Author:Chain Road Prophet

With the Federal Reserve meeting today, onchain flows are telegraphing that crypto traders are topping off exchanges and leaning long ahead of a widely expected 25-basis-point cut.

Pre-Fed Positioning

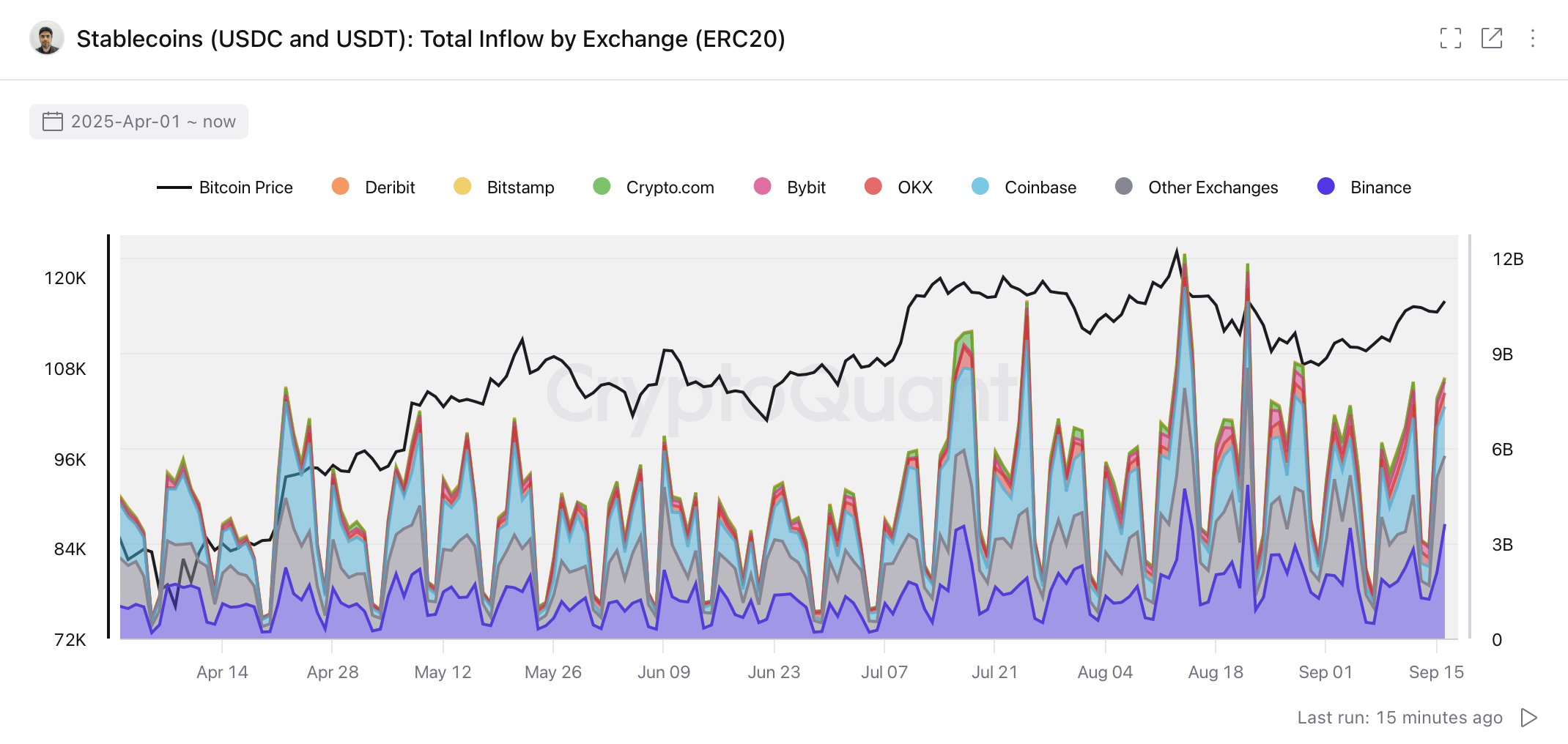

Stablecoins are doing the heavy lifting. Cryptoquant data shows $7.6 billion in fresh USDT and USDC (ERC-20) deposits heading to trading venues ahead of the decision. By venue, roughly $2.1 billion landed on Binance and $1.6 billion on Coinbase, with another $3.9 billion spread across other exchanges.

Cryptoquant’s Head of Research, Julio Moreno, says the build suggests capital is being parked on centralized venues while traders wait for the statement and Jerome Powell‘s press conference. It is not just more stablecoins—it is bigger tickets.

The average USDT deposit has nearly doubled since July, climbing from a 2025 low of $63,000 to about $130,000 today. Whale-sized transfers are most pronounced on Binance, Bitstamp, and Deribit, where average transaction sizes sit near $214,000, $181,000, and $166,000, respectively.

Altcoins, meanwhile, look like they are being packed up for a pit stop. Moreno explains that the seven-day total of altcoin deposits rose to 55,000, after idling between 20,000 and 30,000 in May and June.

Cryptoquant’s data shows most of the flows are bound for Binance (25,000) and Coinbase (6,000), with the balance—about 15,000—scattered across rival platforms. Address activity tells the same story: depositing addresses jumped to 42,000 from 23,000 at the start of September. That pattern hints at profit-taking or a rotation to cash before the policy reveal.

Derivatives desks are leaning the same way. Exchange open interest (OI) flipped positive over the past 24 hours for the first time since Sept. 13, aided by new longs and short covering. Cryptoquant’s research analyst says the biggest jumps came on Binance, up $166 million, and OKX, up $131 million, a backdrop that can amplify any post-Fed price move in either direction.

If the committee delivers the consensus 25 basis-point trim, that cash pile can be deployed quickly, while a surprise could force a messy reset. Positioning signals do not guarantee a rally, but they do sketch a market that wants to buy dips rather than sell rips if liquidity and policy line up. The setup resembles prior policy weeks when stablecoin inflows climbed before risk-on bounces, without promising a repeat.

The analysis and charts coming from Cryptoquant’s analyst paints a tidy picture: investors are queuing capital on centralized venues and waiting for Powell’s cue.

No Comments