Author:Encryption Tracker

XRP researcher Ripple Bull Winkle has stressed that new XRP ETFs will require millions of XRP to meet demand.

In his commentary, he argued that the public “won’t realize what happened until it’s too late”. His warning comes as large institutional investors are buying up XRP much faster than everyday traders realize. With more XRP ETFs coming, he believes a supply shortage may already be beginning.

Market Under Pressure, But ETFs Are Quietly Eating Into XRP Supply

In a recent video, Bull Winkle said XRP is building “pressure” beneath its price. He explained that XRP often performs best not when Bitcoin jumps sharply, but when Bitcoin steadies.

Meanwhile, retail investors have largely left the market. Many traders exited positions after volatility spikes, while institutions continued accumulating. This divergence is a major reason why the XRP chart “feels different” despite short-term price declines.

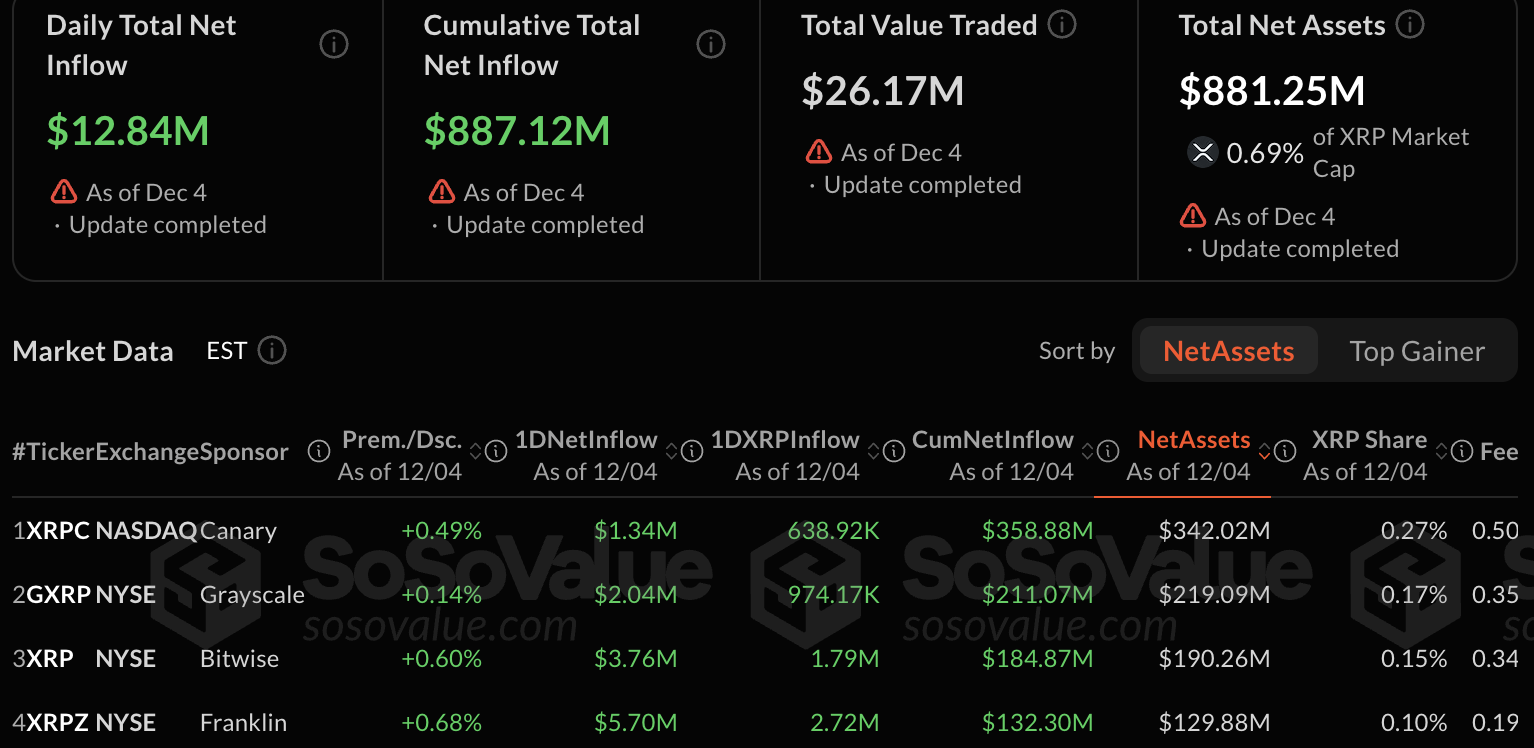

One of the strongest data points he highlighted came from Canary Capital. The XRP ETF has now accumulated $342 million worth of XRP, with consistent inflows into its ETF every trading day since its November launch.

Meanwhile, Canary Capital is not the only ETF buying up XRP. Other asset managers like Grayscale, Bitwise, and Franklin are also posting massive inflows since launch.

In particular, Grayscale has seen $211 million in inflows to its GXRP ETF, while Bitwise has seen $184.87 million. Franklin Templeton has also seen $132.3 million in inflows since launch.

Cumulatively, XRP ETFs have seen investments totaling $887.12 million, with total assets worth over $881.25 million.

To Bull Winkle, this is the clearest sign yet that ETFs and institutions believe the market is mispricing XRP “by a mile”.

Notably, two other XRP ETFs are set to launch this month, including 21Shares and WisdomTree. More ETF launches create more avenues for issuers to buy massive quantities of XRP to support inflows, and that accumulation happens quietly, off-exchange, until it is reflected in liquidity.

The Countdown to Real Price Discovery

According to the researcher, retail investors are repeatedly asking the wrong question: “Why isn’t XRP’s price moving?”

He explains that the action is happening behind the scenes. Institutions are buying, ETFs are preparing, and liquidity is shrinking.

Once ETF filings start competing for XRP, he expects a significant price jump. By then, retail FOMO usually kicks in, but historically, that happens after most of the move is already completed.

Other Analysts Agree

Interestingly, several other XRP analysts share this view regarding XRP supply. Zach Rector argues that XRP’s tradable supply is below 10 billion, much below the roughly 60 billion circulating supply shown by trackers.

Others, like Jake Claver, have said ETFs are rapidly depleting OTC/dark-pool reserves, with only 1–2 billion XRP previously available privately. Claver claims this limited supply could trigger a “crazy” price spike as demand outpaces accessible liquidity.

No Comments