Author:BitEq

Foreword

Following last week's over 15% drop in Bitcoin's price, the cryptocurrency market failed to show signs of a "bottoming out and rebound" as expected. Instead, as trading began this Monday, overall market sentiment remained weak, and Bitcoin's price faced renewed downward pressure, continuing last week's decline. Yesterday, Bitcoin's price briefly fell below the important psychological level of $75,000, even reaching a low of $74,500!

Looking at a longer timeline, this round of Bitcoin's price decline can actually be traced back to mid-January of this year. At that time, the market had just entered the new year, and overall market sentiment was optimistic. After a period of relatively wide fluctuations, Bitcoin's price rose steadily, successfully reaching $97,000, setting a new high for the period. This was once seen as the starting point for the cryptocurrency market to return to a bull market cycle, and many crypto investors quickly increased their expectations for a "full recovery."

However, as of this writing, less than two weeks after that high, Bitcoin's price has already fallen back to its lowest level since April 2025. It's worth noting that last April, under the "leadership" of President Trump, the US government launched an indiscriminate tariff trade war against all major countries globally. At that time, the global macroeconomic environment deteriorated rapidly, risk-averse assets were collectively pressured and sold off, and Bitcoin and other cryptocurrencies were not immune.

Now, with Bitcoin's price falling back to this price range, and considering a series of global macroeconomic and political events this year, the core factor driving this round of significant correction or even crash in the cryptocurrency market clearly points to the same person: the key figure who repeatedly stirs up the global political and economic environment—US President Trump.

Bitcoin stabilized at $75,000; can it return to $80,000?

Looking at the current Bitcoin price chart, when the price fell and touched near last year's lowest price, there were relatively clear signs of a bottoming out. As can be seen, the price rebounded quickly after hitting a low of $75,000, and at the time of writing, Bitcoin's price has recovered to around $78,500.

The $75,000 price range for Bitcoin is highly consistent with the lows of multiple oscillation cycles throughout 2025. If the price of Bitcoin falls back to this range in subsequent trading, this level is likely to provide strong technical support in the short term.

Furthermore, if Bitcoin can successfully form a "double bottom" pattern within this price range, or effectively consolidate for a period to fully digest the selling pressure released by the previous plunge, the risk of another price drop in the short term may be significantly reduced.

Data Source: CoinMeta

Cost of Funds for Listed Companies Holding Bitcoin

Looking at the cost of funds for global companies holding Bitcoin, this price range also has clear structural significance. According to my article published yesterday, "From a Floating Profit of 15 Billion to a Loss of 900 Million, in Just One Month! Will Strategy Sell Off 710,000 BTC?" The article clearly shows that the cost price per Bitcoin held by US-listed companies that have included Bitcoin on their balance sheets is currently between $74,000 and $76,000. For example, Strategy, a publicly traded company, currently holds 712,647 Bitcoins, with an average cost per Bitcoin of $76,037.

In other words, the cost range of these publicly traded companies has significant practical implications for current market sentiment. A decisive break below this price range could trigger a larger-scale involuntary stop-loss liquidation. Therefore, around the $75,000 price level, these companies will likely focus their buying efforts on defense, potentially making this a key battleground for bulls and bears in the short term.

Once this support level is decisively broken, the overall market risk could be rapidly amplified, with the price potentially falling further, possibly back to $72,000, or even risking a drop below $70,000.

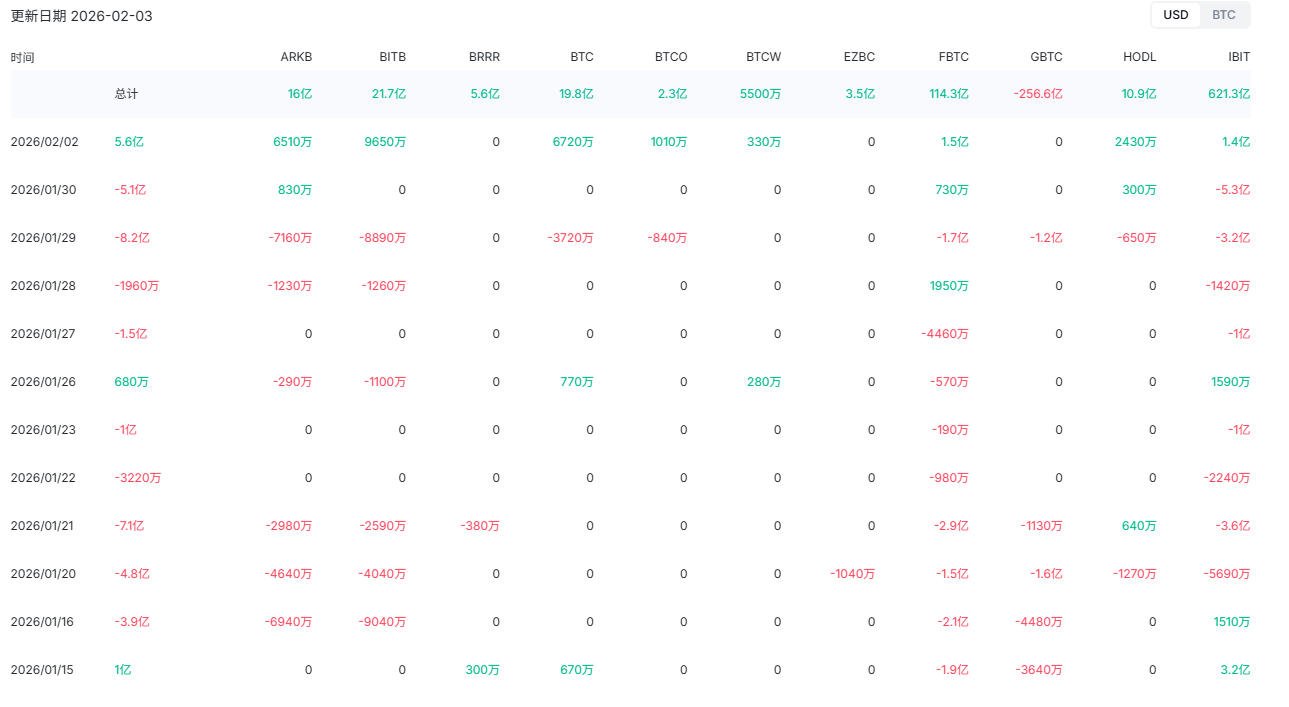

Bitcoin Spot ETFs See Net Inflow of $560 Million in a Single Day

After Bitcoin prices stabilized around $75,000 yesterday, the evening trading session for US Bitcoin spot ETFs saw a significant improvement in Wall Street fund flows. Data shows that the net inflow into Wall Street Bitcoin spot ETFs exceeded $100 million for the first time since January 16th, reaching a total net inflow of $560 million. This ended the previous 10-day streak of large-scale net outflows from Wall Street.

Data Source: CoinMeta

It is also clear that the current support level around $75,000 for Bitcoin is highly significant. This price level is not only an important psychological barrier but also represents the cost basis for many Wall Street institutional investors. As long as Bitcoin does not fall below $75,000 on the daily chart, the fund flows into Wall Street Bitcoin spot ETFs are expected to continue to improve.

Therefore, the biggest variable in the current Bitcoin market lies in whether the net inflow into Bitcoin spot ETFs will remain positive. If ETFs managed by major institutions like BlackRock and Fidelity resume their buying activity, Bitcoin's return to $80,000 will be imminent.

Therefore, the biggest variable in the current Bitcoin market remains whether the net inflow of funds into Wall Street Bitcoin ETFs can remain positive. If ETFs managed by giants like BlackRock and Fidelity resume stable buying activity, then Bitcoin's price returning to above $80,000 will be a short-term possibility.

Meanwhile, the current Bitcoin price is approaching the cost range for Bitcoin held by US-listed companies. If these companies choose to continue adding to their Bitcoin holdings near this cost price, market buying power may be further strengthened, and the price could potentially rebound quickly to above $80,000.

However, Bitcoin's return to $80,000 hinges on the current global macro-political environment not deteriorating further and the Middle East geopolitical situation not escalating further. In particular, under the current Trump administration, the tensions between the US and Iran may once again become the most critical macroeconomic variable affecting overall market risk appetite. If the negotiations between the US and Iran in Turkey on February 6 break down or fail to reach a substantial agreement, the key support level of Bitcoin around $75,000 may face a severe challenge.

Currently, Trump has clearly signaled a hardline stance, stating bluntly that "if the negotiations fail, there will be adverse consequences." Against this backdrop of "maximum pressure," the talks in Istanbul on February 6 have become a "time bomb" of high uncertainty in the global financial environment.

Disclaimer: Readers are advised to strictly abide by the laws and regulations of their locality. This article is based on publicly available market information and is for reference only. It does not constitute any investment advice.

No Comments