdependence reminds us that Bitcoin's rhythm still dictates the dance of most digital assets.

Source: CoinMeta

The Altcoin Dilemma: Winners, Losers, and Defensive Strategies

While the Bitcoin crash dragged down many altcoins, not all suffered the same blow. Tokens associated with revenue-generating protocols such as lending and decentralized exchanges experienced sharp corrections. These assets, designed to offer utility beyond speculation, still mirrored Bitcoin's losses, raising questions about their role as independent investments.

On the other hand, some assets have shown relative resilience. For example, stablecoins have acted as safe havens during turbulent times, allowing traders to anchor their funds unaffected by price fluctuations. Furthermore, some blockchain-native tokens tied to highly utility networks have performed better, exhibiting "defensive" characteristics similar to stable sectors in traditional finance, such as TRX, which saw a 30-day drop of only 1.46%. This difference underscores the importance of prioritizing projects with real-world applications and strong fundamentals when building portfolios to weather cryptocurrency market volatility.

Source: CoinMarketCap

For those exploring altcoin performance during downturns, focusing on metrics like trading volume and user adoption can reveal hidden gems that weather the storm, rather than purely speculative plays.

Lessons from the Crash: Building Resilience in a BTC-Dominated World

The current Bitcoin crash offers valuable lessons for the crypto community. First, it underscores the importance of promoting sectors like DeFi as potential safe havens. In traditional markets, investors turn to bonds or utilities when stocks sell off; cryptocurrencies could benefit from a similar "defensive" category, fostering genuine diversification.

Furthermore, the rise of institutional instruments such as spot exchange-traded funds (ETFs) has inadvertently reinforced Bitcoin's central role. While these products bring legitimacy and capital, they also concentrate attention on BTC, potentially delaying the maturation of other ecosystems. To address this, industry leaders should advocate for broader adoption of utility-driven tokens and explore ways to reduce correlation through innovative financial products.

As the cryptocurrency market evolves, investors should adopt a multifaceted approach: diversifying across asset classes, paying attention to regulatory developments, and using risk management tools such as stop-loss orders. By doing so, they can mitigate the impact of future Bitcoin price crashes and seize opportunities in emerging sectors.

Looking Ahead: Can Cryptocurrencies Escape Bitcoin's Shadow?

In short, the recent Bitcoin crash painfully demonstrated that the cryptocurrency market's dependence on BTC remains, despite technological and adoption advancements. This reality calls for a strategic rethink—focusing on building strong, independent sectors that thrive regardless of Bitcoin's performance. For investors and enthusiasts, remaining vigilant about BTC dominance and altcoin performance will be key to long-term success. If you are dealing with cryptocurrency market volatility, consider consulting reliable resources or a financial advisor to tailor a strategy based on your risk tolerance. What are your thoughts on the impact on Bitcoin? Feel free to share in the comments section of the CoinWorld app and join the discussion.

No Comments