Author:Coin Gabbar

Binance SAFU moves 1315 Bitcoin into user protection fund During Crash

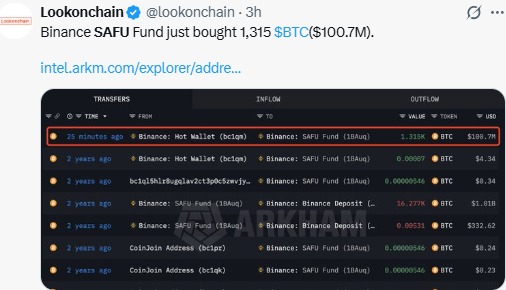

Binance has moved 1,315 Bitcoin, worth around $100 million, into its Secure Asset Fund for Users (SAFU). The update comes during a weak phase for the crypto market and shows that the exchange is continuing with its plan to strengthen user protection using Bitcoin.

According to blockchain data shared by Arkham, the Bitcoin was transferred from a wallet directly into the Binance SAFU fund. The move did not involve outside wallets, which means this was an internal transfer, not a purchase made on the open market.

Source: X (formerly Twitter)

What Changed in the SAFU Fund?

The platform announced earlier that it would convert $1 billion worth of SAFU reserves from stablecoins into BTC over a 30-day period. This latest transfer marks the first completed batch of that plan.

So far, about $100 million has been converted. That means they still has around $900 million left to shift into BTC for the user protection fund. The exchange also said it will share updates as the conversion continues.

It was created in 2018 to protect users in case of major incidents like hacks or system failures. Until now, the fund was mostly held in stablecoins. Moving SAFU to this digital currency changes how the fund behaves, because Bitcoin’s value moves up and down with the market.

To manage this risk, Binance has promised that if the SAFU’s value falls below $800 million, it will add more coins to bring it back up.

Why This Matters During a Market Drop?

This move happened while the crypto market is under pressure. BTC has fallen about 2.22% in the last 24 hours, trading near $76,665. Over the past week, it is down almost 13%.

The wider crypto market is also down. Total market value has slipped to around $2.61 trillion. Several factors are behind this decline:

Over $700 million in crypto positions were liquidated in one day

U.S. spot BTC ETFs saw $1.1 billion in outflows last week

It fell below the key $80,000 level, triggering technical selling

These conditions have caused fear among short-term traders.

Justin Sun, Saylor Signals, and the “Buy the Dip” Mood

Justin Sun recently said he plans to buy up to $100 million of this crypto asset for TRON’s treasury. This echoes a familiar pattern during market dips.

Meanwhile, Michael Saylor has once again fueled speculation with cryptic posts like “more orange,” often seen as hints of future BTC buying. His company’s stock has fallen sharply, but past cycles show Saylor tends to buy during weakness.

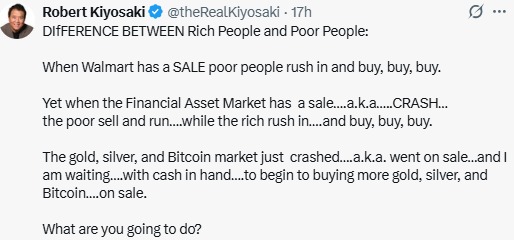

This mindset aligns with views shared by Robert Kiyosaki, who recently said market crashes are “sales” where wealthy investors buy while others panic sell.

Source: X (formerly Twitter)

Binance Sends a Different Signal

Even as the prices drop, Binance is moving ahead with its SAFU Bitcoin strategy. By putting the cryptocurrency into its user protection reserve, the platform is demonstrating that it considers Bitcoin to be a long-term store of value, rather than simply a trading vehicle.

On-chain analysis also indicates that the SAFU fund had been adding new approved addresses, which could indicate that Binance was preparing for crypto transfers.

What Comes Next?

Looking at the Bitcoin price prediction, In the short term, it appears that Bitcoin must hold the $76,000 to $78,000 level in order to prevent a further drop towards $71,000.

For the moment, the Binance SAFU news is the most significant. While most traders are reacting to the price drops, Binance is quietly improving its safety fund. This is a sign of preparation and planning, not panic.

YMYL Disclaimer: This article is for informational purposes only and is not financial advice. Crypto investments are risky. Do your own research before making any decisions.

No Comments