Author:Coin Gabbar

Bitwise registers uniswap ETF trust in Delaware: What It Signals

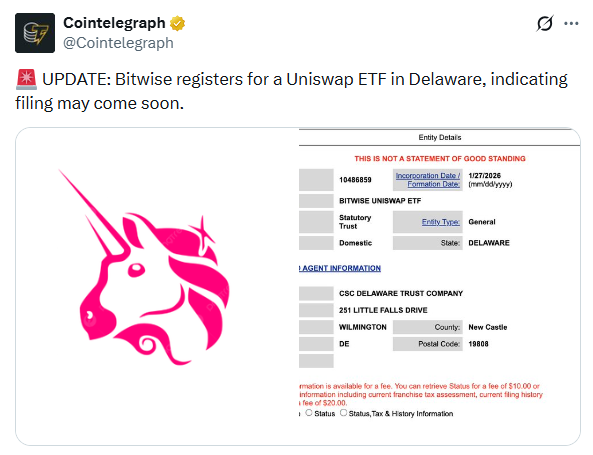

Bitwise registers uniswap ETF by forming a legal entity in Delaware, marking an early legal step towards a possible SEC filing. This registration is a standard early step that many Investment fund issuers take before formally applying for approval from the U.S. Securities and Exchange Commission (SEC).

It does not yet mean that the SEC has approved the Investment fund or that it will begin trading immediately — it simply establishes a legal framework for a potential future application.

This move has attracted attention because it represents growing Professional investors interest in decentralized finance (DeFi) products, particularly the DeFi trading platform, which is one of the largest DeFi protocols.

Source: X official

Why It Matters

This development shows how Bitwise registers uniswap to bridge decentralized finance with traditional funding systems.

The significance is two-fold:

It bridges DeFi with traditional finance, making it easier for mainstream investors to access decentralized protocols without holding tokens directly.

It reflects a trend of DeFi assets becoming part of regulated investment products, expanding crypto beyond Bitcoin and Ethereum.

Why Bitwise Is Taking This Step

The asset management firm has a history of launching crypto investment products, including:

Bitcoin and Ethereum spot Exchange-traded funds.

Several other strategy ETF filings covering a wide range of crypto assets like AAVE and UNI were previously in a group of 11 filings last year.

By registering the UNI ecosystem ETF trust, the asset manager signals it intends to get ahead of regulatory processes and position itself for future approval if market and legal conditions allow.

Experts view this as a strategic and methodical move, not a rushed decision. It shows Bitwise is preparing before a formal SEC submission — a typical approach in financial product development.

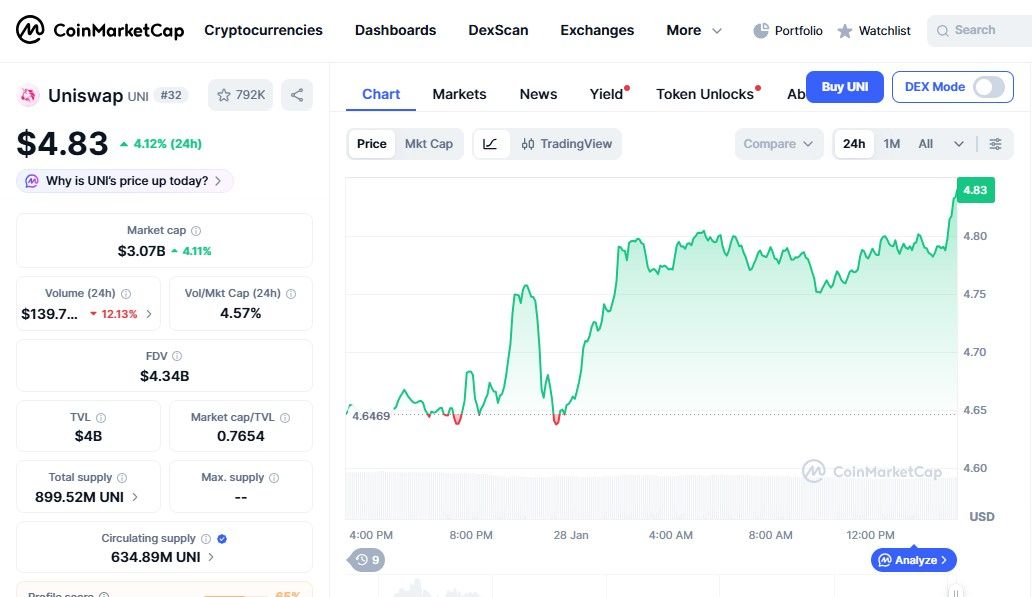

Does this statement have any relevance to Uniswap’s price?

The token price is up today mainly because the news about Bitwise registering a Uniswap ETF trust in Delaware increased investor confidence and created strong buying interest. This news signals possible institutional adoption, which usually boosts sentiment. However, this move is still an early step, so the surge is likely short-term, driven by hype. Long-term growth will depend on real SEC progress and broader market strength, so investors should stay cautious and avoid chasing sudden pumps.

Source: CoinMarketCap official

What This Means for the Future

At this stage:

There’s no formal SEC application yet

No specific launch date

No guarantee of approval

But the registration:

Unlocks the possibility of the UNI protocol ETF in the future

Signals serious interest from traditional finance managers in DeFi protocols

Strengthens the narrative that decentralized assets may enter mainstream regulated funding products

If approved, a Uniswap Investment fund could:

Make Uni exposure easier for large investors

Boost liquidity and Professional investors' confidence

Attract new capital to DeFi-related investments

The way Bitwise registers uniswap could set a model for future DeFi-based exchange-traded products.

Overall, this is an early but important signal that crypto may continue blending into traditional markets via regulated investment vehicles.

No Comments